The Marketing Executives Council (MEC) of the Automotive Aftermarket Suppliers Association (AASA) recently released a Special Report analyzing the buying influences on the independent repair industry. The MEC commissioned an independent third party to conduct a series of focus groups to determine the buying influences of repair professionals. Focus group meetings were held in Raleigh, N.C., Chicago, Ill., and Los Angeles, Calif. Nearly 60 participants were recruited from independent repair shops and included shop owners, technicians and/or service advisors.

In the study, focus groups were asked: How important is it to you that a manufacturer has value-added programs. Focus group discussions yielded surprising responses, said the MEC. Results of the study showed that marketing programs are not respected. “Many of the participants said they just don’t have time for marketing programs such as contests and rebates any more. They want a quality product first and foremost – marketing programs won’t change that,” the MEC wrote in its Executive Summary.

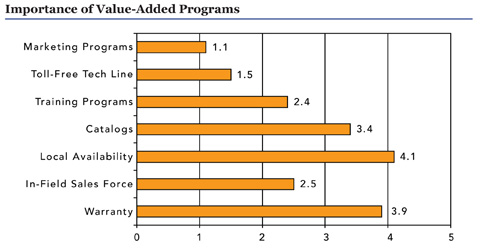

Participants were asked to rate how important the following value-added programs or essential services are when selecting a particular part on a scale of one to five, with one being low and five being high:

· Marketing programs such as spiffs or rebates

· Toll-free technical service hotlines

· Training programs

· Printed and online catalogs that comply with industry accepted standards and formats

· Local availability and widespread distribution

· In-field sales force

· Product warranties

Local availability and warranties ranked as most important, as seen in the chart below.

The AASA Manufacturing Executives Council Special Report, “Independent Repair Industry: Focus Group Findings on Buying Influences of Repair Professionals,” includes an Executive Summary of the findings, detailed reports and charts of the focus group discussions and the conclusion which analyzes the long-term implications of the focus group findings for the entire North American aftermarket channel.

The report is available for free download at the AASA Web site by clicking here.