From The Catevo Group

By Mitch Javidi and Neil Zipser

“How can I provide the highest-quality aftermarket products at the lowest possible price and still make money?”

If that’s one of the questions keeping you up at night, you’re not alone. For many distributors and retailers, the “knee-jerk” answer is simple — go overseas where prices are cheaper due to lower labor and production costs.

Today’s global marketplace requires new thinking on how you do business. Sourcing products from around the world in some cases has become not just another option but a necessity to compete and ultimately survive.

But is importing the only alternative to increasing competitive pressures? And if importing is at least part of the answer, how do you know what you are receiving meets quality standards? And, finally, are you prepared for the other challenges that are inherent with importing?

For many companies, importing translates into big profits. What they fail to consider is the hard work and the financial risk that comes with importing. Before making the decision to import, a distributor/retailer needs to weigh all factors carefully and consider that even though the product may be coming from a low cost country, by the time all the other expenses are added on, the ultimate cost once the parts reach the desired distribution center may not be as appealing as anticipated.

The Realities

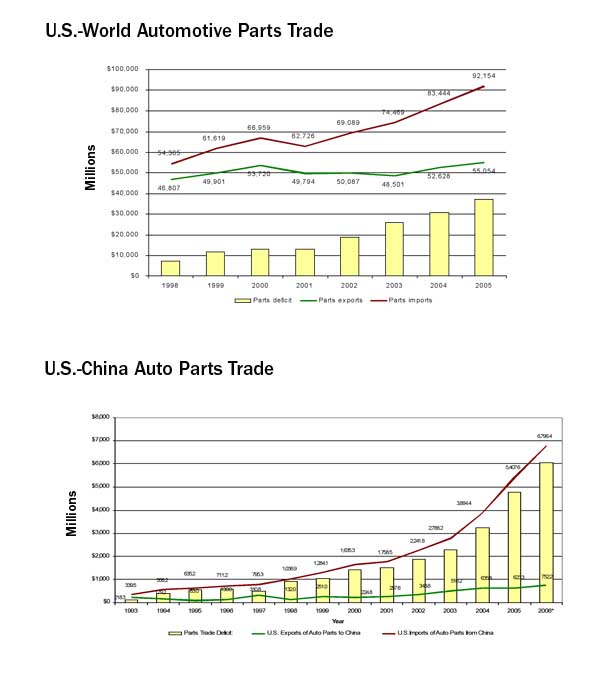

Imported aftermarket components are increasing at unprecedented rates. Imports of automotive parts into the United States totaled $92.2 billion in 2005 – an increase of 10.4 percent from 2004.

China has become a growing player in the aftermarket as imported parts from China reached a total of $5.4 billion in 2005, according to the U.S. Department of Commerce. Since 2000, the auto parts trade deficit with China has increased 239 percent. These numbers are projected to rise dramatically over the next several years.

One manufacturing executive recently said, “If you’re not sourcing some of your product from overseas, than you are not thinking clearly.” Another industry executive added that 10 years from now there may be virtually no manufacturing of aftermarket products in the United States at all, so a low-cost country sourcing strategy is required for survival.

Sourcing products by manufacturers to complete their product lines and by their customers to find lower-cost products has become a reality – and a necessity. However, sourcing aftermarket products from non-U.S. manufacturers brings many challenges: How can you be assured of quality? Are the product offerings diverse enough for your customers? If you are planning to import, how and where do you start what could be a complex process? How do you protect your intellectual property? And how can manufacturers leverage low-cost country sourcing as a competitive advantage?

It used to be that American companies could point to quality as the reason to avoid sourcing products from overseas. That argument is no longer valid in most cases as quality has improved and in some instances is as good, or better, than domestically made products.

So how can you provide the highest-quality products at the lowest costs? The first step is to understand the issues of importing. Then you can educate your customers on why they should rely on your expertise to source high-quality, low-cost products. They have trusted you to build their businesses to this point; let them rely on you to help expand their businesses further both in the United States and abroad. And, more importantly, you take on the risk and responsibility of sourcing overseas products and allow them to concentrate on what they do best – focus on their customers.

Understanding the Issues

As global competition expands, companies are exposed to a myriad of risks related to their international trade activities. It’s important for companies to manage these trade risks in the same way they manage other business risks. New opportunities overseas, increased government scrutiny of imports due to heightened security concerns, a surge in special trade programs and increasing trade activity make 2007 a year in which businesses will need to manage these trade risks more than ever before.

The first step for an aftermarket supplier is to embrace low-cost country sourcing. A strategy that includes sourcing products from low-cost countries allows a supplier to take advantage of lower labor and raw material costs to complete a product line or expand product offerings in a cost-effective manner. It allows you to source slower-moving products or products that can help you provide an all-makes, all-models product offering that doesn’t otherwise make good business sense to manufacture.

Once low-cost country sourcing is embraced, you will need to become an expert in managing that strategy. While the purchasing and manufacturing executives are doing their job identifying the best possible partners, it’s up to the sales and marketing teams to understand how low-cost country sourcing can be used as a competitive advantage.

For example, the growth of importing aftermarket automotive parts has uncovered a number of major issues that many distributors and retailers may not fully understand, including:

- Fragmented manufacturing base – very few manufacturers can provide diverse product lines;

- Inconsistent product quality – quality may be inconsistent throughout or even within product lines;

- Large order quantities – bulk quantities are needed to fill shipping containers to make transportation cost-effective;

- Long lead times/high inventory levels – the time it takes to ship and clear customs requires that orders be made well in advance;

- Packaging/labeling issues – many companies in low-cost countries do not or will not provide the appropriate packaging and labeling needed to effectively sell products in the Unites States;

- Various time-consuming logistical and duty issues that the importer of record may be responsible for, including: anti-dumping issues, countervailing duties, need scale to leverage freight, difficult to manage and administer; large responsibility to be importer of record

- Freight expense volatility, rising fuel surcharges – tariffs and other surcharges tend to vary and change at any time making costs hard to predict;

- Lack of product coverage depth – while some manufacturers offer the product you are looking for, SKUs are often limited, making an all-makes, all-models strategy difficult or impossible to execute;

- Cataloging – overseas companies typically cannot provide catalogs that meet U.S. industry standards and usually contain inaccurate or missing data; and

- Manufacturing capacity – some overseas manufacturers will not dedicate capacity to your business and may subcontract to a broker or trader, making reliability a concern.

Becoming the Experts

It was a wake-up call to many manufacturers last year when NAPA announced that it was opening a purchasing facility in China strictly to source lower cost products. But was it necessary for NAPA to invest in opening a facility and staffing it with procurement specialists? Perhaps not, if U.S. manufacturers were positioned to become importing experts and take on the role as importers of record. Here are some issues that work in the favor of U.S. suppliers if they are committed to enhancing their value as full-source partners.

Managing the quality: The greatest concern of any distributor and retailer when importing aftermarket products should be the quality of the products they are receiving. Many U.S. suppliers have years of proven quality success and have earned the difficult-to-obtain ISO and other quality certifications. U.S. suppliers can identify the best possible sourcing partners, test the products and then vouch for their quality and performance. This will help distributors and retailer ensure consistent high-quality and delivery. Additionally, this will help alleviate the very real concerns of accepting counterfeit or sub-standard products which jeopardize consumer safety and, ultimately, may lead to civil and criminal penalties that the distributor/retailer may be responsible for.

Acting as the “Importer of Record: ” It is critical to consider the effects of tariffs, taxes, port-handling fees and other miscellaneous customs charges when determining the product’s final cost. Typically, the importer (buyer) is responsible for paying these charges. If the U.S. supplier acts as the “Importer of Record,” the customer does not have to worry about these confusing and burdensome costs which can be built into the overall product price. The release of this burden frees a significant amount of administrative time and transfers risk to the supplier.

Direct shipment to your destination(s): Distributors and retailers that import products into the country have to then ship products to their various distribution centers or other desired destinations once clearing the ports. Dealing with U.S. Customs (now under the direction of the Department of Homeland Security) may not be fast or easy at times. A U.S. supplier can manage this distribution process by direct shipping the products to their customers’ locations which alleviates another time-consuming, costly and burdensome process.

Accurate cataloging: The industry has worked long and hard to develop cataloging standards that are now commonplace in the industry. Will manufacturers in low-cost countries understand these unique cataloging issues? Will the information be accurate? Will it be consistent with what has been accepted for years? Will it comply with AAIA and ACES standards? U.S. suppliers are in the best position to manage this process and provide complete, accurate and compliant cataloging.

Proper labeling and packaging of products: Each customer generally has unique labeling and packaging requirements, and sometimes, these requirements can be confusing. There are multiple private brands, specific requirements for products being sold in Mexico and Canada, products that need more reinforced packaging than others, bar codes meeting AIAG standards and contain the appropriate label information such as part number, supplier number, serial number and purchase order are just a few of the considerations. Like cataloging, this is a business necessity that may be overlooked when pricing is put in front of everything else. A U.S. manufacturer that clearly understands the unique labeling and packaging requirements of their customers can best manage this process.

Cultural and Regulatory Issues

As more and more organizations are expanding globally into Asia Pacific (notably China and India), Latin America, Europe and Russia, there is an increasingly growing concern over the shifting set of regulatory and contractual issues associated with managing relationships in these regions. Western managers are often not well-trained in cross-cultural differences and struggle to manage these relationships effectively.

A recent study by the International Association of Contract and Commercial Managers found that the greatest differences in relationship management and cultural problems appear to occur in regions such as China, Japan, the Middle East, Russia and Eastern Europe. It is often in these areas where the religious and cultural differences are greatest. The research shows that the difficulties typically occur because most corporations rely on unstructured processes, poorly informed teams, and lack of planning. However, a recent panel of experts at North Carolina State University pointed to the fact that managers encountering these difficulties should think through a different approach towards management of these relationships. The panel emphasized the following points:

- Involve government partners and applicable stakeholders early on, and bring them along – and do not wait until the very end. Many governments in foreign countries require that they be involved, or they will put up barriers to your project. We have had plenty of successes and frustrations – and yet in most cases we didn’t handle that correctly, panel members said.

- Build relationships early on. One panelist noted that he completely overlooked the importance of making a group of Chinese managers feel like they were part of the team during the relationship formation stage.

- Develop an intimate understanding of the local business culture and understand its specific preferences and requirements. The importance of building effective communication is one of the most overlooked elements. One panelist noted that, “We often assume that people who can speak our language can fully understand what we are saying. That may or not be true.”

Managing lead times: It can take cargo three weeks or more just to travel by ship across the ocean and another week to clear customs. Putting the onus of inventory control on the manufacturer takes an enormous responsibility off the customer. For this to happen, aftermarket suppliers must become better forecasters and arm themselves with better data to anticipate demand. The longer lead times in shipping product overseas and clearing customs requires more advanced planning. Carefully managing inventory overseas and planning its delivery will significantly reduce inventory levels and costs in the United States.

Accounting Issues: The U.S. importer of record must use “reasonable care” to enter, classify and determine the value of imported merchandise and provide any other necessary information customs needs to properly assess duties, collect accurate statistics and determine whether the transaction meets all applicable legal requirements. An importer’s failure to exercise reasonable care could delay release of merchandise and, in some cases, result in the imposition of penalties. Some companies participate in voluntary self-governance programs offered by the U.S. government in exchange for not being audited. Others incorporate the import/export function into their Sarbanes-Oxley Act testing programs. But perhaps the most common practice is to rely on customs brokers, the agents responsible for filing entry paperwork with U.S. Customs and Border Protection, to help manage trade risk. This is a burdensome task that U.S. suppliers can perform for their customers.

There are other financial risks to consider including fluctuations in foreign currency which can affect profits unless you can arrange to collect revenue in your home currency. Another risk is associated with tariffs as sudden changes in the classification of goods or duties can happen which can change the cost of your goods.

Since the birth of the aftermarket, North American suppliers have been the benchmark for technology, quality and service and have been the driving force to make the industry what it is today. As distributors and retailers consider low-cost sourcing strategies, it is certainly worth their time and energies to look to their trusted partners for assistance and leadership in helping craft a plan of action. By understanding all the critical issues, everyone will achieve the ultimate goal: providing the highest-quality products at the lowest cost.

The Catevo Group is an integrated marketing and communications and business consulting group based in Raleigh, NC. Catevo Aftermarket serves as an integrated strategic services organization enabling navigation for global aftermarket business evolution. For more information about The Catevo Group, go to: www.catevo.com.

Mitch Javidi, Ph.D. president and CEO of The Catevo Group, is a tenured professor of business strategy and market research and a member of the Academy of Outstanding Teachers & Scholars at North Carolina State University.

Dwight Hallman, vice president of Business Consulting for The Catevo Group, has more than 15 years of experience in financial analysis, sales and project management.

Neal Zipser is vice president of Catevo Aftermarket and directs Catevo’s business efforts in the automotive and heavy duty aftermarket industry. Prior to joining Catevo, Zipser was vice president of marketing and communications for a major automotive supplier trade association.