Standard Motor Products, Inc. (SMP) reported its consolidated financial results for the three and six months ended June 30, 2023.

According to SMP, net sales for the second quarter of 2023 were $353.1 million, compared to consolidated net sales of $359.4 million during the comparable quarter in 2022. Earnings from continuing operations for the second quarter of 2023 were $18.4 million or $0.83 per diluted share, compared to $20.8 million or $0.93 per diluted share in the second quarter of 2022. Excluding non-operational gains and losses identified on the attached reconciliation of GAAP and non-GAAP measures, earnings from continuing operations for the second quarter of 2023 were $18.6 million or $0.84 per diluted share, compared to $20.8 million or $0.93 per diluted share in the second quarter of 2022.

Consolidated net sales for the six months ended June 30, 2023, were $681.1 million, compared to consolidated net sales of $682.2 million during the comparable period in 2022, according to SMP. Earnings from continuing operations for the six months ended June 30, 2023, were $31.1 million or $1.40 per diluted share, compared to $41.4 million or $1.85 per diluted share in the comparable period of 2022. Excluding non-operational gains and losses identified on the attached reconciliation of GAAP and non-GAAP measures, earnings from continuing operations for the six months ended June 30, 2023 and 2022 were $31.9 million or $1.44 per diluted share and $41.4 million or $1.85 per diluted share, respectively, the company says.

“Overall, sales decreased 1.8% versus last year’s strong second quarter, while year-to-date we were roughly flat to 2022,” said Eric Sills, Standard Motor Products’ chief executive officer and president. “The cooler and wetter conditions in the quarter had a negative impact on our aftermarket business, particularly on our Temperature Control segment. Additionally, we continue to experience the impact of a recent bankruptcy of a large aftermarket customer, negatively impacting our quarterly sales by 1.6%. While we believe in the long run that volume will return, as the business has either been acquired or will be absorbed by other accounts, in the near term it will continue to be a headwind.”

Results by Business Segment, according to SMP:

“Vehicle Control sales were down 1.1% in the quarter, though remain 1.5% favorable on a year-to-date basis. This segment was the most impacted by the customer bankruptcy, reflecting a 2.2% negative impact in the quarter, which again, we believe will eventually be recovered. Meanwhile, we continue to see favorable customer sell-through, suggesting general market stability.

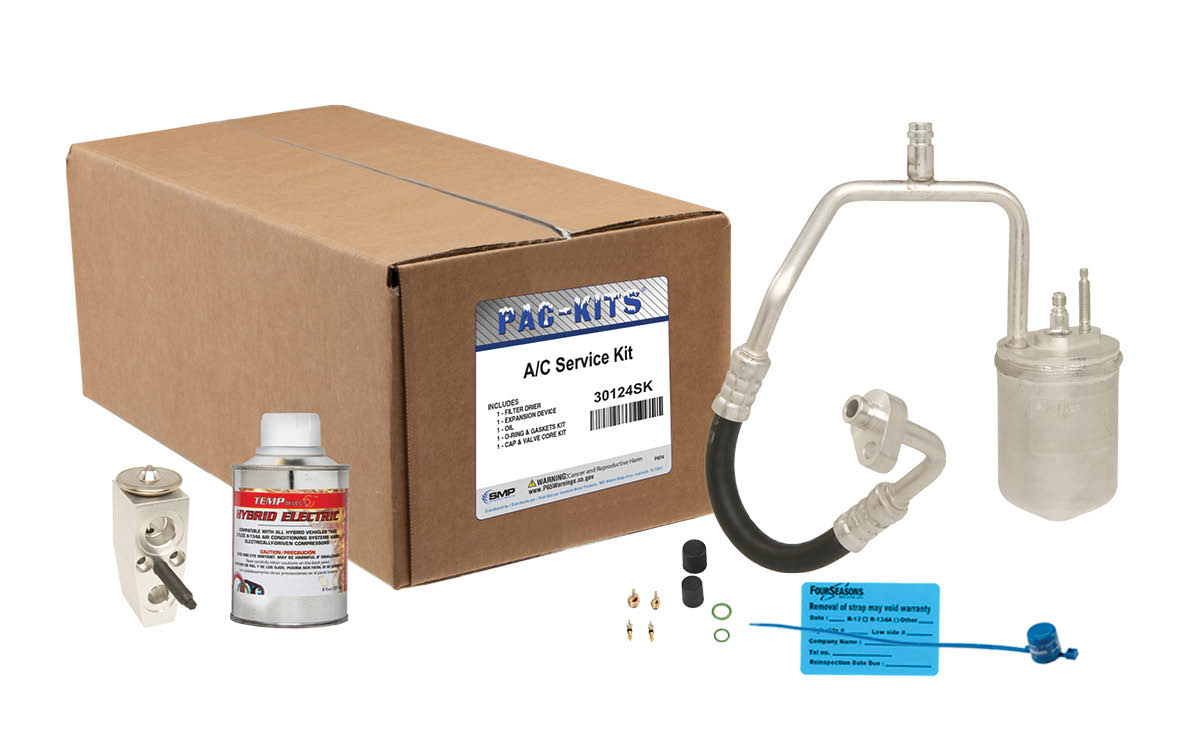

“Temperature Control sales declined 8.1% versus the strong 6.4% growth experienced during the same quarter last year, and down 5.2% in the first half. As noted above, a cooler and wetter spring negatively impacted demand for this seasonal product category against an already difficult prior year comparison. That said, after a slow start, the heat has picked up across the country, with many areas hitting record temperatures, and that should bode well for the third quarter.

“Our Engineered Solutions segment sales increased 6.2% in the quarter due to strong demand from our existing customers as well as new business wins. We continue to be bullish on long-term sales growth in this segment as we gain traction with our expanded customer base, though revenue growth is not necessarily linear.”

Looking at profitability, SMP says, consolidated non-GAAP operating margins were 7.8% in the quarter, flat with the 7.8% in the second quarter last year. “We are pleased with our ability to largely overcome the impact of inflation through a combination of pricing actions and cost reduction initiatives. While Temperature Control operating margins, down 390 basis points from last year, came under pressure due to sales performance, the Vehicle Control and Engineered Solutions segments improved operating margin by 190 basis points and 100 basis points, respectively. During the quarter, our operating income was impacted by a $4.8 million increase in customer factoring program expense over last year from elevated interest rates. On the bottom line, Adjusted EBITDA and earnings per share were down primarily due to the lower sales performance in Temp Control, lower overhead absorption from inventory reduction efforts, and the impact of interest rates both on our customer factoring programs and our borrowings,” the company adds.

Regarding full-year expectations for 2023, SMP says; “We anticipate top line sales growth to be in the low single digits. We are updating our Adjusted EBITDA expectations to approximately 9.5% of revenue for the full year 2023 from our prior estimate of approximately 10%. This outlook considers higher expense related to customer factoring programs that will fall between $48-$50 million at current rates, the impact of startup costs and duplicate overhead expense associated with the new distribution center discussed above, an exchange rate headwind from the weakening of the U.S. Dollar on our international operations, and the impact from softer than expected sales in our second quarter.”

The Board of Directors has approved payment of a quarterly dividend of 29 cents per share on the common stock outstanding, which will be paid on September 1, 2023, to stockholders of record on August 15, 2023, according to SMP.

Closing Remarks

“As we start to look into the second half of the year, we are optimistic that the return of hotter summer weather patterns should help normalize aftermarket demand trends where fundamental industry dynamics remain favorable,” Sills said. “Our Engineered Solutions business, which can be lumpy quarter to quarter, is on a very nice trajectory. And, our initiatives of reducing inventory levels and improving working capital have us on track to return to healthy levels of operating cash flow consistent with years past. We recognize that macro pressures are lingering, but we will continue to invest in our business and people to be well-positioned to take advantage of the strength of the industries in which we operate once these near-term headwinds subside. We want to thank all our employees for our current success and helping us achieve our goals for the future.”