Each month, Northcoast Research publishes the Northcoast Research Mechanic Index, based on the results of a survey of approximately 50 independent repair shops operating in the top 10 states (based on the light vehicle fleet population), plus Advance Auto Parts’, AutoZone’s and O’Reilly’s aggregate store count.

Below are highlights from the results of Northcoast Research’s Independent Automotive Repair Garage Survey for December 2012.

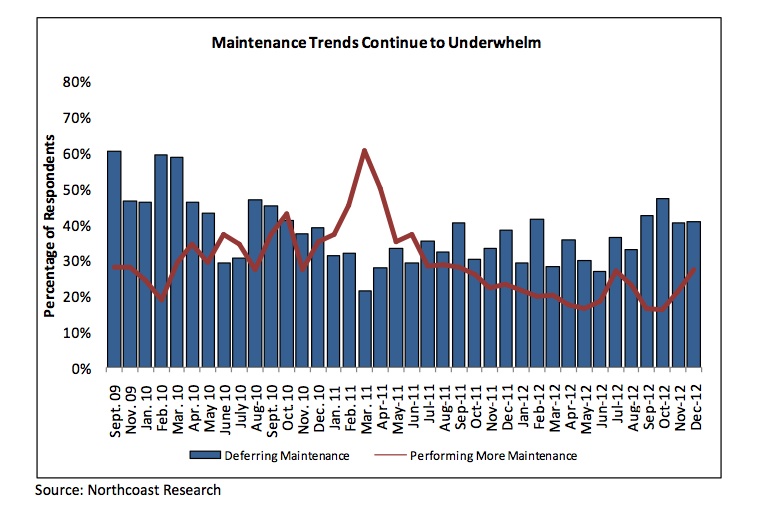

According to the survey responses of nearly 350 independent garage owners, demand trends in the DIFM channel remained severely pressured in the final month of 2012, as evidenced by the fact that the Northcoast Research Current Sales Index finished December at 38.4, which punctuated a less-than-spectacular year for the industry.

"It is important to point out that the weakness moderated from the anemic trends witnessed in November," Northcoast stated in its most recent report. "Additionally, it is important to highlight the fact that the industry faced a tough calendar comp in that Christmas fell on a Tuesday this year, as opposed to a Sunday in 2011. This shift had the effect of shortening the operating calendar, since most garages are already closed on Sunday.

"Despite the fact that the weak traffic results in December were obviously exaggerated by the timing of Christmas, there clearly is a downward trend in the net percentage of garages that are experiencing year-over-year gains in car count.

"Temperature trends through the first two weeks of January have improved significantly from the patterns witnessed in December as temperatures have largely been colder across the country relative to the conditions seen in the prior year. That said, we do not think this development will have a material impact on demand trends.

"The collective outlook of the garage owners in our sample became meaningfully more optimistic as we entered 2013. The most commonly cited reasons for the improved outlook were: (1) easy comparisons; (2) the expectation for a release of pent-up demand for repair work; and (3) the belief that weather can’t serve as another material headwind in 2013.

"While we continue to appreciate the opportunity that the publicly traded players in the automotive aftermarket have to gain market share in the DIFM channel, current valuations are not attractive enough to pique our interest, especially given the ongoing weakness in sales trends. Furthermore, we continue to have concerns over what a changing mix of automobiles in the nation’s light vehicle fleet could mean for demand trends over the next three to four years. As a result, we are maintaining our NEUTRAL ratings on Advance Auto Parts, AutoZone, Monro Muffler Brake and O’Reilly Automotive."

To read the full report on Northcoast Research’s November 2012 Independent Garage Survey, click here.

ABOUT NORTHCOAST RESEARCH

Northcoast Research is an independent, full-service institutional equity research and trading firm headquartered in Cleveland, Ohio. Founded in 2009, the company’s mission is to add value in each phase of the investment process by aligning the company’s goals with those of its clients. Northcoast aims to provide unbiased, proprietary and actionable fundamental research on select industry verticals and companies, underpinned by comprehensive channel checks across a broad array of industry contacts. The company’s core research verticals are Consumer, Health Care, Industrial and Business Services.

J.D. Power: BEV Owners Experience More Vehicle Problems

The study found that owners’ experience with BEV advanced technology is more problematic than with ICE vehicles.

Battery-electric vehicle (BEV) owners experience more problems with advanced technology than do owners of internal combustion engine (ICE) vehicles, according to the J.D. Power 2023 U.S. Tech Experience Index (TXI) Study, released on August 24. The study focuses on the user experience with advanced vehicle technology as it first comes to market and is an early measure of problems encountered by vehicle owners.

AAA: The Lifesaving Potential of Driving Assistance Tech

AAA forecasts that 37 million crashes could be prevented over the next 30 years with ADAS.

S&P Global Mobility Report: Aftermarket May See Boom

The share of vehicles more than eight years old will increase, the report says, signaling increased aftermarket business.

57% of All Diesel Trucks on Roads Are Near-Zero Emissions

New near-zero emission diesel trucks on the road increased 10.2% from 2021 to 2022, according to the Diesel Trucking Forum.

Digital Influence on Auto Parts to Reach $200B by 2026

The impact of digital media on retail sales will be $177 billion in 2023 in the US, according to Hedges & Co.

Other Posts

Consumers in Canada Sour on EVs, J.D. Power Finds

More than 60% of respondents said they’re unlikely to consider an EV for their next car.

Edmunds: Pent-Up Demand to Prop Up New Car Sales in Q2

Edmunds forecasts that more than 4 million new cars and trucks will be sold in the U.S. in Q2 2023.

SEMA: Specialty-Equipment Market Sees $51B in Sales in 2022

Pickup accessorization remains the biggest segment for the industry, topping $15 billion in sales, the study found.

EY Research: Nearly Half of US Car Buyers Want to Buy an EV

US consumer interest in electric vehicles is at an all-time high, according to the EY Mobility Consumer Index.