Genuine Parts Company, a global distributor of automotive and industrial replacement parts, announced its results for the third quarter ended September 30, 2023. Sales were $5.8 billion, a 2.6% increase compared to $5.7 billion in the same period of the prior year. The growth in sales is attributable to a 0.5% increase in comparable sales, a 1.7% benefit from acquisitions and a 0.4% net favorable impact of foreign currency and other factors. The third quarter of 2023 had one less selling day in the U.S. compared to the third quarter of 2022, which negatively impacted third-quarter sales growth by approximately 1.2%.

“Our third quarter performance was highlighted by double-digit earnings growth, driven by benefits from the mix and geographic diversity of our businesses as well continued progress on our strategic initiatives,” said Paul Donahue, chairman and CEO. “Through our One GPC approach, we are simplifying our business while driving productivity and efficiency across our operations. We would like to thank our teams around the world for their continued dedication to serving our customers and delivering solid quarterly results.”

In its Q3 report, GPC reported a net income of $351 million, an increase of 12.4%, compared to net income of $312 million in the prior year. Diluted EPS was $2.49, an increase of 13.2% compared to $2.20 in the prior year period.

Net income of $351 million compares to adjusted net income of $317 million for the same three-month period of the prior year, an increase of 10.7%. On a per share diluted basis, net income was $2.49, an increase of 11.7% compared to adjusted diluted earnings per share of $2.23 last year.

Third Quarter 2023 Segment Highlights

Automotive Parts Group (“Automotive”)

Global automotive sales were $3.6 billion, up 3.9% from the same period in 2022, with a 0.6% increase in comparable sales, 2.4% benefit from acquisitions and a net 0.9% favorable impact of foreign currency and other. Segment profit of $322 million increased 4.1%, with segment profit margin of 8.9%, flat compared to last year.

Industrial Parts Group (“Industrial”)

Industrial sales were $2.2 billion, up 0.6% from the same period in 2022, reflecting a 0.3% increase in comparable sales and a 0.6% benefit from acquisitions, slightly offset by a 0.3% unfavorable impact of foreign currency. Segment profit of $283 million increased 16.6%, with segment profit margin of 12.9% up 180 basis points from the same period of the prior year. The third quarter of 2023 had one less selling day in the U.S. compared to the third quarter of 2022, which negatively impacted third quarter Industrial sales growth by approximately 1.6%.

“While our industrial and international automotive businesses performed well during the third quarter, the results for our U.S. automotive business were below our expectations and negatively impacted by one less selling day,” said Will Stengel, president and COO. “Our third quarter results reflect continued improvement in segment margins, driven by strong team operating discipline despite the slower growth environment.”

Nine Months 2023 Results

Sales for the nine months ended September 30, 2023 were $17.5 billion, up 5.6% from the same period in 2022. Net income for the nine months was $1 billion, or $7.08 per diluted share, an increase of 8.4% compared to $6.53 per diluted share in 2022. Net income of $1 billion, or $7.08 per diluted share, compares to adjusted net income of $896 million, or adjusted diluted earnings per share of $6.29, in 2022, an increase of 12.6%.

Balance Sheet, Cash Flow and Capital Allocation

The company generated cash flow from operations of $1.1 billion for the first nine months of 2023. GPC said it used $473 million in cash for investing activities, including $350 million for capital expenditures and $211 million for acquisitions, net of $80 million in proceeds from the sale of its remaining investment in S.P. Richards and other investments. The company also used $599 million in cash for financing activities, including $393 million for quarterly dividends paid to shareholders and $172 million for stock repurchases. Free cash flow was $733 million for the first nine months of 2023.

The company ended the quarter with $2.2 billion in total liquidity, consisting of $1.5 billion availability on the revolving credit facility and $655 million in cash and cash equivalents.

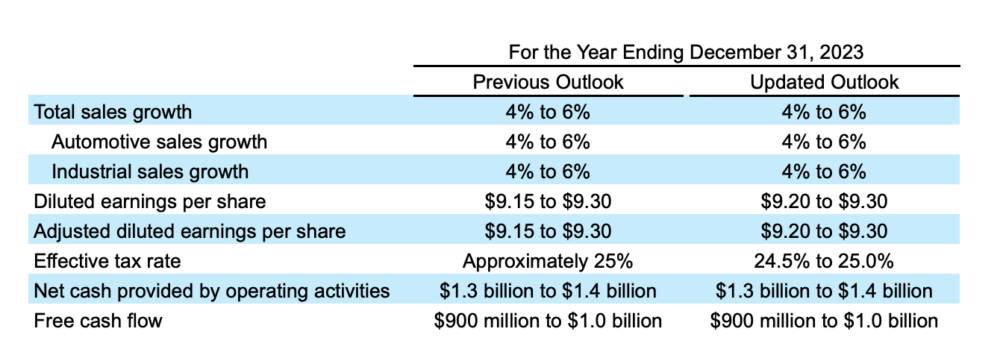

2023 Outlook

The company is updating full-year 2023 guidance previously provided in its earnings release on July 20. The company considered its recent business trends and financial results, current growth plans, strategic initiatives, global economic outlook, geopolitical conflicts and the potential impact on results in updating its guidance, which is outlined in the table below.