The Northcoast Research Miles Driven Index is designed to capture/estimate the trend of year-over-year changes in the number of miles driven by the light vehicles in the United States. Northcoast’s data series is similar to the Federal Highway Administration’s Vehicle-Miles Driven and Traffic Volume Trends reports, with the noted differences being that this index is designed to exclude the impact of medium and heavy duty trucks and is available 6 to 7 weeks ahead of the governmental data.

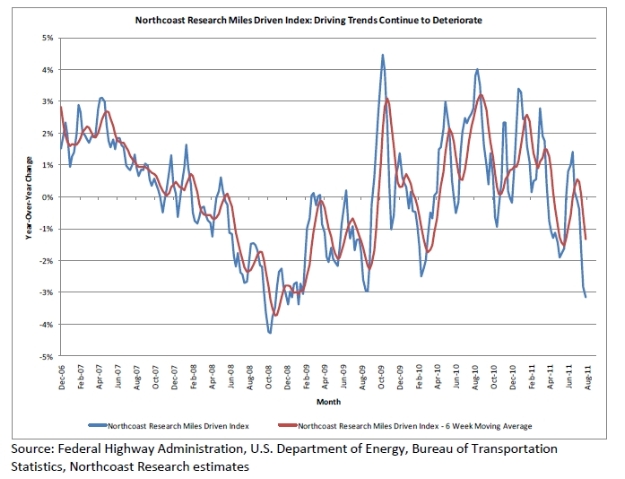

The Northcoast Research Miles Driven Index decreased 3.1 percent in July, which came on the heels of a 0.1 percent decline in June. The index was unchanged in May following a 140 bp year-over-year slide in April. Northcoast Research says it continues to believe that the significant increases in gasoline prices on a year-over-year basis during the past six months, combined with an economy that is losing momentum, are the leading factors pressuring the trend in miles driven.

On a two-year stacked basis, the index has been fluctuating back and forth between positive and negative territory since the beginning of the year. The index ended July down 50 bps versus a 240 bp increase in June. Much like the case with the one-year data, comparisons in the two-year data series remain challenging as we move throughout the remainder of the year.

In its research note, Northcoast Research stated, "We are very cognizant of the fact that the headwinds to miles driven are strong and that we could see further deterioration as we move throughout the remainder of the year. Further weakness would clearly have negative implications for intermediate demand trends in the DIFM and DIY channels, and, more importantly, serve as a psychological overhang on the stocks in the space.

"While we appreciate the opportunity that the national automotive parts retailers have to gain market share in the DIFM channel and we like many of the macro trends at work in the space, including the aging of the nation’s light vehicle fleet and the ability for consumers to fund vehicle repairs if gas prices do not trump gains on the employment front, we do not think current valuations are attractive enough for us to dip our toes back into the water, especially given the challenging comparisons throughout the remainder of CY11. As a result, we are maintaining our NEUTRAL ratings on Advance Auto Parts, AutoZone and O’Reilly Automotive.”

Northcoast Research is an independent, full-service institutional equity research and trading firm headquartered in Cleveland, Ohio. Founded in 2009, the company’s mission is to add value in each phase of the investment process by aligning the company’s goals with those of its clients. Northcoast aims to provide unbiased, proprietary and actionable fundamental research on select industry verticals and companies, underpinned by comprehensive channel checks across a broad array of industry contacts. The company’s core research verticals are Consumer, Healthcare, Industrial and Business Services.