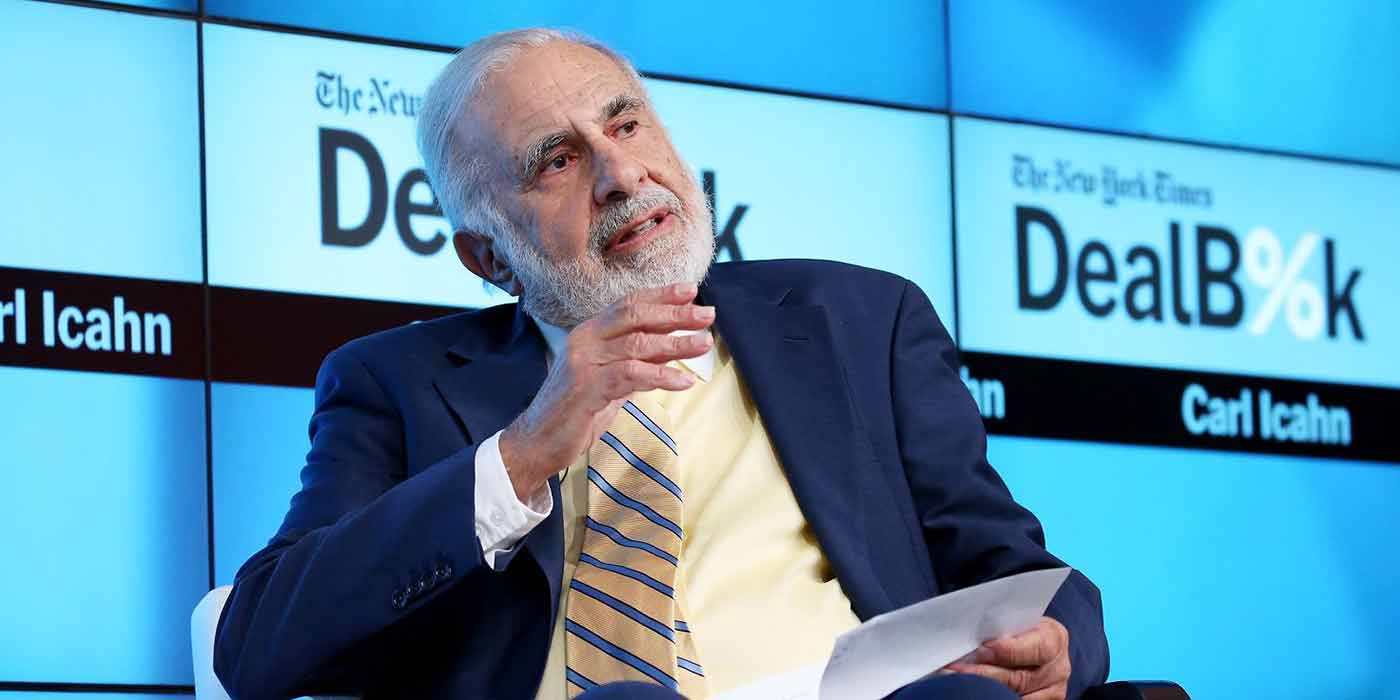

Icahn Enterprises L.P. (IEP) issued a statement today reporting that despite the success of several companies that it owns, IEH Auto Parts Holding LLC and its subsidiaries (collectively, known as Auto Plus), an aftermarket parts distributor held within the automotive segment of IEP, has not fared as well.

According to Icahn’s statement, various factors have negatively impacted this business as well as the industry in general, including lessened demand, supply chain disruptions, an inflationary environment and the effects of COVID-19. As a result, on Jan. 31, 2023, Auto Plus determined to file a voluntary Chapter 11 case. This proceeding is limited to Auto Plus and will not have a significant impact on IEP.

IEP stated that since acquiring Auto Plus, it has “invested significantly in transformation and restructuring initiatives and has loaned significant amounts to Auto Plus but has obviously been disappointed in the results of these investments and the continued losses that Auto Plus has experienced. As a result, IEP has determined that it would no longer be prudent to continue to loan money to Auto Plus at this juncture unless done in connection with a restructuring process.”

Auto Plus expects to continue to operate its business in the ordinary course and plans to run a sale process for substantially all its assets during the Chapter 11 case.

Icahn Enterprises L.P., a master limited partnership, is a diversified holding company engaged in seven primary business segments: Investment, Energy, Automotive, Food Packaging, Real Estate, Home Fashion and Pharma.