Moody’s has published its outlook for the global auto industry today, which reflects its expectations for fundamental business conditions in the industry over the next 12 to 18 months.

The investor service says it is maintaining a stable outlook on the global automotive manufacturing industry, based on its expectations for steady demand across key regions.

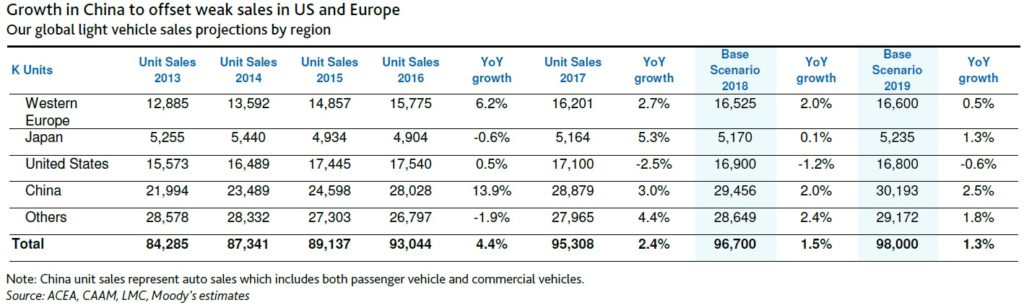

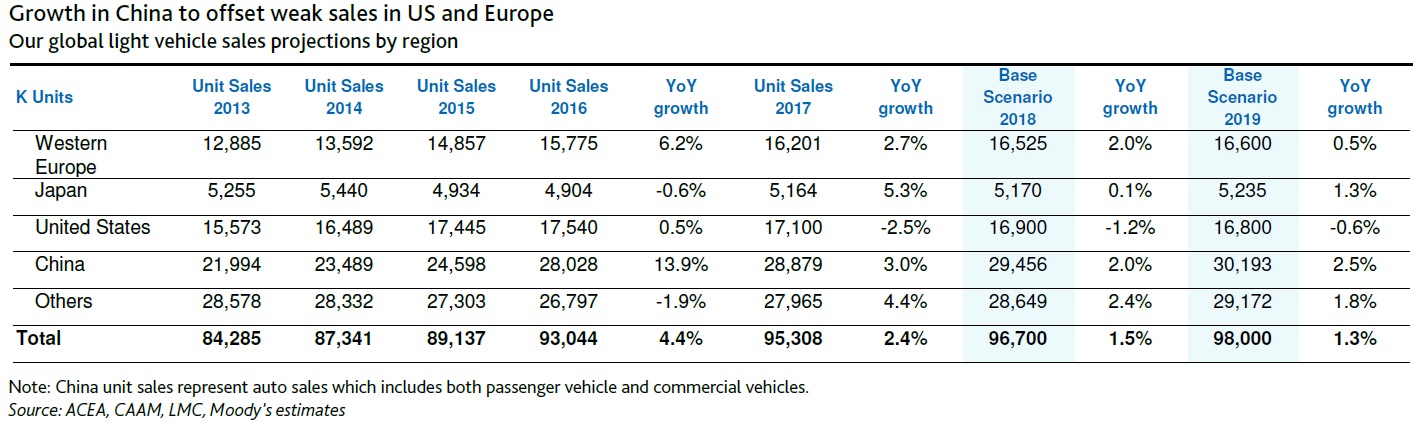

“We expect global light vehicle sales to grow 1.5 percent this year and 1.3 percent in 2019. While year-to-date sales support our full-year 2018 forecast, we see greater risks emerging that could hurt sales next year, including ongoing trade and tariff disputes, rising interest rates and higher fuel prices,” Moody’s said in a press release.

Looking across the regions, auto sales in China are expected to grow 2 percent this year – slowing from 3 percent in 2017 – and 2.5 percent in 2019.

Looking across the regions, auto sales in China are expected to grow 2 percent this year – slowing from 3 percent in 2017 – and 2.5 percent in 2019.

U.S. light vehicles sales will likely cool in the coming months, Moody says. Rising interest rates, higher vehicle prices and the threat of tariffs on auto imports are likely to make consumers consider a used car or delay buying a new one.

Although U.S. light vehicle sales are expected to fall by 1.2 percent in 2018 and 0.6 percent next year, they will remain strong relative to historical levels and are on track to reach 16.9 million units this year.

Moody’s expects Western European sales to grow by 2 percent in 2018 before slowing to 0.5 percent in 2019, while Japanese sales growth is forecast to slow to 0.1 percent this year, before accelerating to 1.3 percent next year.

Consumer demand for new cars will remain strong in India and will continue to rebound in Brazil and Russia, buoyed by improving macroeconomic fundamentals.

Recent profit warnings from leading carmakers suggest that the sector will face greater risk in the year ahead. The automotive sector is still highly cyclical and the operating environment could deteriorate quite rapidly, due to factors such as new import tariffs or rising commodity costs.

Manufacturers will continue to face mounting environmental policy pressures, which will likely lead to stricter emissions-reducing regulatory targets, rising pressure on margins and cash flows, changing consumer preferences and technological disruptions.

Moody’s report, “Automotive manufacturing – Global, Modest growth in light vehicle sales to continue into 2019 amid threat of US tariffs,” is available on moodys.com.

“While global auto sales so far this year support our full-year 2018 forecast, we see greater risks emerging that could hurt sales next year, including trade and tariff disputes, rising interest rates and higher fuel prices,” said Falk Frey, a Moody’s senior vice president and author of the report. “Steady auto sales in China are a key driver of our global forecast, but growth will remain far more modest than the double-digit percentage gains seen as recently as 2016.”