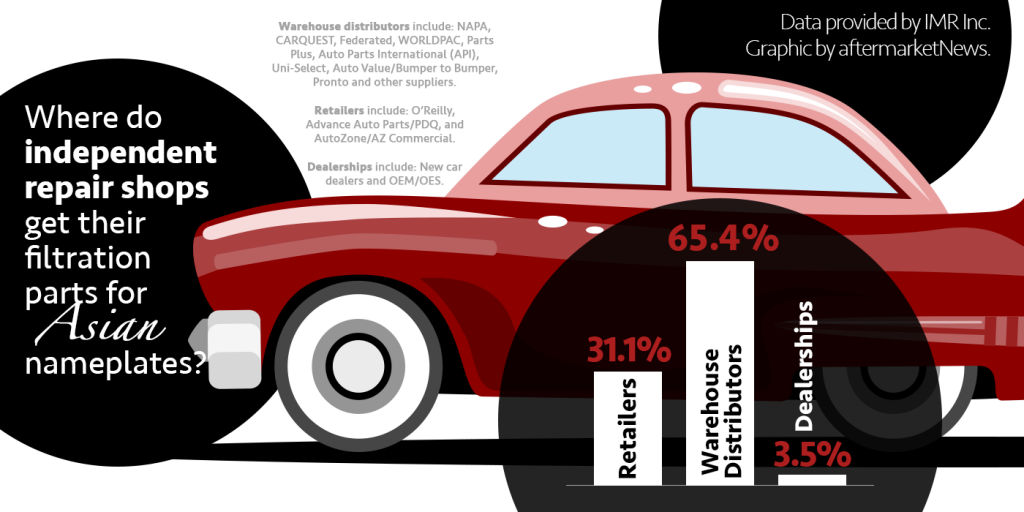

As it was with domestic vehicles, nearly two-thirds of independent repair shops call their warehouse distributors (WDs) first when they are looking for filtration parts for Asian vehicles. In the survey conducted by IMR Automotive Research, 65.4 percent of respondents contacted their WDs first, while only 31.1 percent called a retailer as their first call.

As it was with domestic vehicles, nearly two-thirds of independent repair shops call their warehouse distributors (WDs) first when they are looking for filtration parts for Asian vehicles. In the survey conducted by IMR Automotive Research, 65.4 percent of respondents contacted their WDs first, while only 31.1 percent called a retailer as their first call.

“As with our filtration research in regard to domestic vehicles, shops are very consistent on who they contact first for parts for Asian cars and again it is the WD for a vast majority of independent repair shops,” said Bill Thompson, president and CEO of IMR Inc. “However, we did see a slight uptick in the number of shops contacting a new car dealer for Asian filtration products as 3.5 percent of shops called a dealer first compared to only 2.9 percent calling a dealer for domestic vehicles.”

For over 40 years, IMR Inc. has been an industry leader in automotive research and conducts syndicated and proprietary market research studies that focus on automotive parts and services, repair shops, technicians, accessories and vehicle technology trends. To find out how IMR research can help your business, call 800-654-1079, e-mail [email protected] or visit AutomotiveResearch.com.