It has often been said that the only way growth can take place is if we step out of our comfort zone. Suffice it to say, there has been quite a bit of growth in the automotive aftermarket over the past 12 months.

In March 11, 2020, the World Health Organization officially declared COVID-19 as a global pandemic, sending the entire world into a series of rapid changes to the way we live and work. In January, Babcox Media commissioned a consumer study from Qualtrics that surveyed U.S. vehicle owners looking at whether COVID-19 may have any long-term effect on the desirability of auto ownership. In the short-run, Vehicle Miles Traveled (VMT) is off, but as lockdowns end and people return to offices, will things go back to the way they were before?

Consumer Behavior – Long-Term Changes or Short-Term Trends?

Various reports have shown significant shifts in consumer behaviors, such as moving out of urban areas to more rural settings as full-time remote work became more commonplace, in addition to investing in new and used vehicles vs. using public transport and ride sharing. In addition, while VMT took a dip in the early stages of lockdown, American motorists are showing a strong preference for road trips over air travel for the foreseeable future.

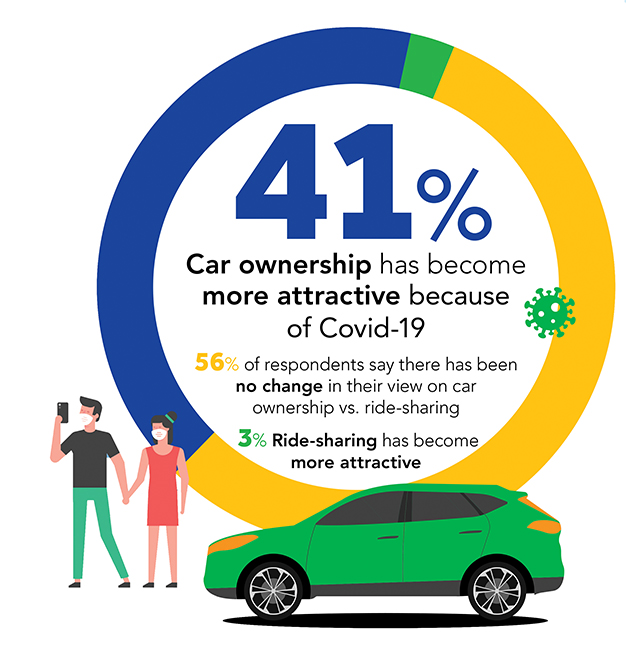

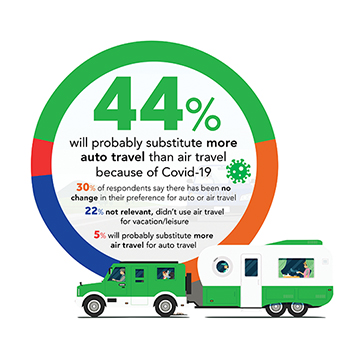

According to September 2020 data from McKinsey & Co., COVID has brought a marked shift in preferred modes of transport in urban areas, moving from airplane and train to private vehicles for intercity traveling. A third of consumers said they increasingly value “constant access” to a private vehicle more than before COVID-19, especially younger consumers. As the New York Times dubbed it, the personal vehicle is the “ultimate PPE.” The Qualtrics consumer survey echoes these stats: 41% think that car ownership has become more attractive since the start of the pandemic; 44% say they will opt for more travel by car rather than air travel.

Despite sharp declines in total travel since the COVID-19 pandemic, Americans have been taking significantly more long-distance road trips than in previous years. COVID-19 took hold during the warmer months and peak travel periods for many Americans, contributing to a more than 30% decline in total travel since 2019, according to recently released government data. However, while social-distancing measures and remote work have led to a decrease in short-distance trips and air travel, the number of miles logged on long-distance road trips has risen dramatically above last year’s numbers.

On average, during the first two weeks of August 2019, about 2.5 million people passed through U.S. airports per day. In 2020, that number was only about 700,000. On the other hand, in the first two weeks of August 2020, Americans recorded nearly 12 million long-distance (100- to 500-mile) road trips per day, compared to 8.6 million in 2019 — a 37.6% increase. Such a shift in travel behavior may serve as an example of the “new normal” when it comes to how Americans will travel to more distant destinations.

In tandem with these changes in consumer behaviors over the past year, we wanted to find out how these shifts have impacted the automotive aftermarket. We spoke to several leading aftermarket suppliers for their insights on the small victories, silver linings and lessons learned over the past 12 months.

For global filtration supplier MANN+HUMMEL, and many other suppliers, the forced growth that the pandemic brought on created opportunities for efficiencies and performing at a higher level than before.

“We are all aware we are living in unprecedented times, which has led to unprecedented decisions when it comes to how we can best provide our products to those who need them. We have found more ways to leverage the global network within MANN+HUMMEL to support our core retail and commercial businesses,” said Donald Chilton, director of Product Management for MANN+HUMMEL. “We made operational changes last year and consolidated two plants into one. This will lead to greater efficiencies for our passenger-car business.”

In addition to the filtration products MANN+HUMMEL creates to address vehicle air-quality issues, this past year the company introduced several air-purifying units for classrooms, offices and other areas that will offer important sanitation benefits as students and professionals return to school and work.

For MAHLE Aftermarket, with many working remotely over the past 12 months, the company had to find creative ways to address the “human” side of the business.

“As with most organizations, the conversion to a fully remote schedule was somewhat trying at first,” said Ted Hughes, marketing North America for MAHLE Aftermarket. “The biggest deficiency was the lack of the human element. While working in the office, even if it was organic, there was inter-personal contact inherent to just being in the office. Over time, we had different teams implement different measures to make up for it. As a Microsoft house, we incorporate Teams a lot. While it may be easier on the surface to send an instant message through Teams, or an email, we encouraged team members to simply hit the video conference button and it became almost equivalent to walking down the hall or visiting someone’s workspace. Having cameras on and being able to look at a colleague as they speak to you went a long way to ‘normalizing’ daily operations.”

Hughes added that the company also upped its game when it came to its training programs, launching a new video warehouse for customers.

“We recognized early on that in-person contact was going away for a very long time, and we at MAHLE put a lot of effort into our training programs. We have always had an eLearning platform, but the reality of need for in-person training was something that we took seriously,” Hughes said. “With a staff of up to eight trainers in the field calling on customers and visiting shops to offer everything ranging from technical, product or even business insights – this was not going to be continuing in that form in the ‘new normal.’ We immediately went to work to create what we call the MAHLE Video Warehouse. Anyone can visit videos.mahle-aftermarket.com, and be directed to product information, features and benefit information, and technical training videos at the click of a button through simple searches or drill-downs. The response since we launched it has been overwhelmingly positive – and this will lay the groundwork to further development down the road like in-person training and webinars for customers and technicians.”

Both MANN+HUMMEL and MAHLE Aftermarket said that being able to tap into their global networks enabled them to manage through the supply chain issues that rippled throughout a number of major industries at the height of the pandemic.

This was the case for Dayco Products as well, according to Tom Tecklenburg, vice president, North American Aftermarket, Dayco.

“Supply chain issues absolutely had an impact, but being a global company, Dayco was able to off-load production from Asia and Europe facilities to the Americas early in the pandemic, and then switch back to Asia and Europe as the cases and quarantines increased in the Americas,” said Tecklenburg, speaking about Dayco’s supply chain strategy during the pandemic. “In North America, the sharp V curve recovery and discretionary spending for vehicles and recreation equipment in Q3, especially among the DIY market, depleted some of our safety stock, so we’ve had to work hard to recover and keep our fill rates at acceptable levels. As reported, raw materials, freight and logistics continue to be battles that all suppliers and customers in North America are challenged with.”

Like MAHLE, Dayco also found opportunities during the pandemic to “optimize some of Dayco’s systems and processes,” Tecklenburg said. He cited a number of examples:

• Reviewed its talent management process and focused on increasing top aftermarket talent, especially in product management;

• Analyzed and made enhancements to its sales inventory and operations planning process;

• Made investments in its Roseville Tech Center to enable more product development and testing; and

• Honed in on catalog management and added thousands of new product applications, ensuring that Dayco has the most robust offering for customers.

For California-based US Motor Works, being ISO-certified was a key component to managing any supply chain hiccups, says VP of Sales & Marketing Tom Longo.

“Fortunately, we are an ISO-certified company, so constant improvement is something we utilize on a daily basis,” he said. “We identified the potential for supply issues early on and compensated for it and that has been a real game-changer as we kick off 2021.”

In fact, while some operations were slowing down, US Motor Works experienced significant growth. “Like most automotive companies in our industry, we were deemed essential and business has been booming,” Longo said. “Our team has made the necessary adjustments to operate safely and thankfully we have not been forced to close, not even for a day. Through the pandemic we decided to not only increase production in our current facilities, we also opened up a brand-new manufacturing and distribution facility in Monterey, Mexico. We are extremely excited to announce our latest acquisition, the purchase of the assets of OSC Automotive, a major player in the heat-transfer aftermarket.”

Battery maker Clarios also is in a strong position at the moment, thanks to both the recent winter storm in the middle of country and increased use of recreational vehicles and boats as consumers looked for new ways to vacation and spend time during COVID. According to Jim Gracyalny, VP of sales & marketing, Aftermarket – US & CA, the company noticed a major uptick in business as soon as stimulus checks began hitting Americans’ bank accounts.

“Our battery business is doing fantastic, which indicates most of our customers are doing extremely well,” he said. “In the early mid-March timeframe, when the shelter-at-home and stay-at-home orders impacted everybody, we saw an immediate drop-off in demand. A lot of our customers were trying to conserve their cash positions because nobody knew how long this was going to last. But, we can mark the day that the stimulus checks from the government started hitting people’s bank accounts as an immediate turnaround within the automotive aftermarket – point-of-sale took off, demand took off and eventually orders for our batteries took off as well. So, we’ve seen really strong demand. It’s been sustained through the summer, and we saw great sales growth in the fall and into early winter.”

Stimulus Boost

Reporting by Josh Cable

One of the things we learned in 2020 is that if you send free money to millions of people – many of whom are at home with extra time on their hands – they’ll spend a significant portion of that money on repairing and maintaining their personal vehicles.

How do we know this? Just look at how the auto parts retailers fared after the first round of stimulus checks hit customers’ bank accounts.

Through the first two weeks of O’Reilly Auto Parts’ second quarter in 2020, the combined impact of a pandemic, business closures, stay-at-home guidance and a looming recession looked like a recipe for the perfect storm. Then came “the most dramatic swing in demand our business has ever seen,” as O’Reilly CEO Greg Johnson described it.

“In the 63-year history of our company, I can safely say we’ve never seen a quarter like this year’s second quarter,” Johnson said during the company’s second-quarter conference call in August 2020.

As DIY customers began receiving stimulus checks in late April, O’Reilly’s business turned sharply positive, setting the stage for a second quarter that ended with record revenue and earnings. The company reported second-quarter 2020 sales of $3.1 billion, up 19% from its second-quarter 2019. Comparable-store sales jumped 16.2%, while diluted earnings per share rocketed 57% higher to $7.10.

The momentum – buoyed by another round of stimulus checks later in the year – carried over into the third and fourth quarters for O’Reilly. The company reported record full-year financial results, highlighted by full-year revenue of $11.6 billion, up 14% compared to full-year 2019.

O’Reilly wasn’t alone. Advance Auto Parts reported a 7.3% year-over-year increase in second-quarter 2020 net sales. The surge in DIY demand picked up steam in Advance’s third quarter, helping to drive net sales to $2.5 billion – a nearly 10% increase over third-quarter 2019. Comparable-store sales jumped 10.2% compared to third-quarter 2019, marking Advance’s biggest comp-sales increase in 15 years.

During Advance’s third-quarter earnings call in November, CEO Tom Greco talked about some of the “external demand drivers” that buoyed sales in 2020. The decline in new-vehicle sales contributed to the aging of the car parc – always a plus for the aftermarket – while consumers’ reluctance to use mass transportation created “a heightened emphasis and reliance on personal vehicles,” Greco noted. And with more people working from home than usual, some DIYers had more time on their hands to do their maintenance and repairs.

When Advance recently reported its full-year 2020 results – annual net sales topped $10 billion for the first time in the company’s history.

When Advance recently reported its full-year 2020 results – annual net sales topped $10 billion for the first time in the company’s history – Greco asserted that “our DIY omnichannel net sales continued to benefit from the impact COVID-19 had on the economy and resulting consumer behaviors.”

For AutoZone, which uses a fiscal calendar, the stimulus boost came in its fourth quarter. For AutoZone’s fiscal fourth quarter of 2020, which ended Aug. 29, the company reported a 14% year-over-year increase in net sales, and a 21.8% year-over-year increase in same-store sales – the latter of which was a company record.

For AutoZone’s fiscal year ending Aug. 29, net sales increased 6.5% to $12.6 billion, while domestic same-store sales were up 7.4%.

For its first quarter of fiscal 2021, AutoZone reported net sales of $3.2 billion, a nearly 13% year-over-year increase. Domestic same-store sales for the quarter, which ended Nov. 21, were up 12.3%. While its previous quarter was a tough act to follow, AutoZone CEO Bill Rhodes seemed pleasantly surprised by the first-quarter numbers.

“In Q1, we felt we would see substantial above-normal growth, but we wouldn’t have thought double-digit same-store sales,” Rhodes said during AutoZone’s first-quarter earnings call in December.

Genuine Parts Co. (GPC), parent company of NAPA Auto Parts, reported that full-year 2020 net sales for its Automotive Parts Group declined from $10.99 billion in 2019 to $10.86 billion in 2020. However, GPC is projecting that its automotive sales will increase between 4% and 6% in 2021.

“The year 2020 was extraordinary in every respect,” GPC CEO Paul Donahue said in February 2021. “The COVID-19 pandemic has been incredibly challenging, but the global GPC team proved resilient and up to the challenge.”

All of the national parts retailers emphasized that they took a number of strategic actions to not only ensure the health and safety of employees and customers but also capture stimulus-driven sales opportunities. Because the national parts chains already were stepping up their e-commerce capabilities, they were able to hit the ground running when the pandemic started to escalate, quickly implementing services such as curbside pick-up and one-day or even same-day home delivery. Pep Boys, which has service centers in all of its stores, now offers touchless drop-offs and a mobile-pay option.

In April, Advance launched same-day curbside pick-up, same-day home delivery and a mobile app to serve customers during the pandemic. And the retailer already had additional initiatives in place to court DIYers, such as its retooled “Speed Perks” rewards program. In 2020, the number of Speed Perks VIP members – those with an annual spend of $250 to $500 – grew by nearly 15%, according to the company, while the number of Elite members – those who spend more than $500 – increased by more than 20%.

The pandemic has thrust parts specialists onto the front lines of a public health crisis. During AutoZone’s fiscal 2021 first-quarter conference call, Rhodes emphasized that the company’s top priority “continues to be the health, safety and wellbeing of our customers and our AutoZoners.”

Rhodes outlined the various measures AutoZone has implemented during the pandemic, such as requiring facemasks at all AutoZone facilities and providing masks and hand sanitizers to AutoZone employees.

At the beginning of the pandemic, the company announced it would be providing two weeks of “emergency time off,” or ETO, to full- and part-time hourly AutoZoners. Later in the year, the company extended the same benefit to store managers and distribution-center advisors.

“In essence, it amounted to two extra weeks of vacation, to give [AutoZoners] the flexibility to ensure their safety, deal with childcare issues, care for a sick family member or, most importantly, stay home if they were showing any symptoms,” Rhodes explained. “It has worked, and it’s worked exceptionally well.”

When AutoZone introduced ETO, company leaders expected it to be “a one-time extraordinary benefit,” Rhodes noted. With the pandemic still dragging on, though, the company recently announced that employees could carry over any unused ETO into 2021 or receive a payout in January. AutoZone also is offering another week of ETO to all eligible full- and part-time hourly employees, store managers and DC advisors in the United States this year.

Rhodes said the ETO benefits will come with a $50 million price tag, which the company will recognize in its second-quarter financials.

“I’m exceptionally proud to work with a team of leaders and a board of directors who ensure we live consistent with our stated values,” Rhodes added.

While the DIY boom was a major storyline in 2020, some of the major retailers saw strength in their DIFM business, especially as the year wore on. During Advance’s most recent earnings call in February, Greco noted that the company’s professional business “continued to recover with positive comp sales in both Q3 and Q4.” Through the first four weeks of 2021, Advance’s comparable-store sales were trending higher “in the low double-digit range, with strength across both DIY and professional,” according to Greco.

Reflecting on O’Reilly’s full-year results, Johnson noted that DIFM sales “began to turn around in May and delivered solid above-plan results for the third and fourth quarter.”

“On the professional side of our business, we expect solid performance throughout [2021] as we anticipate our current momentum to continue as miles driven continue to rebound,” Johnson added.

The Babcox Media/Qualtrics consumer survey underscores Johnson’s comments. In the survey, 78% of respondents said “maybe” or “no” when asked if they will attempt more DIY vehicle repairs because of the pandemic – suggesting that DIFM demand should continue to rebound in 2021.

With the increased production of the COVID-19 vaccine, and the projection that the U.S. will produce enough vaccine for every adult in the U.S. by the end of May, Americans are eager to return to “normal.” While we can’t say for certain which of the changes implemented over the past year will remain – many companies say they appreciated the decrease in travel budgets, but miss the in-person networking opportunities, for example – we do know the aftermarket shows strong indicators for continued growth and success.

Moving Forward

In the Qualtrics consumer survey, 60% of people said they wait for their cars at the shop, possibly showing that people are ready to get back to normal with proper precautions. More vehicle repairs means more parts moving through the supply chain. More repaired vehicles mean more cars on the road and more Vehicle Miles Traveled.

While the industry has experienced growing pains over the past 12 months, as is the case with overcoming most obstacles, it appears that the automotive aftermarket will emerge stronger because of it.