As we prepare for the winter driving seasons, many brake manufacturers and distributors have begun ramping up promotions to get motorists into repair shops for brake inspection and replacement. According to data from the most recent P.A.R.T.S. survey conducted by Counterman magazine, repair shops on average perform 10 jobs a month that require brake friction products. Forty percent of shops keep brake friction product in stock and when it’s time to re-stock, they have an average 3.3 sources that they rely on.

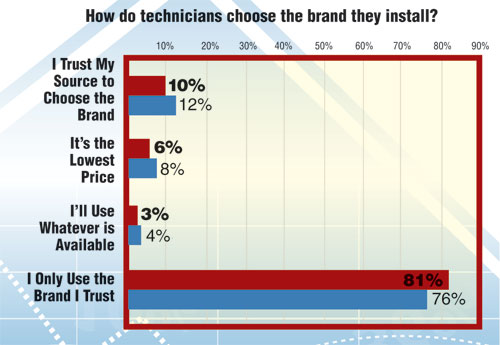

Jobbers continue to be the primary source for shops sourcing brake friction, among 54 percent of survey respondents, followed by WD direct (18 percent) and Retailers (14 percent). When asked why they chose a particular source as their ‘first call,’ survey respondents cited availability (40 percent), best sales reps (29 percent) and fastest delivery (25 percent) among their top reasons. And as brakes are one of the most critical safety components on any vehicle, choosing a brand they trust is of utmost importance to techs.

These and other statistics can be found in P.A.R.T.S., produced annually by Counterman magazine. Nine years ago, Counterman began surveying repair shops annually to determine when, how and why they source specific automotive parts and products. The resulting data, published every fall, offers perspective on how sourcing and brand-loyalty trends have changed. The 2009 P.A.R.T.S. report is mailed with the September issue of Counterman.