Introduction

You could argue that the stage is already set for auto aftermarket commercial distributors. The automotive aftermarket is projected to grow at a rate of 5.8% through 2026. This means a lot of opportunity to capitalize on a growing market.

But becoming (and more importantly staying) that first call won’t happen on its own. You’ll need a strategic plan to grab market share from your competitors. This can be seen throughout similar industries like building materials. During the Covid pandemic, organic growth was high, but those who leaned into strategies of higher growth out-performed at a great pace.

Start in these two areas: growth and retention among customers and enhancing relationships among vendors.

Customer Growth & Retention

For a distributor, growing and retaining customers can happen through two routes. The first is the obvious route: your customers. The second is the less obvious: your sales team.

Luckily, either route has a beneficial by-product: the opportunity to enhance vendor relations.

Customers

We recommend starting by asking yourself and your sales leaders a few questions.

· How well do you know your current customer base?

· What does your sales data tell you about their purchasing habits?

· Have you looked at and defined your key customer segments?

· Have you defined a sales/marketing plan by segment?

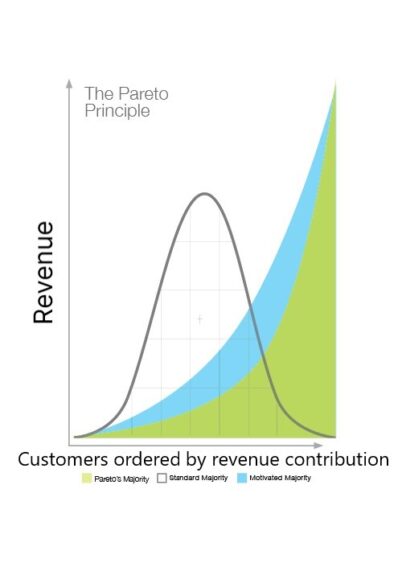

When we look at customer segments we find, and the Pareto Principle agrees, that the majority of companies get 80% of their revenue from 20% of their customers. These are your top customers, the ones you don’t just want, but need, to keep around. This leads us to what we call a defensive strategy.

Defensive Strategy

The crux of the defensive strategy is recognition. Your top customers are the ones you’ve built relationships with over the span of years and a lot of great business. You need to let them know how much they’re valued, because they really are and 80% of your revenue would say so.

You shouldn’t expect that much more growth from these folks over organic growth rates. It’s more about retention. So, reward them with an annual trip, supply those individuals with an unforgettable experience, or gift them with some highly aspirational merchandise. They’ve earned it and they’ll remember your brand for it.

Keeping this within budget can go two ways:

- A fixed percentage of your customers, like the top 20%, earn this reward.

- This provides a certainty to your costs. You know exactly how many people you’ll reward.

- The downside is that in a down year, you could be rewarding people who didn’t achieve last year’s sales.

- A fixed target over a personalized goal, like customers who hit 2% over last year’s sales earn the reward.

- This can actually help self-fund the reward, because the small growth pays for itself.

- The downside is that in a good year, you could be rewarding a lot more customers than usual, diminishing the trophy-value of the reward.

Offensive Strategies

We find that other 80% of customers have the highest potential for growth. Look at this chart, for example.

The green here represents your current sales with your current customers. Lose one at the far-right end (the top 20%) and you’re in trouble. But the blue represents what a small shift in sales volume within that 80% can do. It makes you more secure.

Easier said than done, though. This is where offensive strategies come in.

Promotions

The first step is running disruptive promotions that will gain insight into who these customers are beyond just sales transactions (some ideas here). We’re finding that face-to-face interactions often feel the most effective. Still, some online promotions, when targeted at high potential segments, can have a high impact.

Segments

Once you have some more data on your audience, there’s a few ways you can split the data. Sales data is a good source for seeing if there was a drop-off. Does one segment have a high propensity for potential churn? Did another group of customers spend more with you historically? These could be great targets for certain product lines pushes. Couple this with vendor co-op or MDF support and you’re off to the races.

A great way to support growth in segments like this is to offer goals toward desired behaviors or product purchases. For instance, you could set individual goals for this segment of customers over the same time period in the prior year. Or ask them to buy a number of key vendor products in a year. You get vendor support, reward them for purchasing, and you’ve got a great segment of engaged customers.

The goals could also be as easy as getting someone to make that call to you one more time a month, quarter, year.

Try some innovative promotions with your highest potential groups. Success in one segment might mean being able to bring the same promotion and growth to others too.

Driving Desired Behaviors

It’s not all about sales, though. You can also encourage them into other, higher margin behaviors.

For instance, it’s costly to have someone taking orders over the phone all day. Focus on driving adoption of Omni-channel purchasing.

Digital channels like websites and eCommerce are there to make purchases and to conduct research before they buy. By 2035, there’s expected to be an increase of 20-30% in eCommerce part sales.

Other behaviors could include:

· Increase sales of specific segments (think vendor relations again).

· Increase bundling of service agreements, warranties.

· Increase text orders to the branch and continue the shift to online.

Growth from your customers can come in a lot of different forms. That’s why we always pair it with growth from your salespeople, who should champion your customers’ growth too.

Salespeople

Motivating your sales team to help grow your customers isn’t always about hitting quota. We find that in high performing teams, it’s equally about setting behaviors that lead to success.

The underlying goal of a sales incentive is to set a culture of success, competition, and excitement among the team. By nature, what you’re asking of the team should be good for them and for you. There are a lot of levers to help drive those certain behaviors. Here are a few.

High Margin Behaviors

Did they sell a product that’s super high margin? Did they sell something that’s been sitting in inventory forever? Did they take a training on a certain vendor product?

Create opportunities and engagement around training and enablement. Provide disruptive and exciting reasons to stay with your company and grow their career.

If you’re able to stand up a point-based model, rewarding certain point values for certain behaviors, it could look like this.

· Enrollment into the program: 1,000 points

· Taking eLearning certification: 2,000 points

· Selling key products: 1,500 points

· Product launch sales: 2,500 points

Whatever you give them for amassing points should be something above and beyond the compensation package. A golden rule is to consider the reward fall between of 1%-3% of their annual income. Remember, it’s all about creating recognition for excellence.

Driving Preferred Products / Vendors

Of course, the above lends itself to enhancing vendor relations. Structure this program so they can make more money by selling…

· Vendor products you already have

· Product that are not turning

· Key vendor products

Bring this structure to your vendors and you’ll be cooking with gas (or co-op / MDF).

Enhance Vendor Relations

As you can see, adding vendor focus into your customer retention/growth and sales initiatives creates a built-in vendor-first approach.

Creating these programs allows you to create more space for your venders in your promotions. It encourages sales to take the trainings that your vendors often provide.

Creating this structure also creates a foundation in your own go-to-market strategy. This can bolster your co-op funding and MDF conversations. The foundation of vendor-first marketing and selling gives you the stopping power to approach more vendors. Instead of asking for funds to support efforts, ask them who wants to buy into these well-crafted strategies.

Looking for more resources to help capitalize on 2024 growth? Visit our library of resources here.