SPRINGFIELD, Mo. – O’Reilly Automotive has announced record revenues and earnings for its fourth quarter and year ended Dec. 31, 2011. The results represent 19 consecutive years of comparable store sales growth and record revenue and operating income for O’Reilly since becoming a public company in April of 1993.

Sales for the fourth quarter increased $81 million, or 6 percent, to $1.39 billion from $1.31 billion for the same period one year ago. Gross profit for the fourth quarter increased to $695 million (or 49.9 percent of sales) from $637 million (or 48.6 percent of sales) for the same period one year ago, representing an increase of 9 percent.

Operating income for the fourth quarter increased to $207 million (or 14.9 percent of sales) from $164 million (or 12.5 percent of sales) for the same period one year ago, representing an increase of 26 percent.

Net income for the fourth quarter increased $17 million, or 16 percent, to $123 million (or 8.8 percent of sales) from $106 million (or 8.1 percent of sales) for the same period one year ago. Diluted earnings per common share for the fourth quarter increased 27 percent to 94 cents on 130 million shares versus 74 cents for the same period one year ago on 143 million shares.

"We are pleased to report another quarter of solid financial results," said Greg Henslee, CEO and co-president of the company. "As a result of our continued efforts to profitably grow sales, along with our culture of strict expense control, we generated a fourth quarter increase in comparable store sales of 3.3 percent while also increasing our adjusted operating margin to 14.7 percent, a 214 basis-point improvement over the fourth quarter last year. For the year, we generated a comparable store sales increase of 4.6 percent, and we expect to continue these strong results in 2012 with comparable store sales guidance of 3 percent to 6 percent. For the full year, we generated a record 14.9 percent adjusted operating margin, and we expect to achieve an operating margin of 15 percent in 2012, a year earlier than our 2013 goal. Our continued success is the direct result of our team members’ commitment to providing the highest level of service to our customers every day. I want to thank Team O’Reilly for your dedication and hard work and congratulate you on another great year."

Sales for the year ended Dec. 31, 2011, increased $391 million, or 7 percent, to $5.79 billion from $5.40 billion for the same period one year ago. Gross profit for the year increased to $2.84 billion (or 49 percent of sales) from $2.62 billion (or 48.6 percent of sales) for the same period one year ago, representing an increase of 8 percent.

Operating income for the year increased to $867 million (or 15 percent of sales) from $713 million (or 13.2 percent of sales) for the same period one year ago, representing an increase of 22 percent.

Net income for the year increased $88 million, or 21 percent, to $508 million (or 8.8 percent of sales) from $419 million (or 7.8 percent of sales) for the same period one year ago. Diluted earnings per common share for the year ended December 31, 2011, increased 26 percent to $3.71 on 137 million shares versus $2.95 for the same period one year ago on 142 million shares.

Commenting on O’Reilly’s full-year results, Henslee added, "We are very proud of the success we achieved in decreasing our net inventory investment by over $420 million for the year. This working capital improvement, along with lower capital expenditures during the year, generated $791 million in free cash flow. During the year, we generated significant shareholder value through our share buyback program by repurchasing over 15 million of our shares for a total investment of almost $1 billion, and we expect to continue to prudently execute our buyback program during 2012. I would like to again thank all of Team O’Reilly for their continued contribution to our company’s successes, and we look forward to the opportunities 2012 will bring."

Ted Wise, COO and co-president added, "During 2011, we expanded into our 39th state, completed the acquired CSK store interior resets to the O’Reilly format, converted the CSK exterior signs to the O’Reilly Brand and opened 170 net, new stores, which increased our store count to 3,740. Our outlook for 2012 includes the continued expansion of our store base with the opening of 180 new stores along with the relocation or renovation of nearly 50 existing stores. We continue to open stores in both existing and new markets and have maintained our focus on rapidly growing professional service provider business in the western states. Our team members’ commitment to superior service levels was the foundation for our 4.6 percent comparable store sales increase during 2011, which was on top of an extremely strong comparable store sales increase of 8.8 percent last year, and we look to continue this solid growth in 2012."

On Jan. 11, 2011, the company’s board of directors authorized a $500 million share repurchase program. The board approved resolutions to increase the authorization under the share repurchase program by an additional $500 million on Aug. 5, 2011, and an additional $500 million on Nov. 16, 2011, raising the cumulative authorization under the share repurchase program to $1.5 billion. During the fourth quarter ended Dec. 31, 2011, the company repurchased 1.8 million shares of its common stock at an average price per share of $75.60, for a total investment of $136 million.

During the year ended Dec. 31, 2011, the company repurchased 15.9 million shares of its common stock at an average price per share of $61.49, for a total investment of $976 million. Subsequent to the end of the fourth quarter and through the date of this release, the company repurchased an additional 0.1 million shares of its common stock at an average price per share of $79.45, for a total investment of $10 million. As of the date of this release, the company had approximately $514 million remaining under its share repurchase program.

PACCAR Elects New Board Directors

Pierre Breber and Brice Hill have been elected to serve on the PACCAR Board, effective July 1.

PACCAR, Inc. announced Pierre Breber and Brice Hill have been elected to its Board of Directors, effective July 1, 2024.

The announcement was made by Mark Pigott, PACCAR executive chairman. “PACCAR is very pleased that Pierre Breber and Brice Hill will be joining the Board. Mr. Breber’s finance and international operations experience in the energy industry, and Mr. Hill’s years as a senior finance and operations executive in the technology industry, will benefit PACCAR in its global growth,” he said.

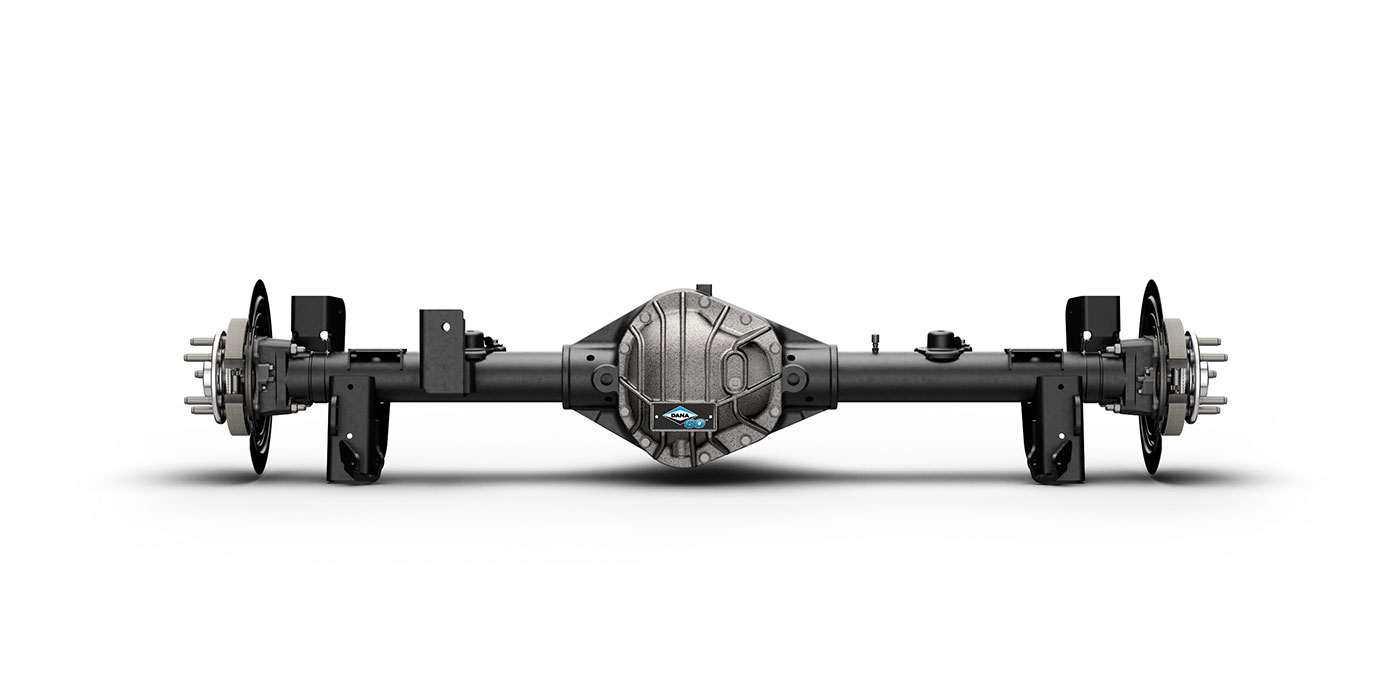

Dana Releases Rear Semi-Float Axles for Jeeps

The axles provide Jeep owners with a direct-fit, bolt-in upgrade solution that is built for superior strength inside and out, the company said.

Dayco Announces Leadership Hires, Headquarters’ Relocation

Dayco said these developments strengthen its focus on innovation and growth.

Cummins Names VP, Cummins Emissions Solutions

Alison Trueblood was promoted to the role, effective May 1.

Fix Network World Celebrates Apprenticeship Program Approval

The program is also celebrating the graduation of its first apprentice, Gabrial Duran.

Other Posts

SMP Announces Q1 2024 Results

Net sales for the first quarter of 2024 were $331.4 million, compared to consolidated net sales of $328.0 million during the comparable quarter in 2023.

GPC Acquires Largest NAPA Independent Store Owner in the US

Genuine Parts Company said the acquisition advances its strategic initiative to own more stores in priority markets.

APA Celebrates ‘Nitro Weekend Giveaway’ Promotion

From April 26-28, eight winners and their guests enjoyed an all-expense-paid trip to Charlotte, NC, to witness the NHRA Four Wide Nationals, including access to Kalitta Motorsport’s hospitality tent.

Akebono Expands Severe Duty Disc Brake Pad Kits

Akebono said it expanded its severe-duty ultra-premium disc brake pad line by 14 new part numbers.