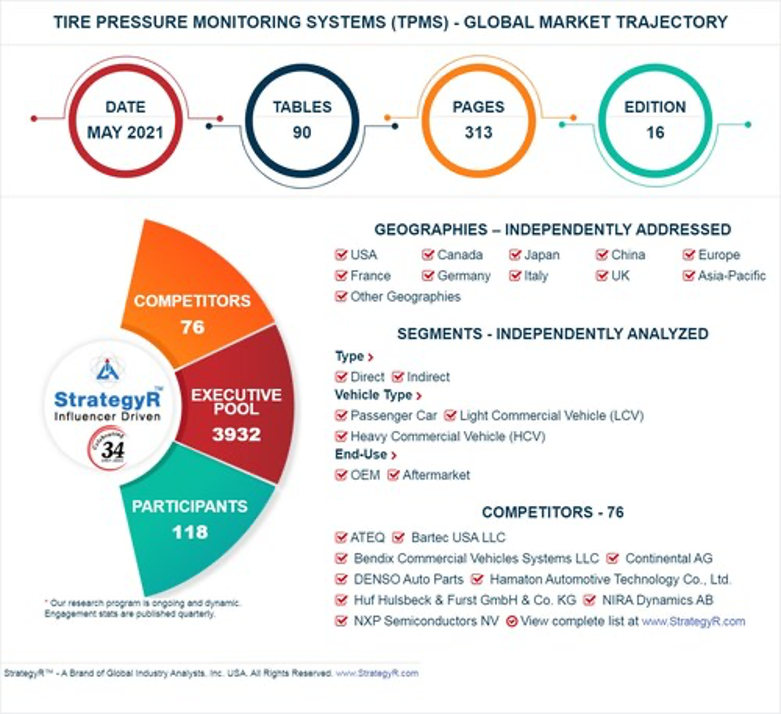

Amid the COVID-19 crisis, Global Tire Pressure Monitoring Systems (TPMS) market is projected to reach US$18.6 billion by 2024, registering a compounded annual growth rate (CAGR) of 10.4% over the analysis period. Europe represents the largest regional market for Tire Pressure Monitoring Systems (TPMS), accounting for an estimated 32.6% share of the global total. The market is projected to reach US$5.8 Billion by the close of the analysis period. China is expected to spearhead growth and emerge as the fastest growing regional market with a CAGR of 17.7% over the analysis period, according to GIA.

TPMS is a market driven largely by legislations. Several pieces of legislation related to TPMS are already in place in the United States, Europe and Asia, and will continue to shape growth patterns in the market. TPMS in the U.S. for instance witnessed substantial growth as sales following the TREAD Act legislations that mandated installation of TPMS in all new cars.

Currently, direct tire pressure monitoring systems are considered technologically superior for meeting required safety standards. However, direct TPMS are relatively more expensive than indirect TPMS. The market is expected to witness a complete change in the event of successful technology innovations that help indirect TPMS match the accuracy levels of direct TPMS, thereby assisting vehicle manufacturers in reducing their overall production costs. Tire pressure monitoring systems are used predominately in passenger cars and commercial vehicles.

Installation of these systems in other vehicles such as motorcycles and off-road vehicles is expected to help expand the market’s revenue stream in the coming years, says GIA. The market is expected to be significantly influenced by emerging players attempting to penetrate the market through the introduction of new products offering better performance in terms of price, size, accuracy and power.

Ongoing technological advances in TPMS, active industry research and establishment of new frequencies hold significant promise in expanding the capabilities of TPMS. Advanced systems that can transmit live tire pressure data to the cloud is combined with AI predictive analysis to alert drivers, fleet managers and tire service providers about potential issues. To display more information on the health of the vehicle, specifically related to tires, will require continuous transmission of massive amounts of data in real-time.

New generation TPMS leverage IoT technology and cloud services to provide a more accurate and easy-to-visualize data relating to tire condition. The large amounts of data will be critical to the future of vehicle-to-everything (V2X) communication, GIA says. A key application of IoT, vehicular networking collects and shares data that play a vital role in connecting cars (V2V) and road infrastructure (V2I). It also has the potential to empower more intelligent and safe driving.

The development of intelligent TPMS based on vehicular networking technology and cloud services offer more reliable and stable algorithms essential to monitoring tire pressure. For fleet managers, IoT enabled TPMS offers key benefits such as fewer tire inspections, less maintenance, and faster response times to tire-related functional problems. Real-time tire pressure monitoring provides data insights into wear pattern on the tires, which enables predictive maintenance and accurately predict cases of probable puncture.

To learn more, visit: http://www.strategyr.com.