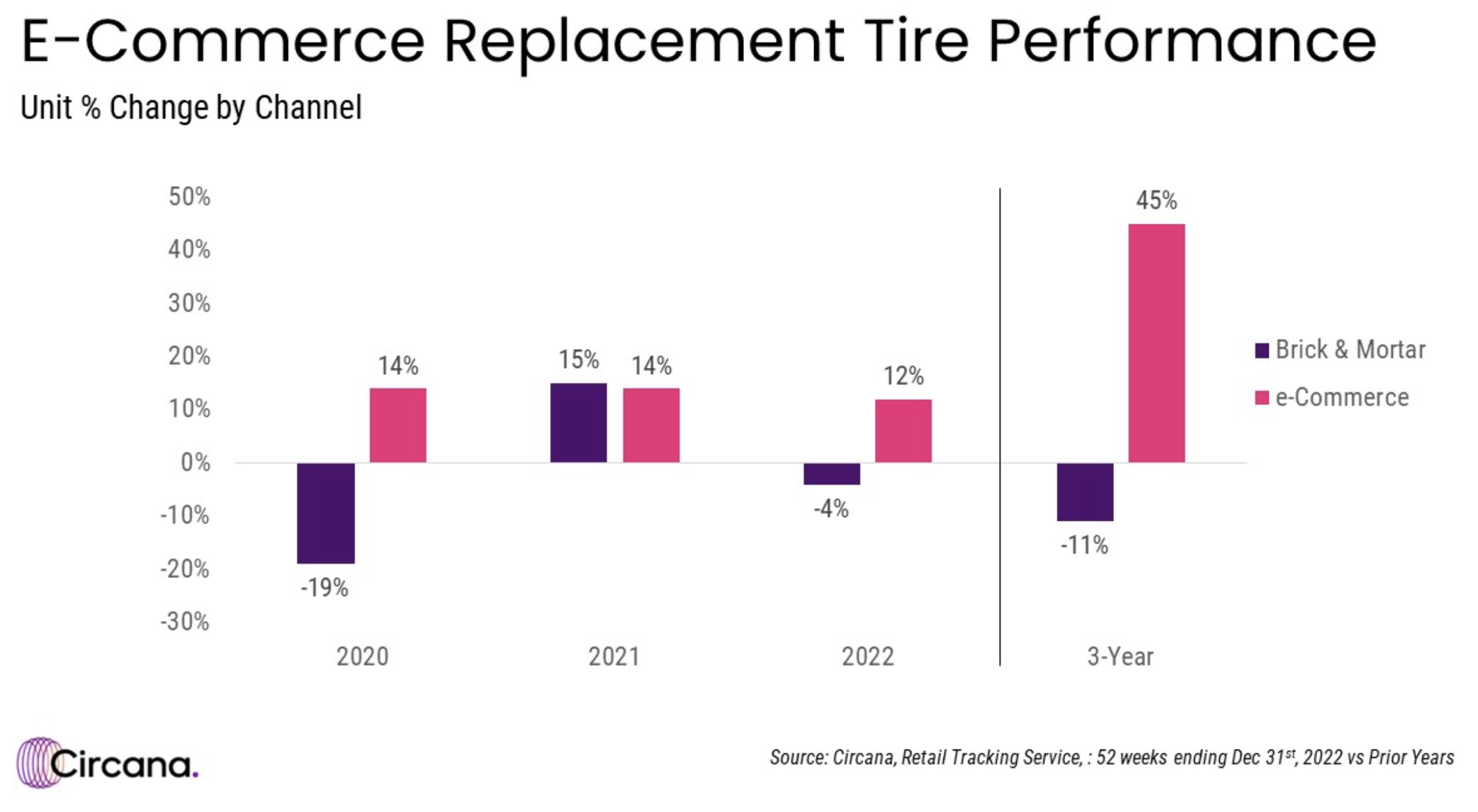

According to Circana, formerly IRI and The NPD Group, the U.S. replacement tire market has experienced its share of retail change since the start of the pandemic. E-commerce sales of replacement tires grew 45% over the last three years while the number of units sold at physical stores declined 11%.

“The amount of online traction in the replacement tire market is one of the biggest retail shifts that has appeared in past few years,” said Nathan Shipley, automotive industry analyst for Circana. “The convenience offered by e-commerce is providing a value to high-income aftermarket consumers, a group that recently re-engaged with their automobiles, tackling do-it-yourself projects, and taking family road trips over the past few years. And now they are continuing to spend at elevated levels across all automotive categories, including tires.”

Circana reports overall, 3% fewer replacement tires were sold at retail in the 12 months ending February 2023 than in the prior year. However, total tire sales are still 13% above to two years ago when consumer behavior was very different. E-commerce now represents 14% of all replacement tire sales, up from 9% in 2019.

Additionally, the company reports the average price of a tire sold online has increased 54% over the past three years, compared to a 32% in-store increase. In addition to economic price elevation, variations in product mix are contributing to some of the spending trends developing across retail. Despite continued average price increases, the modern trade channel, which includes tire replacement retailers that are not dedicated solely to selling tires, is another growing segment in the replacement tire market. In the first two months of 2023, 4% more tires sold through the modern trade channel than the same time last year, while 2% fewer sold through the traditional independent retailer channel. Prices in the modern trade channel average $40 below traditional independent tire retailers.

“Low-income consumers, in particular, are seeking value and stretching their car care needs and maintenance-related dollars to offset the pinch they are feeling from rising grocery prices,” Shipley said. “The income bifurcation of the consumer base has never been more apparent than it is now, and retailers who recognize that the pandemic fundamentally changed the who, what, where, when, and why of driving are the ones succeeding in today’s market.”