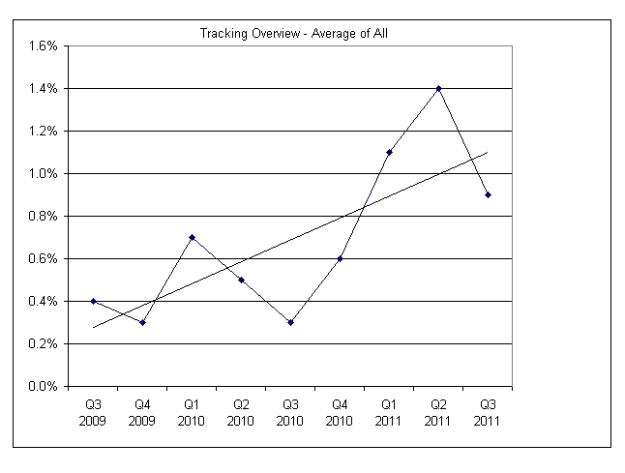

While not appearing directly in the market as of yet, the pricing pressure discussed in earlier quarters continues to build, according to TLG Research. Click here to see data from the previous quarter.

The pressure comes from three sources, TLG says:

1. While raw materials have stabilized, especially steel and related, the pause is related to demand drops globally, and many economists believe inflationary.

2. The desire by manufacturers to avoid waiting only to find they need to see a customer with a large increase, when it’s possible to take several smaller increases.

3. The largest manufacturing cost component, labor costs, is growing. With the core inflation rate for food and related consumer goods up significantly, as well as the pressure to add staff and the increasing costs of benefits at every level, the heat is on to find money to cover these increases. There has been a pause for now in pricing movement as we’re seeing the economy and demand soften, and it has been our forecast that we’ll continue to see a flat economy for some time to come. However, due to the factors noted above, this pause is temporary and we fully expect, as noted last quarter, to see significant movement in the fourth quarter of 2011 and first quarter of 2012.

Technicians, faced with mounting people costs also have had to increase their pricing. One government source noted a clear increase in auto repair labor rates in a recent overview. This will continue to be the case as we are faced with a nagging shortage of good, qualified technicians in every channel.

Definitions:

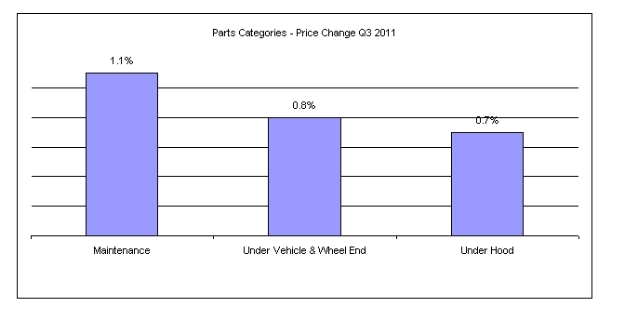

Parts Category

1. Based on reported pricing of parts to service repair centers

2. Represents change of current quarter over the prior quarter

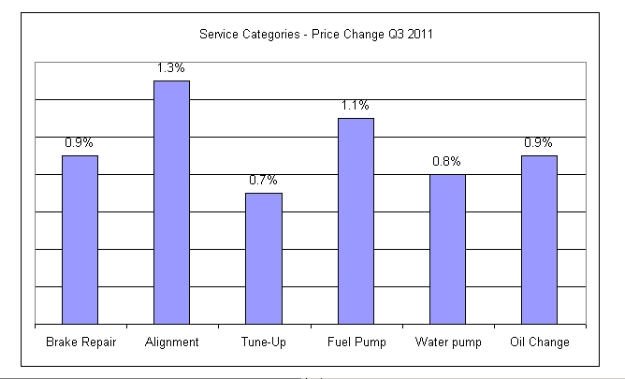

Service Category

1. Represents total job repair order price to prior quarter

Methodology for Pricing Calculations:

The pricing is based on changes in the current quarter relative to the prior quarter. The data is collected from service repair centers with additional service repair center level pricing information provided by Nu-Way Automotive. The "Parts Categories" includes only the parts. The "Service Categories" include both parts and labor and is based on the average reported. Pricing is collected in percent change, and is averaged across the U.S. Where needed, the data is weighted in order to represent the entire market.

Focused exclusively on all segments of the global automotive industry, TLG Research (TLGR) offers clients a unique approach to obtaining and keeping a global competitive advantage. Recognized as the “Parts Problem Solvers,” TLGR provides information quickly and cost effectively. Founded in 1992 by Thomas Langer, a 30-year industry veteran, TLGR, through its proprietary database, provides a unique "menu driven" approach to offer services such as price comparisons and strategies, product/market data, channel information, competitive analysis, surveys, new product strategies and technical writing.