HOUSTON — Consumers continue to look for value in today’s turbulent economy, but more often value when purchasing automotive parts is determined by quality rather than low price, according to aftermarket research from The NPD Group.

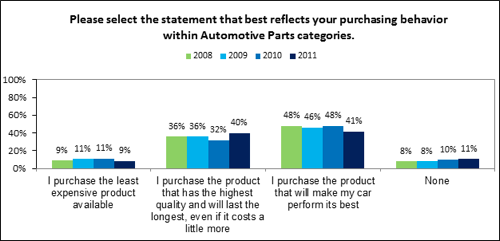

NPD’s 2012 Aftermarket Consumer Outlook Study, which captures aftermarket consumers’ purchase behaviors and attitudes, finds consumers are increasingly more interested in purchasing automotive parts that are of the highest quality and will last the longest time while their interest in purchasing the least expensive parts has declined.

Forty percent of the consumers surveyed for the 2012 Aftermarket Consumer Outlook Study said they purchase the highest quality auto parts. This compares to 32 percent who said they did in response to last year’s Aftermarket Consumer Outlook Study. In addition, quality was the only attribute among the 10 measured that increased in importance over the last year with a 45 percent rating quality as “very important” on a five-point scale from very to not at all important.

“Prior to the recession we were a disposable society, if something broke we bought a new one rather than fix it,” says David Portalatin, NPD aftermarket industry analyst. “The current consumer mindset is to maintain and repair and keep it working for a long time. We want to keep our cars maintained and on the road for a longer period of time than we did a decade ago. Value in terms of quality and long-lasting is what’s key to today’s consumers.”

Percentages of consumers who said they purchased the highest quality auto maintenance, appearance and accessories, and fuel and oil additive products also increased compared to the percentages who said they did last year. The 2012 Aftermarket Consumer Outlook Study also captures consumers’ attitudes and behaviors about new vehicle purchase, driving patterns, repair spending expectations, oil change intervals, and do-it-for-me channel choices.

NPD’s 2012 Aftermarket Consumer Outlook Study was conducted between Aug. 30 and Sept. 8 among a U.S. representative sample. The sample included 1,533 adult vehicle owners age 18 and older.