In recent years, the automotive aftermarket has found itself at the intersection of various economic, societal and technological crossroads. As we delve deeper into 2023, the industry faces the traditional challenges of catering to consumer needs and the complexities arising from a transforming economic landscape. The rising Consumer Price Index (CPI), an aging vehicle fleet, fluctuating gas prices and changing driving patterns are key factors affecting the automotive aftermarket, each with its unique implications and intricacies. But how do all these factors interplay, and what does it signify for the future of the industry? This article unravels the impact of elements influencing the aftermarket to provide insights and strategies for businesses aiming to navigate and thrive amidst these ever-evolving challenges.

Steering Through the Economic Upheavals

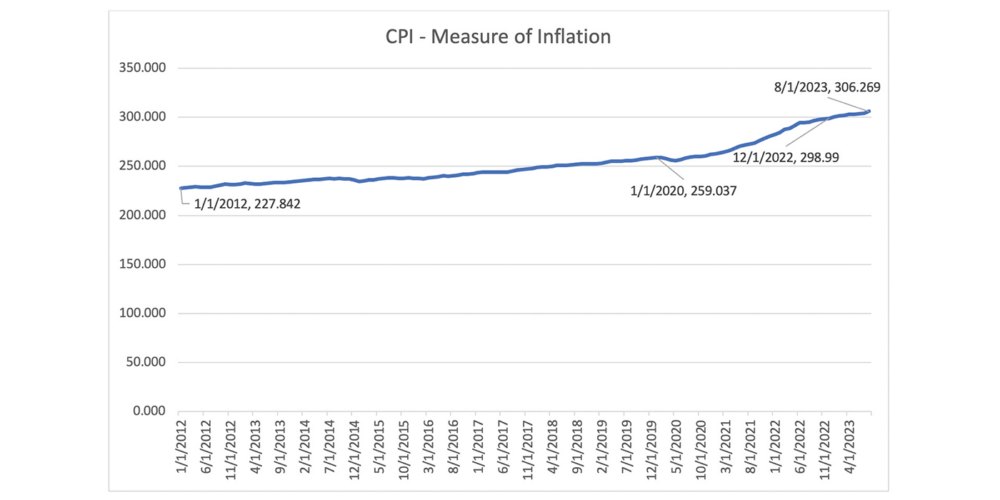

If you’ve spent any time looking at screens in the past few years, you’ve come across the term “inflation” at least a couple of times (or maybe several hundred). Simply defined, inflation is when the general price level of goods and services increases. Chart 1 showcases a rising CPI (a measure looking at the value of goods and services of urban consumers compared to the year prior), which currently stands at 306.27 this past August, an uplift of about 18.23% since January 2020 and roughly 2.43% from December 2022.

CHART 1 (Source: US Bureau of Labor Statistics)

As so many Americans know too well, rising inflation leads to less buying power and an erosion of savings for many consumers who can’t keep up with rising interest rates. Adding fuel to the fire, those eligible to receive a raise at work do not always see a boost in pay that exceeds or even matches the inflation rate. Some reports say this rift should close late in 2024, but certain industries, such as education, need to make up more ground than others.

Additionally, inflation and unemployment have generally had an inverse relationship throughout history. While we won’t get into the finer details of this concept throughout this article, some of the strategies to combat inflation often constrict investment opportunity; with less investment comes less growth in businesses or development of new companies, leading to fewer job opportunities, which can further lead to less buying power.

A Tilt Toward Aftermarket Quality or Affordability

In today’s automotive landscape, the financial strain is evident. With the average price of non-luxury vehicles now standing at an eye-opening $44,451, vehicle ownership, maintenance and repair dynamics are rapidly evolving. For many consumers, brand-new vehicles with such hefty price tags are far from reach, propelling the importance of maintaining and repairing their current rides. But the critical question remains: Will consumers prioritize quality or affordability in aftermarket products and services?

The Quality Pursuit: For a segment of vehicle owners, the emphasis may shift toward sourcing high-quality aftermarket parts and services. These consumers, recognizing the longevity and durability benefits, might perceive investing in quality as a cost-savings measure in the long run. By opting for superior parts and services, they aim to reduce the frequency of replacements and repairs. Essentially, it’s the philosophy of “buy once, cry once.” These individuals believe that spending a little extra now can save considerable time, money and hassle in the future.

The Affordability Angle: Conversely, another significant group of consumers have financial constraints that might heavily influence their automotive repair decisions. For these individuals, immediate cash outflow takes precedence over long-term considerations. They may often postpone non-critical repairs, pushing their vehicles to the brink before seeking assistance. And, when they finally do, their directive to their technician or service provider is clear: “Fix it, but at the lowest cost possible.” This approach, often termed as the “band-aid” solution, focuses on temporary fixes rather than addressing the root cause, prioritizing immediate affordability over durability. However, depending on the customer’s automotive knowledge, they may put off some rather important repairs and upkeep, thinking they aren’t necessary, making shop-to-consumer communication even more critical.

Navigating the Future

Indeed, the essence of survival in business largely hinges on adaptability. Although the discussed framework primarily holds the end-user as the focus, it’s important to acknowledge that the economic influences and consumer trends are equally influential on the B2B end of the spectrum. Viewing these principles through the lens of B2B instead of B2C necessitates a thoughtful examination and slight recalibration of this approach.

The aftermarket ecosystem might need to embrace innovative adaptations, from absorbing a fraction of the escalating costs to ensure client loyalty, to championing value-driven services. In these turbulent waters, revisiting inventory blueprints and finetuning supply chain models might offer the required anchor against the inflation tide.

Additionally, whether you are a manufacturer or general repair shop, addressing the diverging preferences of the automotive consumer exacerbated by economic conditions can be a potentially game-changing source of competitive advantage for both your business and those that are part of your value chain. Whether it’s through tiered service offerings, flexible pricing strategies or educational efforts to inform consumers about the pros and cons of each approach, the aftermarket industry is poised for an era of adaptability and customer-centric innovation.

The Intersection of Vehicle Age and Economic Climate

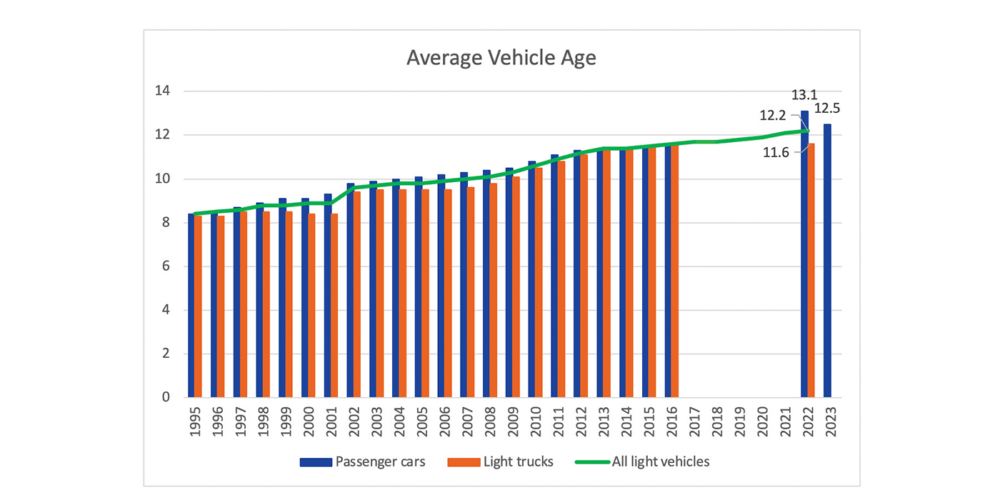

As mentioned in the previous section, inflation is up, and that includes the price of new vehicles. So, with the crazy economic situation we find ourselves in, let’s talk about another aftermarket driver, the average age of vehicles. In the most recent numbers, as seen in Chart 2, the average age of passenger cars reached 12.5 years in 2023. Light trucks weren’t far behind, with an average age of 11.6 years as of 2022. Zoom out, and the canvas depicts an overarching aging trend, with all light vehicles registering an average age of 12.2 years in 2022. For those who have been in the aftermarket industry for some time, you will recognize that these vehicle ages are at the precipice of the aftermarket’s sweet spot.

CHART 2: (Source: U.S. Department of Transportation)

Vehicle Age Dynamics and the “Sweet Spot”

It’s undisputed that a vehicle’s age carries weight in mapping its maintenance trajectory. The older the vehicle, the more its upkeep gravitates toward comprehensive repairs, spanning from rudimentary parts replacements to intricate tasks such as transmission refurbishments.

Vehicles under five years old boast OE warranties, in some cases sidelining extensive aftermarket intervention. On the other end, those past 13 years often confront a financial problem: do repair costs outweigh the vehicle’s value? Vehicles over 13 years old start to see major failures and/or repair costs begin to surpass the car’s worth. Hence, the sweet spot of having an average vehicle age between 6-13 years emerges, focusing on vehicles that have outlived their OE warranties yet merit investments in top-tier parts and services to keep them in good working order. Additionally, with rising new-vehicle costs and improved parts technology, this vehicle segment that propels the aftermarket industry could see an expansion, with consumers electing to squeeze a bit more value out of their vehicles for a few more years, while incurring some upkeep costs.

Charting a Future Course

Below are five ways our industry can adapt to and capitalize on the economic trends that exist in the market today.

- Precision Marketing: Recognize that the lucrative six-to-13-year age bracket can empower businesses to sculpt tailored marketing plans, appealing directly to this demographic (keeping in mind geographies, psychographics and behaviors, of course).

- Strategic Inventory: With a coherent understanding of the average vehicle age, you can better predict and meet inventory demands from this aging car fleet.

- Elite Offerings: Given the rise in CPI, providing high-end services addresses customers’ desires for products that last longer and are more durable. This makes the higher cost of premium services reasonable and justified in the eyes of consumers.

- Value-Focused Offerings: With climbing inflation, it’s crucial to offer products and services that appeal to cost-conscious consumers. These affordable, yet quality services meet the customers’ needs for longevity and durability without the premium price tag, delivering value that justifies the cost.

- Guided Consultations: Crafting advisory resources for consumers, especially for vehicles teetering on the edge of the “sweet spot,” fosters trust. This consultative approach aids in determining whether rejuvenation or replacement is the path ahead.

At the crossroads of inflation, the rise in vehicle longevity, and the instability of new-car prices, the automotive aftermarket stands to continue to flourish based on its unique ability to understand and adapt to customer needs at all levels of the industry’s parts, distribution, and repair and service pipeline.