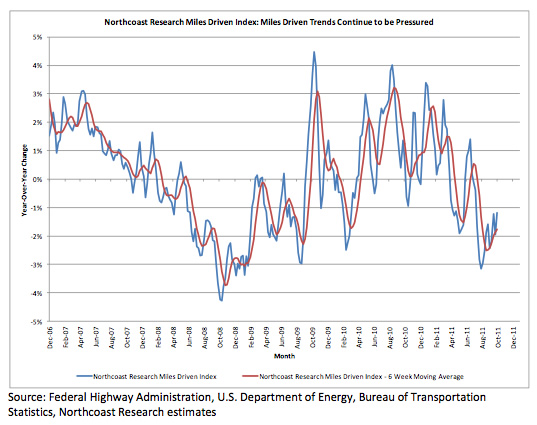

The Northcoast Research Miles Driven Index is designed to capture/estimate the trend of year-over-year changes in the number of miles driven by the light vehicles in the United States. Northcoast’s data series is similar to the Federal Highway Administration’s Vehicle-Miles Driven and Traffic Volume Trends reports, with the noted differences being that this index is designed to exclude the impact of medium- and heavy-duty trucks and is available six to seven weeks ahead of the governmental data.

Year-over-year miles driven trends remained pressured in September as the Northcoast Research Miles Driven Index decreased 1.2 percent, following a 1.6 percent decline in August. As a reminder, the index fell 3.1 percent and 0.1 percent in July and June, respectively.

Given the continuation of deteriorating miles driven trends and a choppy economic backdrop, Northcoast Research says it continues to have a bearish outlook on the year-over-year growth prospects for the aggregate miles driven by the nation’s light vehicle fleet over the next six to 12 months.

The number of miles driven on a 2-year stacked basis has been vacillating between positive and negative territory since the beginning of the year. This characteristic continued in September as the index decreased 60 bps, which was a reversal from the 80 bp increase in August.

"We remain very cognizant of the headwinds facing consumers and believe that we are likely to see further deterioration of aggregate miles driven as we move throughout the remainder of the year," Northcoast Research stated in its latest Miles Driven Index. "In our opinion, further weakness would clearly have negative implications for intermediate demand trends in the DIFM and DIY channels, and more importantly, it could serve as a psychological overhang on the stocks in the space.

"While we continue to appreciate the opportunity that the national automotive parts retailers have to gain market share in the DIFM channel and we like many of the macro trends at work in the space — including the aging of the nation’s light vehicle fleet and the ability for consumers to fund vehicle repairs if gas prices do not trump year-over-year gains on the employment front — current valuations are not attractive enough for us to dip our toes back into the water, especially given the challenging sales comparisons that began in March and extend throughout the remainder of CY11. As a result, we are maintaining our NEUTRAL ratings on Advance Auto Parts, AutoZone and O’Reilly Automotive."

Northcoast Research is an independent, full-service institutional equity research and trading firm headquartered in Cleveland, Ohio. Founded in 2009, the company’s mission is to add value in each phase of the investment process by aligning the company’s goals with those of its clients. Northcoast aims to provide unbiased, proprietary and actionable fundamental research on select industry verticals and companies, underpinned by comprehensive channel checks across a broad array of industry contacts. The company’s core research verticals are Consumer, Health care, Industrial and Business Services.