Standard Motor Products Inc. (SMP), a leading automotive parts manufacturer and distributor, has reported its consolidated financial results for the three months and nine months ended Sept. 30, 2021.

Consolidated net sales for the third quarter of 2021 were $370.3 million, compared to consolidated net sales of $343.6 million during the comparable quarter in 2020. Earnings from continuing operations for the third quarter of 2021 were $29.2 million or $1.29 per diluted share, compared to $36.2 million or $1.59 per diluted share in the third quarter of 2020. Excluding non-operational gains and losses identified on the attached reconciliation of GAAP and non-GAAP measures, earnings from continuing operations for the third quarter of 2021 were $29.7 million or $1.32 per diluted share, compared to $36.2 million or $1.59 per diluted share in the third quarter of 2020.

Consolidated net sales for the nine months ended Sept. 30, 2021, were $988.9 million, compared to consolidated net sales of $845.9 million during the comparable period in 2020. Earnings from continuing operations for the nine months ended September 30, 2021, were $79.3 million or $3.50 per diluted share, compared to $57.7 million or $2.53 per diluted share in the comparable period of 2020. Excluding non-operational gains and losses identified on the attached reconciliation of GAAP and non-GAAP measures, earnings from continuing operations for the nine months ended September 30, 2021 and 2020 were $80.4 million or $3.54 per diluted share and $57.8 million or $2.53 per diluted share, respectively.

Eric Sills, Standard Motor Products’ CEO and president stated, “We are extremely pleased with our third quarter results. We once again posted record sales, generating an increase of nearly 8% over a very strong third quarter of 2020 when business was surging as we emerged from pandemic-related lockdowns. Impressively, this quarter’s sales were up 20% from 2019.

“Year-to-date, our sales are up 17% over 2020, though the first half of last year was adversely impacted by the pandemic. However, the first nine months of 2021 are up 10.3% over 2019.

“By division, Engine Management sales were up 7.7% as compared to 2020, and up nearly 15% vs. 2019, with several contributing factors. We experienced a combination of strong demand, continued success from customer initiatives, new business wins, and the impact of recent acquisitions.

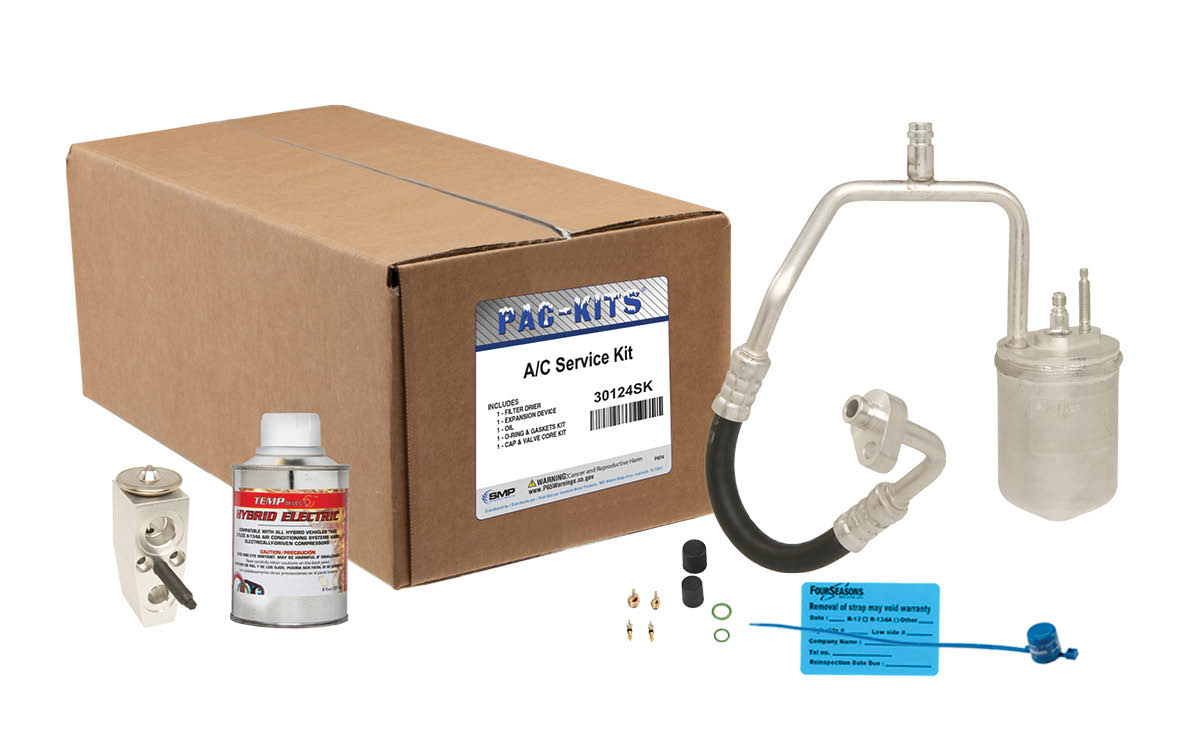

“Our Temperature Control sales were up 7.9% as compared to 2020, and up nearly 35% over 2019. This was one of the longest and hottest summers on record, and our business remained robust throughout the quarter.

“Third quarter earnings are down from the third quarter of 2020, but the 2020 results included many unique non-recurring benefits, related to the Covid-19 pandemic. However, third quarter 2021 earnings did compare favorably on a two-year stack, up almost 30% from a more normalized 2019. Most importantly, year-to-date earnings are at record levels, exceeding both 2020 and 2019 by 40%.”

“As anticipated and stated in our second quarter earnings announcement, we experienced some compression in our gross margin percentage in the third quarter, primarily in the Engine Management division. This was the result of two main factors. First, like many companies, we experienced a surge in various costs, including raw materials, labor and transportation. We will begin passing these costs on in the fourth quarter.

“The second component of our reduced gross margin percentage is related to our growth in non-aftermarket, specialized original equipment business, which we will discuss below. This business, which we believe has great potential for us, has a different margin profile than our aftermarket business – it has lower gross margins, but also lower SG&A expense, and thus generates comparable operating margins.

“Turning to acquisitions, on Sept. 1 we announced that we had acquired Stabil Operative Group GmbH (“Stabil”), a European manufacturer of original equipment sensors, electronics, and clamping devices for passenger car and commercial vehicle applications. This marked our third acquisition this year, all geared towards expansion into specialized OE channels, including medium and heavy duty vehicles, construction and agricultural equipment, power sports, and other sub-segments. When combined with our legacy business in this arena, our non-aftermarket sales are approaching a run rate of $300 million annually. In addition to expanding beyond our core aftermarket business, it is also providing geographic expansion as we now have meaningful footprints to grow sales in Europe and Asia.

“We are extremely pleased with our efforts in growing our business in this channel. As we combine these different entities, we are able to take advantage of shared customer lists, product portfolios, manufacturing and engineering capabilities, and geographic reach. It is also important to note that much of this business is not beholden to internal combustion engines. Many of the products are either powertrain-neutral, or are geared toward electric and alternative energy vehicles. While we are still in the early days of integrating these businesses, the potential synergies and sales growth opportunities are very exciting.

“As we have continued to grow our business and post record results, we have also looked to return value to our shareholders. To this end, we repurchased shares of our common stock in the amount of $15.4 million during the quarter, bringing total repurchases to $26.5 million for the year so far. Further, our Board of Directors recently authorized an additional $30 million common stock repurchase plan. Finally, our Board also approved payment of a quarterly dividend of 25 cents per share on the common stock outstanding. The dividend will be paid on December 1, 2021 to stockholders of record on November 15, 2021.

“In closing, we are very pleased with our year thus far. We have posted record sales and earnings, have consummated three complementary acquisitions, and have garnered substantial new business wins with existing accounts. Our core market is doing very well and our relationships with our customers are strong. We have made major strides in expanding into new complementary markets with significant upside potential. As such, we are very excited about the future,” Sills concluded.