What started as an advertising program group for 35 jobbers 50 years ago has turned into one of the only shareholder-owned parts distribution groups with around 100 members and 121 distribution centers. That group is Automotive Parts Associates (APA), started by Kansas City warehouse distributor Jim Green in the early 70s. Now celebrating its 50th anniversary, APA has evolved and grown with market challenges, but it refuses to rest on its laurels as both its supplier partners and members grow with the changing automotive aftermarket.

“We must celebrate the past but live in the present and future,” says Steve Tucker, APA president who took over the top spot a little over two years ago. “We’re concerned with growing the group and its members and giving them the tools and solutions to do that.”

In the most admirable way, Tucker describes APA’s current membership as an “island of misfit toys.” As one of the smaller program groups, APA, headquartered in Collierville, Tennessee, in the Memphis metro area, caters to warehouse distributors who don’t quite fit into other groups: import specialists, heavy-duty jobbers and both large and single-location distributors. When looking at satisfying their needs, strong supplier relationships, over a half-billion dollars in buying power annually and a no-nonsense approach to business is what sets APA apart from big-box retailers, Tucker believes.

“It’s as simple as providing good service. Listening to our shareholders and understanding their business,” Tucker says. “When I came on, I wanted to go to a back-to-basics approach. No trick plays, just blocking and tackling.”

With a long history of providing its members with the tools and solutions needed to take their business to new heights, APA is looking to a digital future and finding ways it can better service shareholders, their customers and supplier partners.

A Storied History

As one of the oldest program distribution groups in operation, APA was founded in 1973, and has since acquired members who steadfastly believe in its slogan “Allies for Success.” Major growth points included 1981, when membership almost doubled and the group amassed $450 million in annual sales. In the ’90s, Canadian buying group Best Buy Distributors Ltd. joined, and APA launched its Professional Choice auto care parts line. After merging with a privately held corporation for a couple years, APA began operations as a not-for-profit member cooperative in 1994.

“Our goal is for our shareholders to keep finding value in their membership,” Tucker says, noting that member and committee feedback is what drives the group to this day.

Over the years, various buying groups have joined APA, including Poja Warehouse and the Society of Import Parts Specialists. Its latest acquisition came with the addition of TruStar, a Texas-based program group that focuses on undercar parts such as brakes, shocks and exhaust parts. The acquisition represented another “specialist” that makes the group “a good place for niche-type suppliers,” Tucker says.

Digital Solutions

In the early 2010s, APA noticed the rise of digital operations and e-commerce and started supplying its members with business intelligence data and warehouse and inventory management systems to boost efficiency and streamline operations. The group also implemented its APA pricing portal, where members can access supplier pricing, new part number announcements, recalls and more.

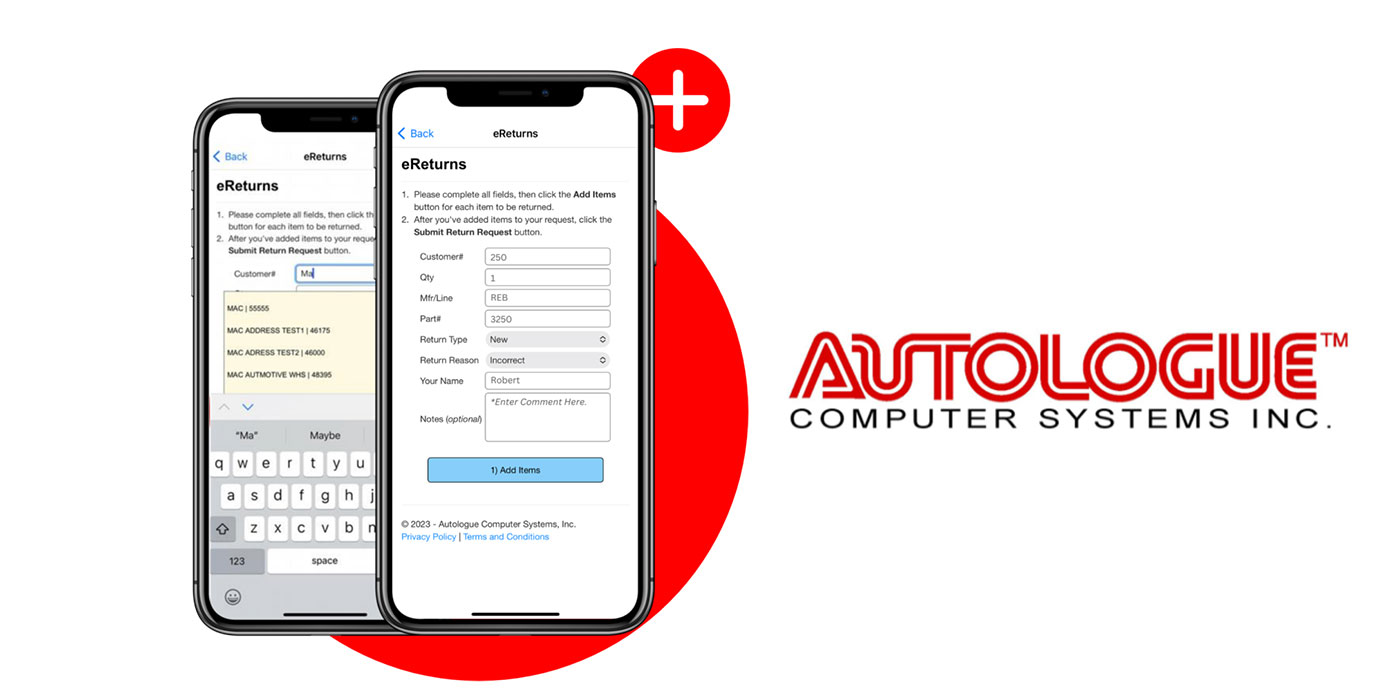

Over the years, e-commerce has also become a large part of member businesses with repair shops. No longer do repair shops call their local WD – they order parts online. That’s why, in 2018, APA implemented an EBiz Parts System, which gives repair shops access to their WDs’ inventory. In recent years, parts lookup by a vehicle’s VIN number and license plate have gained popularity, which APA has added.

The group also implemented a program called SourceIt, which allows parts distributors to find out-of-stock items from fellow APA members. And these solutions, Tucker says, are the tip of the iceberg.

“Our ultimate goal is to be comparative with the larger groups in terms of tools, inventory, data support and sales,” he adds.

In declaring “data is king!” Tucker admits that the business of selling parts has gotten more complicated, but data can help streamline decision making and smart choices at member businesses. APA members have access to the group’s Data Solutions software, which is designed to help optimize inventory and category management with access to industry data, group buying reports and individual business analytics. These reports are meant to help members increase their sales and profitability, better manage their inventory and improve ROI.

The group is also giving its members modern-day tools and solutions to expedite parts delivery to repair shops, such as efficient route planning software, electronic signatures and estimates on delivery times.

“It’s like ordering pizza. The shop wants the part in 30 minutes or less,” Tucker says. “It’s our job to have the data and tools in place to make that happen.”

A Matchmaking Service

A matchmaking service for an island of misfit toys might not seem like it has a place in the aftermarket, but if you ask Tucker, that’s how he describes APA’s role.

“We’re like a real estate agent,” he says. “We’re always looking to please both the supplier and buyer and give them the resources to succeed.”

While APA offers many digital services and data resources for its members, it does the same for its supplier partners, Tucker said. In 2019, APA partnered with Epicor to launch a data program with suppliers to give them information around parts inventory –increasing or decreasing their levels of a certain product and where sellout was happening in certain markets.

When discussing supplier relationships, Tucker admitted that the COVID-19 pandemic forced APA to take on more suppliers to have the inventory their members needed. However, it inhibited them from delivering volume to their suppliers.

“The supply chain was broken,” he says. “Right now, we’re looking at our supplier portfolio. We got fat during COVID with having too many suppliers in one category. We have to look at who is a good fit for us and our shareholders and if we’re a good fit for them.”

Tucker adds, over time, he feels program groups have strayed away from the volume play, but he feels if the correct incentives are in place, the group’s members will support a certain brand.

“We also work for the suppliers, so we have to be better for them,” he says.

Looking Toward the Future

Tucker speaks about APA’s future with positivity, pointing to the opportunities that exist for the group to better serve its shareholders and suppliers. One of those ways is in driving traffic to members and consolidating efficiencies. He said currently APA has the ability to act as a fulfillment partner for service businesses and contractors, such as Home Depot fleets.

“If all members consolidated their inventory in one field, we could act as fulfillment partner for automotive-adjacent businesses,” he says. “We could be their e-commerce partner.”

Other ways in which he feels APA can benefit is by promoting best practices between members to find solutions to grow their businesses, as many members don’t have the time to research the latest in distribution technology. Teaching members how to use technology and data tools is also key to the group’s future success, which includes monthly training sessions and in-person workshops.

One aspect of the industry that Tucker doesn’t shy away from is consolidation. In fact, he feels it’s good for the industry. A few large APA shareholders are consolidators themselves.

“It helps the good guys get better,” he says. “There are a lot of people in our business that are aging out and it provides a solution for their business to live on. These groups will help with our group’s longevity.”

In preparing APA to fulfill shareholder needs for the next 50 years, Tucker says the group needs to ensure that member businesses supply value to their customers in this generation and the next. Part of that means creating an atmosphere where members feel like family. The other aspect is supplying them with the hardware, software, supplier relationships and tools for them to take care of their customers.

“The worst thing to do is think you’re successful at any of it because that will keep you complacent,” he says.