Each month, Northcoast Research publishes the Northcoast Research Mechanic Index, based on the results of a survey of approximately 50 independent repair shops operating in the top 10 states (based on the light vehicle fleet population), plus Advance Auto Parts’, AutoZone’s and O’Reilly’s aggregate store count.

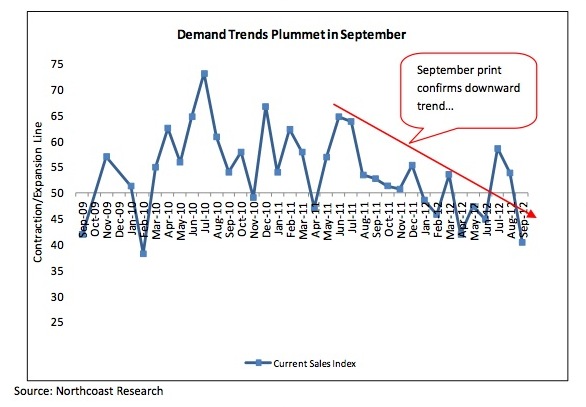

Below are highlights from the results of Northcoast Research’s Independent Automotive Repair Garage Survey for September 2012.

"According to the survey responses from nearly 250 independent garage owners, demand trends in the DIFM channel were severely pressured in September relative to the prior year," Northcoast Research noted in the report. "In our view, this performance confirms our belief that the positive data from July, and to a lesser extent August, was largely driven by above-average temperatures and increased promotional activity – without which demand trends would have suffered."

Northcoast added that while consumers’ tendency to defer non-essential work has been an obstacle to demand trends for a number of quarters, the pain from this trend was particularly acute in September. This development clearly pressured traffic trends during the period.

"Garage owners noted that they anticipate a decline in sales during 4Q CY12, as the Three Month Outlook Index fell below 50.0 for the first time in the three years that we have been conducting the survey," Northcoast stated. "More specifically, the Three Month Outlook Index fell 16.6 percent to close at 48.7.

"While the print is just under 50, we would be remiss not to point out the fact that the group is typically very optimistic. For example, the average reading of the Three Month Outlook Index is more than 20 percent higher than the actual readings in the Current Sales Index since the inception of our survey."

"The three most commonly cited reasons for the bleak outlook were: (1) October has gotten off to a very slow start; (2) recent traffic trends have been very anemic despite the increased promotional activity; and (3) gasoline prices have been moving in the wrong direction.

"While we continue to appreciate the opportunity that the publicly traded players in the automotive aftermarket have to gain market share in the DIFM channel, current valuations are not attractive enough to pique our interest, especially given the recent deterioration in sales trends and signs that the industry remains under some pressure. Furthermore, we continue to have concerns over what a changing mix of automobiles in the nation’s light vehicle fleet could mean for demand trends over the next four to five years. As a result, we are maintaining our NEUTRAL ratings on Advance Auto Parts, AutoZone, Monro Muffler Brake and O’Reilly Automotive."

To read the full report on Northcoast Research’s August 2012 Independent Garage Survey, click here.

ABOUT NORTHCOAST RESEARCH

Northcoast Research is an independent, full-service institutional equity research and trading firm headquartered in Cleveland, Ohio. Founded in 2009, the company’s mission is to add value in each phase of the investment process by aligning the company’s goals with those of its clients. Northcoast aims to provide unbiased, proprietary and actionable fundamental research on select industry verticals and companies, underpinned by comprehensive channel checks across a broad array of industry contacts. The company’s core research verticals are Consumer, Health Care, Industrial and Business Services.