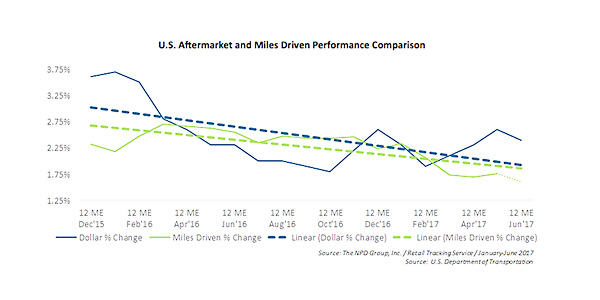

The storyline for the U.S. automotive aftermarket mid-way through last year was that average retail prices were down, yet dollar sales continued to grow. That story has changed in 2017. With a nearly 3 percent increase in average selling price, dollar sales grew just shy of 1 percent in the first six months of the year, while unit/quart volume declined by 2 percent, according to global information company The NPD Group.

The storyline for the U.S. automotive aftermarket mid-way through last year was that average retail prices were down, yet dollar sales continued to grow. That story has changed in 2017. With a nearly 3 percent increase in average selling price, dollar sales grew just shy of 1 percent in the first six months of the year, while unit/quart volume declined by 2 percent, according to global information company The NPD Group.

NPD has found this performance to be correlated with the slowdown in the growth rate of miles driven by consumers in the U.S. In the 12 months through May 2017, miles driven grew by 1.8 percent, equating to an annual increase of almost 55 billion miles; the year prior, it grew at a rate of 82 billion miles**.

“Retail price increases, driven by a mix of inflation and product mix changes, are influencing the aftermarket trend so far this year,” said Nathan Shipley, director and automotive industry analyst, The NPD Group. “We are also seeing a link between the industry’s performance and miles driven, the latter of which is growing at the lowest rate in over two years. Higher gasoline prices in the first 29 weeks of 2017 factors into this slowdown. To put it in perspective, a price increase of just 1 cent per gallon leads to a spending increase of $4 million per day in the U.S. What seems like a little goes a long way, and impacts consumers’ inclination to spend within the aftermarket and at retail in general.”

Industry performance was off to a rocky start during the opening months of the year, but began to improve in March, with May and June being the best-performing months of the year thus far. In the first half, the top-performing categories, which also outpaced the overall automotive aftermarket, were tire/wheel accessories (+7 percent), wipers (+5 percent), lighting (+4 percent), batteries (+4 percent) and tape (+3 percent). With the exception of batteries, all of these top-growth categories experienced retail price increases of 3 percent or more.

“In addition to the miles driven story, there are a number of other factors influencing the aftermarket today with long-term results,” said Shipley. “Aftermarket consumers are slowly migrating toward making non-distressed automotive product purchases online; extended oil change intervals are impacting the number of times a DIY consumer walks into an auto parts store; and millennials are becoming the new core consumer target. These are the ones that should be top of mind.”

*Source: The NPD Group, Inc. / Retail Tracking Service, January-June 2017

**Source: U.S. Department of Transportation, 12 months ending May 2017 versus 12 months ending March 2016