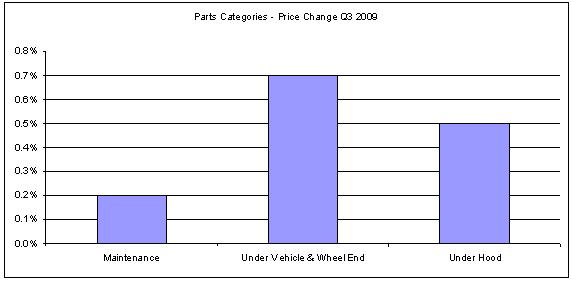

In the chart below we see the wholesale price repair shops pay for a “basket” of parts from three categories: maintenance parts, under vehicle parts and underhood parts. The Undercar category includes: exhaust, steering, suspension, brakes; the Underhood category includes: engine parts, electrical, HVAC, cooling; and the Maintenance category includes: filters, spark plugs, belts and hoses.

As the chart shows, the under vehicle category experienced the largest price increase during the past quarter.

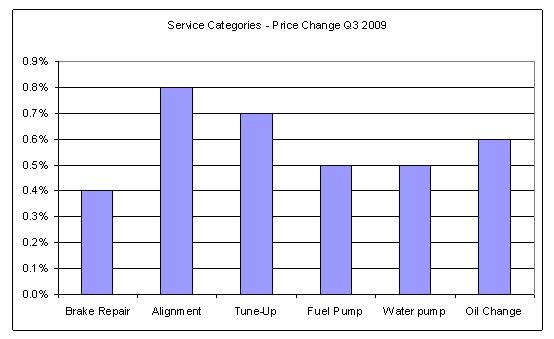

Next, we examine the price change consumers experienced for a select number of services, as illustrated in the chart below. Pricing information is from repair orders and includes parts, labor and all markups. Alignment, tune-up and oil change categories experienced the largest price increases during the past quarter.

The data is collected from service repair centers with additional service repair center level pricing information provided by Nu-Way Automotive.

Focused exclusively on all segments of the global automotive industry, TLG Research (TLGR) offers clients a unique approach to obtaining and keeping a global competitive advantage. Recognized as the “Parts Problem Solvers”, TLGR provides information quickly and cost effectively. Founded in 1992 by Thomas Langer, a 30 year industry veteran, TLGR through its proprietary database, provides a unique "menu driven" approach to offer services such as price comparisons and strategies, product/market data, channel information, competitive analysis, surveys, new product strategies and technical writing.