One of the eagerly awaited events of AutopromotecEDU, IAM – International Aftermarket Meeting once again was held on the second day of the event. Dedicated to the latest automotive aftermarket topics, “Mobile Solutions – Opportunities and Challenges for the Aftermarket” focused on the interconnection between mobile solutions, cars, repair equipment and the opportunities that this interaction offers.

One of the eagerly awaited events of AutopromotecEDU, IAM – International Aftermarket Meeting once again was held on the second day of the event. Dedicated to the latest automotive aftermarket topics, “Mobile Solutions – Opportunities and Challenges for the Aftermarket” focused on the interconnection between mobile solutions, cars, repair equipment and the opportunities that this interaction offers.

With the IAM17 conference, Autopromotec reaffirms its strategic role as a meeting point for high-level international after-sales experts and a support for industry professionals, offering interesting insights on what will soon be new and revolutionary European scenarios in light of the imminent arrival of connected vehicles and the opportunities and challenges that they will create in the car service and repair market.

Josef Frank, former aftermarket director of CLEPA (European Association of Automotive Suppliers) and chair of the panel, commented, “By 2020, the Generation C – i.e., ‘connected’ – will live in a predominantly digital world that will shape the way we work and how we consume. The automotive and aftermarket industry is already connected, and the world’s car manufacturers are present not only at automotive trade shows but also at the Consumer Electronics Show in Las Vegas.”

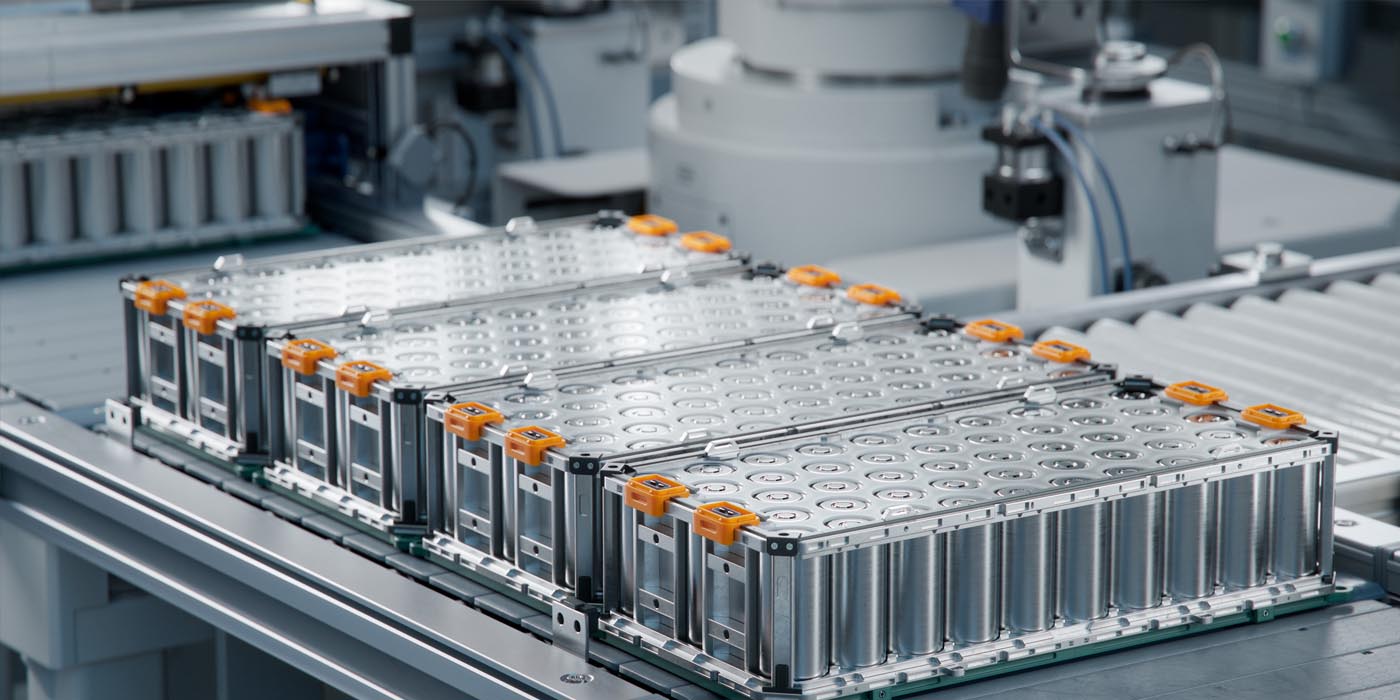

Gianmarco Giorda of ANFIA introduced the panelists and highlighted that the time has come to tackle major technological challenges in the age of global connectivity. In Italy, there are about 2,000 component manufacturers involved in the automotive aftermarket, with a total turnover of 39 billion euros (approximately $43.84 billion USD). After the great recession, even the automotive industry has seen slightly positive growth, with about 1.1 million vehicles produced (1.8 million last year, 2 million forecast by the end of 2017). There is some confidence that there will be a marked improvement in all automotive sectors. It is now necessary to prepare ahead of time for the arrival of the electric car, the connected car and the e-mobility solutions.

The Italian market and general outlook

The Italian market and general outlook

Marc Aguettaz, managing director of GiPA Italy, focused on the Italian market and presented the general outlook, main trends and possible developments. Some key numbers: 32.2 million vehicles on the road (forecast 2017) with a 4 percent increase in the last 10 years; only 16 percent of them are under three years old. New or old, the car continues to be one of the preferred means of transport with an average distance travelled that has remained steady over the past 10 years, with an average of 12,676 km (7,876.5 miles) per year (2016).

In 2022, there will presumably be 32.5 million vehicles in circulation; about 16 million of them (or half) will still be more than 10 years old, according to Aguettaz. He added that this means that we will be faced with a deeply divided situation: on one hand, traditional vehicles model year 2009-’10 that are not connected, and therefore without automated guidance systems; on the other hand, more advanced cars, in many cases capable of interacting with each other, moving in absolute safety because they are connected with advanced driving systems within a “network.” The future is certainly moving rapidly in this direction, but the renewal of the vehicles in circulation will not be so fast. For sure, however, it is necessary to prepare for the new technologies that will be installed on cars used every day. Of course there will be opportunities to “retrofit” the older cars owned by people resistant to change, but it is likely that such solutions will not always be cheap. The sales trend of spare parts favors the independent aftermarket, with a strong reduction in OES parts. The (re)organization and expansion of services will be key to the success of all businesses, at every level of the supply chain, also because it will be necessary to service more fleets than individual private vehicles.

Longterm prospects for new mobility solutions worldwide

Tim Armstrong, vice president of planning solutions of IHS Automotive, presented the longterm prospects for new mobility solutions worldwide, focusing on the impact on car demand and on the chain reaction that will affect the aftermarket industry. With time, the car’s use will change, according to Armstrong. It should no longer be seen as a simple method of transport but as an integrated tool of connected mobility.

Car sharing will be increasingly widespread: The car will be increasingly shared and technologies will change radically, said Armstrong. Buying a new car will be less and less indispensable for the public, who will rely on fleets. As a consequence of all this, service also will be affected by major changes. For example, in a context like this, the aftermarket will sooner or later limit the activities of less structured spare parts dealers, as well as those of small car washes or tire shops. With regard to maintenance, the future will reward those who will be able to offer roadside services, possibly 24 hours a day.

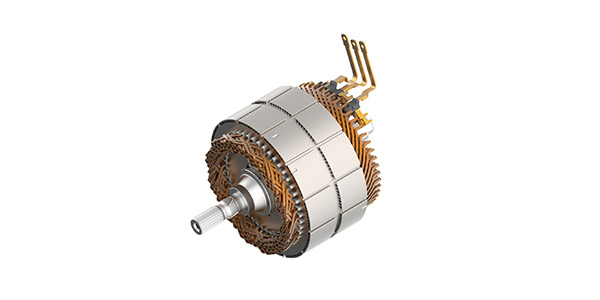

Self-driving cars can truly change the way service is done, eliminating the need for preventive check-ups, because it will all happen automatically. It will be necessary to focus on electronics with adequate and continuous training that will enable operators to intervene more and more effectively and quickly on the vehicle. The safety provided by self-driving cars will reduce the number of accidents and also the consumption of spare parts. In short, cars will have to perform many services to facilitate a mobility that is increasingly interconnected. For example, instead of simply selling cars, travelled kilometres or miles might be sold.

Mobility users and changes in the value chain

Matthias Knirsch, director of business development at Bosch Automotive Aftermarket, talked about mobility users, changes in the value chain, as well as the speed of innovation provided by connectivity and the need for a clear legal framework. Connectivity greatly facilitates fast communication between the actors in the chain for more effective, reliable and speedy after-sales activity. Being connected to the network allows the car owner to interface at any time to receive the assistance required, thus also optimizing the use of the car within the ecosystem.

Many technologies are under development. For example, Knirsch said it will be possible to carry out remote maintenance while the car is parked. Specific connection platforms will be able to connect multiple things. It also will be possible to know in advance where parking is available, with obvious benefits in terms of traffic and pollution, or to know the real-time situation of the usage of components. And with all this data being generated and exchanged, one thing to not underestimate is the need to protect personal data, and Bosch is already studying solutions to keep hackers at bay. Digitalization is making big changes to satisfy the changing needs of a changing clientele.

The shift from navigation to mobile solutions

Sebastian Ruffino, business unit manager of BRIDGE, TomTom, explained the shift from navigation to mobile solutions with BRIDGE, a platform that allows businesses to integrate TomTom technology into their business processes. An important goal for the company is to make services as extensive and integrated as possible, having as the base state-of-the-art maps updated in real time and configured to work with any other device. Connectivity can be useful for reducing traffic, for example, knowing what is happening in a given place. Working on traffic conditions in real time will be increasingly important to ensure deliveries of goods on time. Think of the benefits, for example, that can be achieved managing a commercial fleet with remote monitoring. Integrated navigation systems created for the aftermarket can be implemented with many functions, like digital signatures for delivering a product, photo etc. For example, experiments are being done with networked garbage collection: The garbage bin will be connected to the network, and when it is full it will send a signal to the truck, which will arrive to empty it guided by the navigator.

Distribution and the changes that mobile solutions can bring were discussed by Fotios Katsardis, president and CEO of Temot International, a network that can easily capture changes in terms of lifestyle and demographics, motor technologies, self-driving vehicles and connected vehicles, e-commerce and new concepts of mobility. As a consequence of all this, within a few years the aftermarket also will change. For example, car manufacturers could start offering warranties that reach 10 years of coverage, as well as aggressive campaigns selling “all-inclusive” spare parts and service.

The outlook is that component and auto manufacturers will face off in sales channels that up until now have been the “exclusive” domain of one or the other. “B2B or B2C, who will win?” This question is now obsolete, because “B2everyone” will win, according to Katsardis. Every single business will have to negotiate horizontal or vertical agreements to attack a market in which the margins will continue to shrink. E-commerce will be the core of the entire market on all levels. Katsardis adds that it is useless to demonize it: Whoever will be best-positioned on the internet will surely reap its benefits. In fact, connectivity encourages the emergence of new business models that must be grasped in advance, from a driver’s point of view. For example, by observing driving behavior it is possible to create better-profiled solutions for rental or insurance.