Standard Motor Products (SMP) has reported today its consolidated financial results for the three months ended March 31, 2021.

Consolidated net sales for the first quarter of 2021 were $276.6 million, compared to consolidated net sales of $254.3 million during the comparable quarter in 2020. Earnings from continuing operations for the first quarter of 2021 were $22.2 million or 97 cents per diluted share, compared to $9.6 million or 42 cents per diluted share in the first quarter of 2020.

Excluding non-operational gains and losses identified on the attached reconciliation of GAAP and non-GAAP measures, earnings from continuing operations for the first quarter of 2021 were $22.2 million or 97 cents per diluted share, compared to $9.8 million or 43 cents per diluted share in the first quarter of 2020.

Eric Sills, Standard Motor Products’ CEO and president, stated, “We are very pleased with our first quarter results, as the momentum from the second half of 2020 carried over into 2021. Net sales were 8.7% above the first quarter of 2020, with both divisions showing gains. It is important to note that comparisons to last year will become less relevant due to COVID-19 impacts last year, though the first quarter of 2020 was only modestly affected.

“Engine Management net sales were up 5.4% as compared to 2020. Although we had a substantial reduction in sales in the quarter from the loss of a major account (previously announced), we were very pleased to see strong demand from our other customers offsetting the loss. Looking at our customer POS, their sell-through was even more encouraging, where many accounts enjoyed gains well into the double-digit range. We believe that the actions we have taken to support our customers in the field are having success. Furthermore, we have secured new business wins, which will phase in over the course of the next several months.

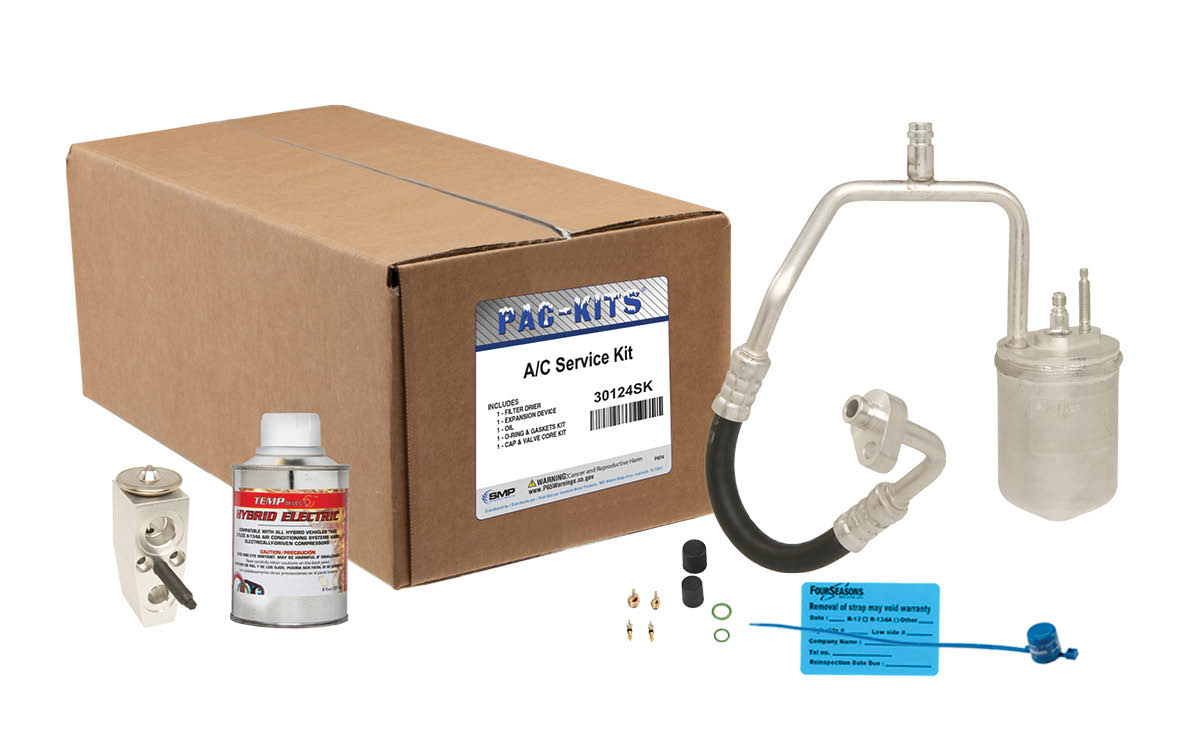

“Temperature Control sales were ahead 21.4%. However, the first quarter essentially reflects pre-season orders, which, as previously discussed, were very light last year. Our pre-season orders continue to be strong in the second quarter as our customers replenish their shelves from a hot 2020 summer, though the full year results will be heavily dependent on how hot this summer will be.

“Gross margin was substantially above the first quarter of 2020, as factory production has remained at high levels throughout the company in our effort to rebuild our inventory. While we expect the ongoing benefit of robust production levels, we do see some offsetting headwinds as we face various inflationary costs in labor, certain raw materials, and transportation.

“Operating expenses were reduced slightly in the quarter. We continue to benefit from discretionary cost reductions instituted during the pandemic, though these were partially offset by increased distribution expense due to higher sales and elevated freight costs.

“The result was an all-time record in first quarter earnings, with non-GAAP diluted EPS from continuing operations more than doubling, from 43 cents in 2020 to 97 cents in 2021.

“We are also very pleased with our progress towards expanding our business in OE commercial vehicle / off-road markets. We have been developing this business for several years, and have recently fortified it with two excellent acquisitions, both from Stoneridge, Inc. In 2019 we acquired their Pollak business, and in March of this year we acquired their particulate matter sensor business (more commonly known as soot sensors). We believe that this OE commercial vehicle focus will provide an excellent growth path for us, and the products we are developing for this segment will strengthen our offering in our core aftermarket business.

“Overall, we are pleased with our momentum as we exit the first quarter. We continue to see strong incoming orders from our customers, which reflect the healthy POS increases they are experiencing. The economy continues to improve, and more people are returning to work. This leads to more cars on the road and increased miles driven, one of the key determinants for our industry. We look forward to the balance of the year.

“Lastly, the board of directors has approved payment of a quarterly dividend of 25 cents per share on the common stock outstanding. The dividend will be paid on June 1, 2021 to stockholders of record on May 17, 2021.”