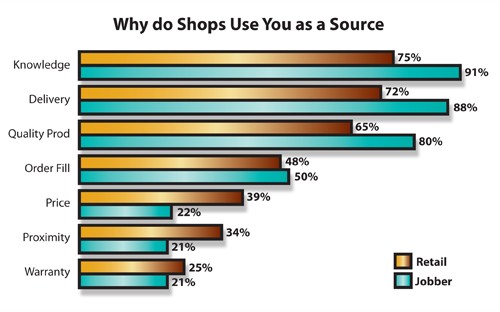

According to data collected by Babcox Research for the 2009 Counterman Reader Profile, the three leading reasons shops select both jobbers and retailers as a source for parts were knowledge, delivery and quality product. Two reasons that were significantly more important at the retail level were price and proximity.

Methodology:

In September 2009, Babcox Research mailed 4,499 questionnaires to jobber and retail subscribers of Counterman magazine. More than 450 surveys were completed and returned for a 10 percent response rate. Both audiences, jobbers and retailers, were sent the same questionnaire.

For more information about Babcox Research, visit http://www.babcox.com/marketing_research.html.