Bapcor Limited, Australia and the Asia-Pacific’s largest automotive aftermarket company, continues to extend its position of industry leadership by investing significantly in Australian and New Zealand bricks and mortar.

Despite the major challenges faced during the 2020 financial year, which also was a record-breaking year in terms of revenue for the Australian company, Bapcor opened 45 new branches across its four automotive aftermarket business divisions in Australia and New Zealand. The Australian company also opened a further 27 branches in the first half of FY21 as well as delivering record revenue and profit.

A key factor in the company’s continued leadership and its future growth can be found in Bapcor’s geographic reach to its customers across all sectors of its automotive aftermarket operations. To ensure that the company’s specialized automotive aftermarket businesses reach the maximum number of customers across Australia and New Zealand, continued bricks and mortar growth plays an essential ongoing component of Bapcor’s highly successful business strategy.

The continued growth in Bapcor-owned Trans-Tasman branches reflects the company’s uncompromising confidence in the future prosperity of both the Australian and New Zealand automotive aftermarket.

“To achieve the optimum trade and retail automotive customer reach across Australia and New Zealand, encompassing all of the automotive aftermarket sectors in which we trade, investing in more branches and employing more team members is imperative,” said Bapcor Limited CEO and Managing Director Darryl Abotomey stated.

“We remain the strongest by aligning our growth to trade and retail automotive customer demand, identifying key geographic locations that best meet the requirements of our vast customer base. Given how challenging 2020 was, the fact that we established almost 50 new branches across Australia and New Zealand during the year is testament to our unwavering commitment to providing an unparalleled industry benchmark in customer service and efficiency,” Abotomey added.

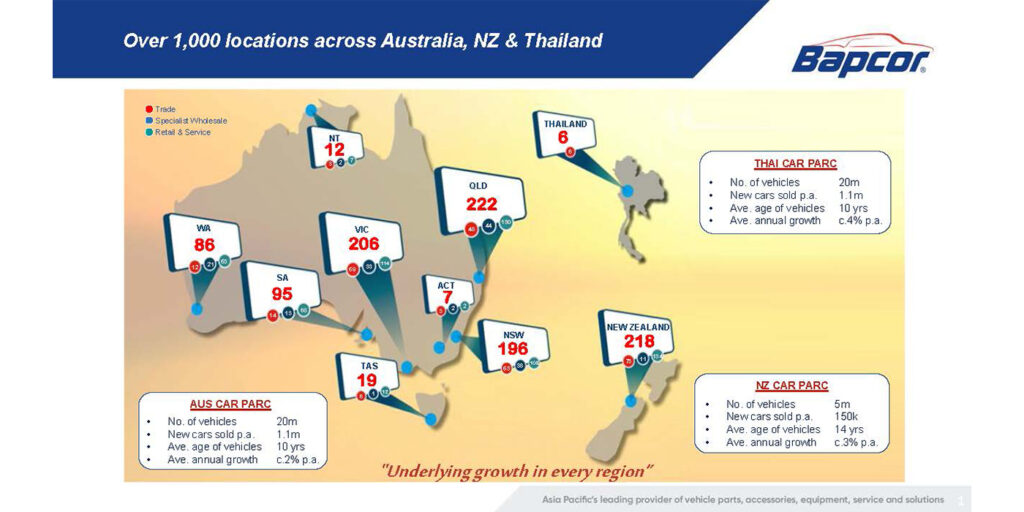

Bapcor’s automotive aftermarket business footprint across Australia and New Zealand follows:

There is a total of 222 Bapcor locations in Queensland, comprising of 130 Retail and Service branches, 48 Trade stores and 44 Specialist Wholesale operations.

Victoria has a total of 206 Bapcor locations, including 134 Retail and Service branches, 59 Trade stores and 33 Specialized Wholesale operations.

A total of 196 Bapcor locations operate in New South Wales, including 105 Retail and Service branches, 53 Trade stores and 38 Specialist Wholesale operations.

In South Australia, there are a total of 95 Bapcor locations, with 68 Retail and Service branches, 14 Trade stores and 68 Specialist Wholesale operations.

There is a total of 86 Bapcor locations across Western Australia, including 53 Retail and Service branches, 21 Specialist Wholesale operations and 12 Trade stores.

In Tasmania Bapcor operates a total of 19 locations, including 12 Retail and Service branches, 6 Trade outlets and one Specialist Wholesale operation.

The Northern Territory has a total of 12 Bapcor locations, comprising of 7 Retail and Service branches, 3 Trade outlets and 2 Specialist Wholesale operations.

There are 7 Bapcor locations in the ACT, with 2 Retail and Service branches, 3 Trade outlets and 2 Specialist Wholesale locations.

In New Zealand, Bapcor operates a total of 218 locations, including 134 Retail and Service branches, 73 Trade outlets and 11 Specialist Wholesale operations. (There are also six Bapcor trade outlet locations in Thailand).

To find out more about Bapcor visit: www.bapcor.com.au