ROANOKE, Va. – Advance Auto Parts has announced its financial results for the fourth quarter and fiscal year ended Dec. 28, 2013. Fourth quarter comparable earnings per diluted share (EPS) were 94 cents, an increase of 6.8 percent versus the fourth quarter last year. These fourth quarter results exclude transaction expenses of 24 cents associated with the acquisition of General Parts International Inc. (GPI) and 3 cents of integration costs associated with the integration of B.W.P. Distributors Inc. (BWP).

Full year comparable diluted EPS of $5.67, increased 8.6 percent from fiscal 2012. These full year results exclude transaction expenses of 28 cents associated with the acquisition of GPI and 7 cents of integration costs associated with the integration of BWP.

"I would like to thank all our team members for their hard work during the fourth quarter and the 2013 fiscal year," said Darren Jackson, CEO. "The acquisition of General Parts was another strategic step forward for our great company positioning Advance as the largest parts provider in North America with considerable sales growth and earnings opportunities. Operationally, we were very encouraged with the progress we made in 2013, which resulted in improved fourth quarter sales performance and record operating profits in 2013. We look forward to 2014 with excitement as we begin the integration of General Parts and build on our performance from 2013.”

Fourth Quarter and Fiscal 2013 Highlights

Total sales for the fourth quarter increased 6 percent to $1.41 billion, as compared with total sales during the fourth quarter of fiscal 2012 of $1.33 billion. The sales increase was driven by the net addition of 151 new stores over the past 12 months, the acquisition of BWP and a comparable same store sales increase of 0.1 percent. For fiscal 2013, total sales increased 4.7 percent to $6.49 billion, compared with total sales of $6.21 billion during fiscal 2012. For fiscal 2013, comparable store sales decreased 1.5 percent.

During fiscal 2013, the company generated $545.3 million in operating cash flow, a 20.4 percent reduction as compared to $685.3 million in fiscal 2012. Free cash flow in fiscal 2013 was $183.1 million versus $412.3 million last year. This decrease in free cash flow was primarily due to the company’s acquisition of BWP and an increase in owned inventory partially offset by a reduction in capital expenditures. Capital expenditures in fiscal 2013 were $195.8 million as compared to $271.2 million in fiscal 2012.

“We are pleased that we were able to exceed our comparable EPS expectations for both the fourth quarter and fiscal 2013,” said Mike Norona, executive vice president and CFO. “Despite the softer sales environment for a large part of the year, our sales acceleration in the fourth quarter combined with our gross profit improvements and disciplined focus on expense management throughout the year allowed us to increase our fiscal 2013 comparable earnings per share 8.6 percent over last year. We look forward to carrying our momentum into 2014 as we begin the journey of successfully integrating our acquisition of General Parts.”

The capital investments for 2014 are expected to be in the range of $325 million to $350 million, inclusive of approximately $50 million to $60 million of capital expenditures related to the acquisition of GPI.

“Our 2014 annual comparable cash EPS outlook will be in the range of $7.20 to $7.40,” said Norona. “We will continue to build on our 2013 progress as we focus on continued sales growth, serving our customers and improving our operating profit as we leverage the size and scale of the combination to deliver on the compelling financial potential of the General Parts acquisition.”

APA Welcomes BS Products as New TruStar Member

BS Products is a full-line nationwide wholesaler of automotive and quick lube supplies.

Automotive Parts Associates (APA) announced it welcomed BS Products as a new member to TruStar.

Founded in 2019 by friends and business partners Brett Peterson and Sean Malmstrom, BS Products is a full-line nationwide wholesaler of automotive and quick lube supplies. It specializes in filters, additives, tools, shop supplies, and safety and janitorial equipment, according to APA.

Federated Announces New Affiliate Member

A collaboration with the Association of Independent Oil Distributors will focus on mutual benefits for the respective members.

APA to Host Annual General Meeting

The event will be held on March 26-28, at the Grand Hyatt San Antonio River Walk in San Antonio.

PGI Wins Quality Award from NAPA Auto Parts

Premium Guard, Inc. was recognized for its leadership and excellence in quality.

Vast-Auto Awards Top Stores, Suppliers at Annual Convention

During the event, the Vast-Auto team recognized its distribution customers and unveiled its new brand image and programs.

Other Posts

Auto Parts 4 Less Group Inc. Announces Growth Strategy

The company said it aims to provide a seamless and reliable platform for high-quality automotive parts and accessories at competitive prices.

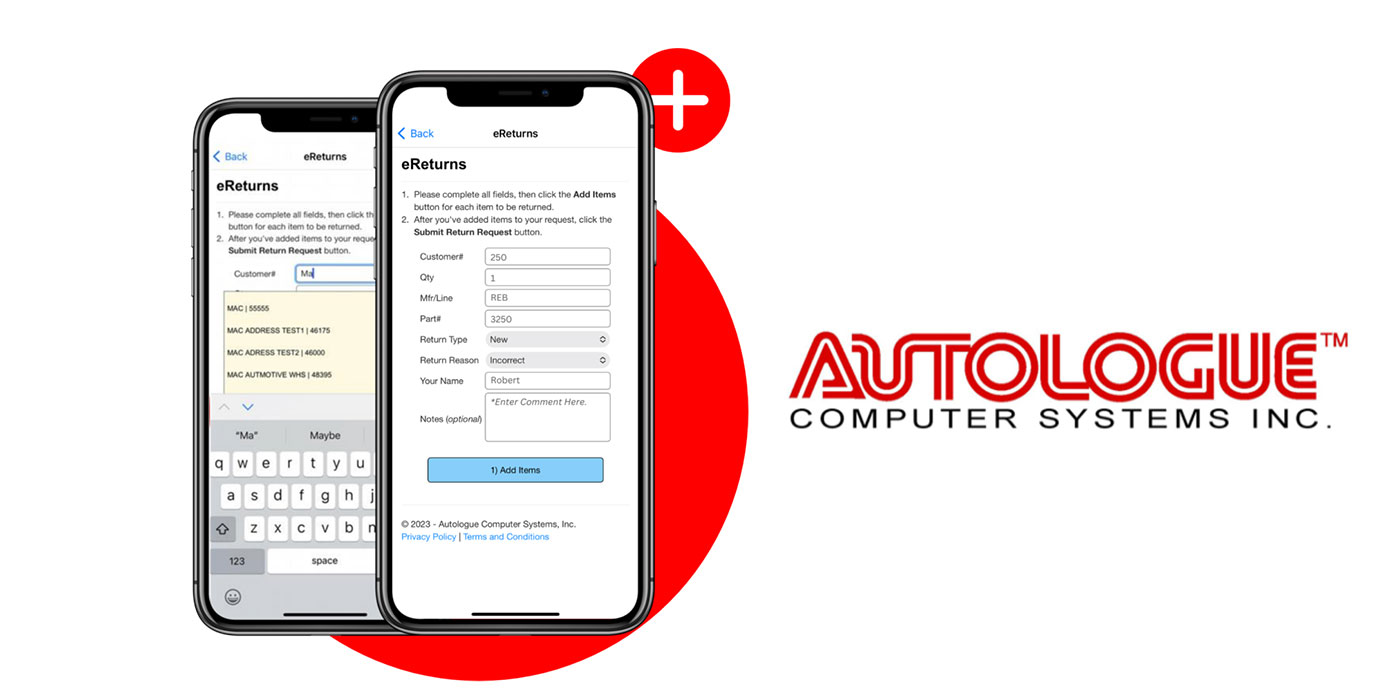

Autologue Creates Software Solution to Manage Customer Returns

The new eReturns module enables the shop to log a part into the app, select a return reason and view the progress of the return process.

APH Expands with Iowa Location

Kurt Croell’s Auto Parts store in New Hampton, Iowa, joined APH and now operates under the name Auto Value of New Hampton.

Fenix Parts Acquires Pacific Rim Auto Parts

Pacific is a specialty automotive recycler focused on eCommerce part listings and sales.