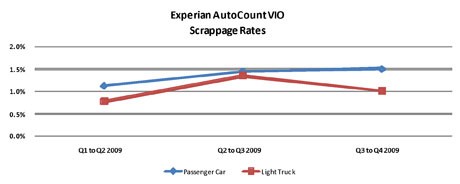

SCHAUMBURG, Ill. — Scrappage rates for light trucks decreased in the fourth quarter of 2009, while rates for passenger cars increased, according to new analysis of Experian Automotive’s AutoCount Vehicles in Operation (VIO) data.

Knowing where the shifts in scrappage rates are occurring is critical to helping automotive aftermarket companies understand which vehicles are and aren’t candidates for aftermarket service or repair, notes Experian. With more passenger cars leaving the vehicle population and a higher population of light trucks on the road today, there may be strong opportunities for those aftermarket retailers and manufacturers serving the light truck market, according to the global information services firm.

Driven by the “Cash for Clunkers” program, scrappage rates for light trucks increased from the second quarter to the third quarter of 2009 by 0.5 percent. Although scrappage rates declined by 0.3 percent from the third quarter to the fourth quarter, they still ended the year higher compared with the first quarter (4.2 percent scrappage rate for the year). However, passenger car scrappage rates continued to increase each quarter and finished the year with an estimated total 5.4 percent rate.

Experian’s analysis also revealed that the number of passenger cars and light trucks in the United States that are now considered to be in the aftermarket “sweet spot” has shrunk to nearly 91 million vehicles, down 1.75 percent from the previous year. The aftermarket sweet spot comprises vehicles five to 10 years old — the age when vehicles are ripe for having the most parts replaced or serviced. According to Marty Miller, senior product marketing manager for Experian Automotive’s AutoCount Vehicles in Operation, the decreasing number of vehicles in the sweet spot provides the aftermarket with fewer opportunities for replacement parts.

“This trend indicates that the aftermarket’s sweet spot is on a course to continue to decline due to the lower number of new vehicle sales that have occurred over the past couple of years,” Miller said. “While volumes are expected to decrease, opportunities will remain high for those aftermarket businesses that understand how these trends impact their specific markets.”

Other key findings in Experian’s just-released AutoCount Vehicles in Operation analysis, which covers the fourth quarter of 2009, reveal:

• Light trucks on the road in the United States once again edged out the number of passenger cars (50.1 percent to 49.9 percent). After light trucks surpassed passenger cars in the second quarter, cars rebounded to edge out light trucks in the third quarter;

• The traditional Big Three automakers (General Motors, Ford and Chrysler) account for 76.4 percent of the vehicle population in the Midwest versus the West, where they comprise 53 percent of the vehicles on the road. (The U.S. average is 63.2 percent for the Big Three.);

• Despite the current media and political attention, hybrid vehicles account for a mere 0.67 percent of vehicles on the road in the United States; and

• The total number of light-duty vehicles in operation in the United States has steadily declined since the second quarter of 2009, as seen in the chart below.

AutoCount VIO quarter Total light-duty vehicles

March 31, 2009 239,986,279

June 30, 2009 240,264,794

Sept. 30, 2009 239,783,612

Dec. 31, 2009 239,061,943

Experian’s AutoCount Vehicles in Operation provides timely visibility to what cars and trucks are on the road in a local market, helping aftermarket retailers better serve their customers by stocking the right parts. The data is updated within six weeks of the end of each quarter, ensuring that aftermarket organizations have the timeliest information available to help better manage inventory levels, efficiently plan for new vehicle introductions, adjust for technology changes, and better assess locations for retail stores and service bays.

For more information on Experian’s AutoCount Vehicles in Operation and other products and services, visit http://www.experianautomotive.com.