The auto aftermarket has always led other industries in the remanufacturing and recycling of products. We have a robust process of valuing cores and returning them to the market as replacement parts in vehicle repair. It is a great process, honed over many years of continuous improvement, but I think it is now ripe for disruption – with radical sustainability and the formation of the circular aftermarket.

Keep your eyes open – you’ll see disruptive movement everywhere.

Maybe it is MEMA’s Center for Sustainability. I attended MEMA Aftermarket’s VISION conference earlier this year, and I would estimate that over 60% of the day’s sessions dealt with the topic of sustainability and how the industry must change to focus more intently on how automotive materials are sourced and reused in the lifecycle of a vehicle.

It could be the actions being taken by vehicle OEMs. Stellantis’s SUSTAINera brand is a good example. The company has targeted over 13,000 products across 37 product lines for remanufacturing – parts like starters, alternators, clutches, turbochargers, injectors, brake calipers, electronic control modules, control units, multimedia, SCR tank, transmissions, engines and high-voltage batteries for electric vehicles are included. The company claims that the SUSTAINera parts will reduce the use of raw materials by 60% and cut CO2 emissions by 30% to 80% compared to new parts production. Remanufacturing is a core element of the Stellantis Dare Forward 2030 strategy, driving to achieve carbon net zero by 2038.

To showcase its approach to the circular aftermarket, Stellantis has recently showcased two cars: the Peugeot e-208 with its high voltage battery that can be remanufactured; and the Citroën Oli concept car that stretches sustainable materials to the max. Its body is made of biodegradable cardboard, which is surprisingly strong and impact-resistant.

Kia is bringing interesting innovations as well. The new EV9 BEV uses a high percentage of recycled polyethylene terephthalate (PET) plastics and post-consumer waste in its interior panels, carpet and seat fabrics. It is increasing the use of bioplastics, BTX paint and bio paint based on rapeseed oil.

The move to a circular aftermarket will be driven by the introduction of several new programs that will go beyond today’s core valuation and part recycling. They will move our sustainability work to the mineral reclamation level. See a few examples below.

Battery Passports

In order to qualify for the USA’s full IRA tax credit, a BEV must be both manufactured in the USA and have battery minerals sourced from Free Trade Agreement countries (in other words – not from China or Russia). In 2023, 40% of the battery’s minerals must be FTA sourced. By 2027, that number has to be 80%–each year between now and then sees 10% added to the previous year’s level. Since China controls a very high percentage of battery mineral sourcing around the world, most BEVs will not qualify for this portion of the tax credit, but we’ll leave that craziness to a future blog. My point here is that mineral tracking is now a real thing, and it will become a factor in future sustainability efforts.

The Global Battery Alliance has created the Battery Passport to create a global reporting framework to govern rules around measurement, auditing and reporting of ESG parameters across the battery value chain and a digital ID for batteries containing data and descriptions about the ESG performance, manufacturing history and provenance, as well as advancing battery life extension and enabling recycling. I see this as an important step in advancing mineral level reclamation of future BEVs.

Blockchains

Companies like Circulor, SourceMap and Kobold Metals are applying blockchain technology, artificial intelligence and high-powered computing to change the way vehicle materials are sourced and tracked.

Rio Tinto, one of the world’s largest mining companies, has created a blockchain sustainability solution for aluminum called START. It plans to partner with BMW in 2024 to supply START-tracked aluminum to BMW’s plant in Spartanburg, South Carolina. Rio Tinto’s aluminum smelter is hydro-powered and uses 50% recycled aluminum in its process. BMW has reported that 25% of its supply chain’s CO2 emissions come from its use of aluminum, and it is projecting a 70% reduction of emissions due to the new program.

ESG

On March 21, 2022, the SEC introduced the most comprehensive federally mandated corporate ESG data disclosure requirement US companies have ever seen. The rule is designed to improve the consistency and quality of public companies in their reporting of environmental (climate-related risks), social (labor regulations, diversity, equity and inclusion, safety, human rights and community involvement) and governance (board diversity, business ethics, compensation policies) processes. The key, of course, is that while ESG rules are ostensibly designed to guide investors in public companies, the actions are quickly moving to private companies as well, as banks apply ESG ratings to loan approvals, insurance companies use Climate Risk Disclosure Surveys to set new coverage rates and possibly even your suppliers apply ESG ratings to safeguard their reputations with a wide variety of stakeholders.

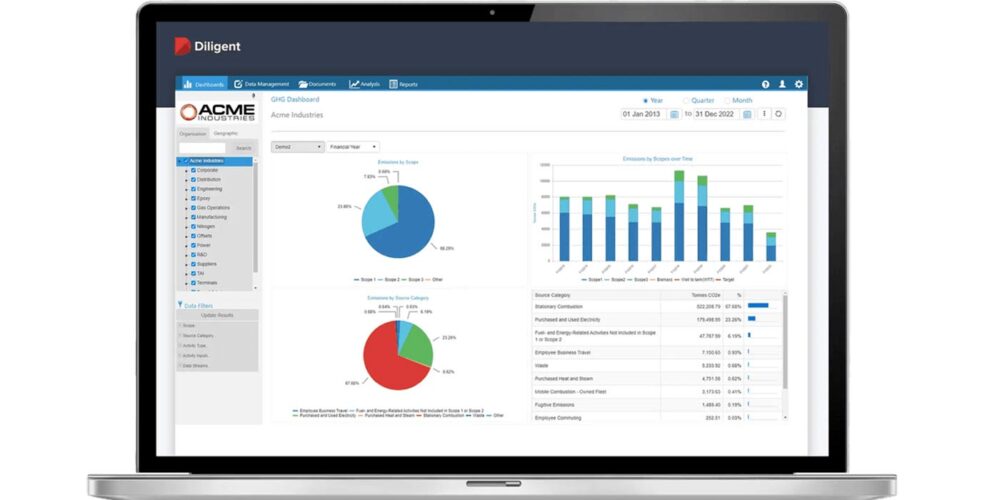

The beauty of capitalism is that governmental interventionism is instantly met with the creation of tools that help companies comply with ever-increasing regulations with efficiency and effectiveness. Look at Diligent ESG. They have created The Climate Leadership Certificate Program, which includes nine courses of interactive eLearning including video panel recordings, curated readings and other interactive exercises. Investigate Novisto. They are more environmental sustainability-oriented and are working to automate and simplify the implementation of an ESG strategy.

Sustainability Balance Sheet

I see auto aftermarket companies creating sustainability balance sheets to track all materials coming in and going out of their operations. That will mean exposing all waste disposal and landfill activity, which will lead to a heavier emphasis on zero-waste programs. Companies like ERI, CJD and MRP are concentrating on circuit board recycling and will play a role in salvaging the precious metals associated with automotive electronics.

The automotive and commercial vehicle aftermarkets have always offered a square deal on affordable parts and service. Now they will go circular.