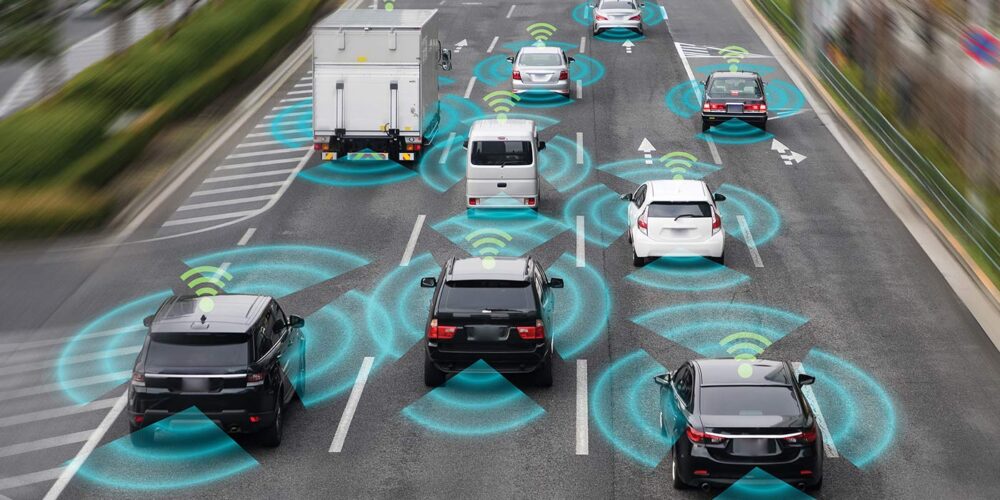

As 91 percent of respondents in the automotive space brace themselves for the entry of a new player in personal mobility, mass-market OEMs are expected to face difficult years, says ABI Research. In a recent B2B technology survey, the research firm found that only 10 percent of respondents expect these brands to have the most to gain from the mobility-as-a-service (MaaS) megatrend. Though automotive incumbents recognize that new personal mobility opportunities will attract competitors from markets such as ride-hailing and autonomous system development, the expectation remains that premium brands stand to gain the most from the prevalent automotive technology megatrends.

“Mass market OEMs thrive on their expertise in maintaining profitability when shipping in high volume, as well as their ability to mitigate for their consumers the necessary expense of private vehicle ownership,” said James Hodgson, senior analyst at ABI Research. “As adoption of shared driverless mobility spreads, private vehicle ownership will diminish and profitability will be tied heavily to utilization of shared vehicles, rather than ever-higher new car sales. In this context, it’s hardly surprising that the industry as a whole is pessimistic about the future of mass-market OEMs.”

High-volume brands are under increasing pressure to demonstrate their relevance in the forthcoming era of shared driverless transportation, most recently due to Tesla’s market cap exceeding that of both GM and Ford. In fact, Ford recently appointed former chairman of its smart mobility division, Jim Hackett, as CEO in a bid to restructure the company from a product seller into a mobility service provider.

Survey results show that 25 percent of automotive respondents expect ride-hailing operators such as Uber and Lyft to dominate the MaaS market, with most accepting that they will have some role to play. Mass-market OEMs have been particularly aggressive in partnering with and investing in smaller ride-hailing operators, and Renault-Nissan recently announced its intention to develop its own shared driverless vehicle service within the next 10 years.

“Premium brands are weathering the transition much better than their mass-market counterparts,” said Hodgson. “Not only do they have a commanding lead amongst automotive incumbents in the ‘nuts and bolts’ development of autonomous vehicles, but their history of delivering premium in-vehicle experiences makes them well-poised to capitalize on the shared third space.”

These findings are from ABI Research’s “Industry Survey: Transformative Technology Adoption and Attitudes – Automotive” report.