Power management company Eaton Corporation has announced its Q2 earnings report. The company said sales in the quarter were $5.9 billion, a quarterly record and up 13% from the second quarter of 2022, driven entirely by organic sales growth.

Segment margins were 21.6%, a quarterly record and a 150-basis point improvement over the second quarter of 2022.

Operating cash flow in the quarter was $851 million and free cash flow was $691 million, up $511 million and $490 million, respectively, over the same period in 2022 and in-line with full year targets.

The company raised its full year adjusted earnings per share guidance to between $8.65 and $8.85, up $0.35 at the midpoint. For the third quarter of 2023, the company anticipates organic growth of 9-11% and adjusted earnings per share of between $2.27 and $2.37.

“Achieving quarterly record adjusted earnings marked the end of a very strong first half of the year. Demand across our markets continues to be strong, propelling backlogs to record levels,” said Craig Arnold, Eaton chairman and chief executive officer. “We’re confident we can achieve our increased guidance for the year and that we remain well positioned to capitalize on reindustrialization in North America and Europe as well as the secular growth drivers of electrification, energy transition and digitalization.”

Business Segment Results

Sales for the Electrical Americas segment were a record $2.5 billion, up 19% from the second quarter of 2022, driven entirely by organic sales growth. Operating profits were a record $669 million, up 35% over the second quarter of 2022. Operating margins in the quarter were a record 26.4%, up 320 basis points over the second quarter of 2022.

The twelve-month rolling average of orders in the second quarter was up 7% organically, with particular strength in data center and distributed IT, industrial facilities, and commercial and institutional markets. Backlog at the end of June was up 30% organically over June 2022.

Sales for the Electrical Global segment were a record $1.6 billion, up 5% from the second quarter of 2022. Organic sales were up 6%, partially offset by the impact of a small divestiture. Operating profits were $290 million, a second quarter record and up 3% over the second quarter of 2022. Operating margins in the quarter were 18.5%, down 40 basis points over the second quarter of 2022.

The twelve-month rolling average of orders in the second quarter was up 1% organically, with strength in utility and data center and distributed IT markets.

On a rolling twelve-month basis, book-to-bill ratio for the electrical businesses remains very strong at 1.2.

Aerospace segment sales were a record $848 million, up 14% from the second quarter of 2022, driven entirely by organic sales growth. Operating profits were $191 million, a second quarter record and up 17% from the second quarter of 2022. Operating margins in the quarter were 22.5%, up 60 basis points over the second quarter of 2022.

The twelve-month rolling average of orders in the second quarter was up 26% organically with particular strength in defense OEM and commercial and defense aftermarket. Backlog at the end of June was up 26% over June 2022. On a rolling twelve-month basis, book-to-bill ratio for the Aerospace segment remains very strong at 1.2.

The Vehicle segment posted sales of $751 million, up 6% from the second quarter of 2022, driven entirely by organic sales growth. Operating profits were $115 million, up 6% over the second quarter of 2022. Operating margins in the quarter were 15.3%, flat to the second quarter of 2022.

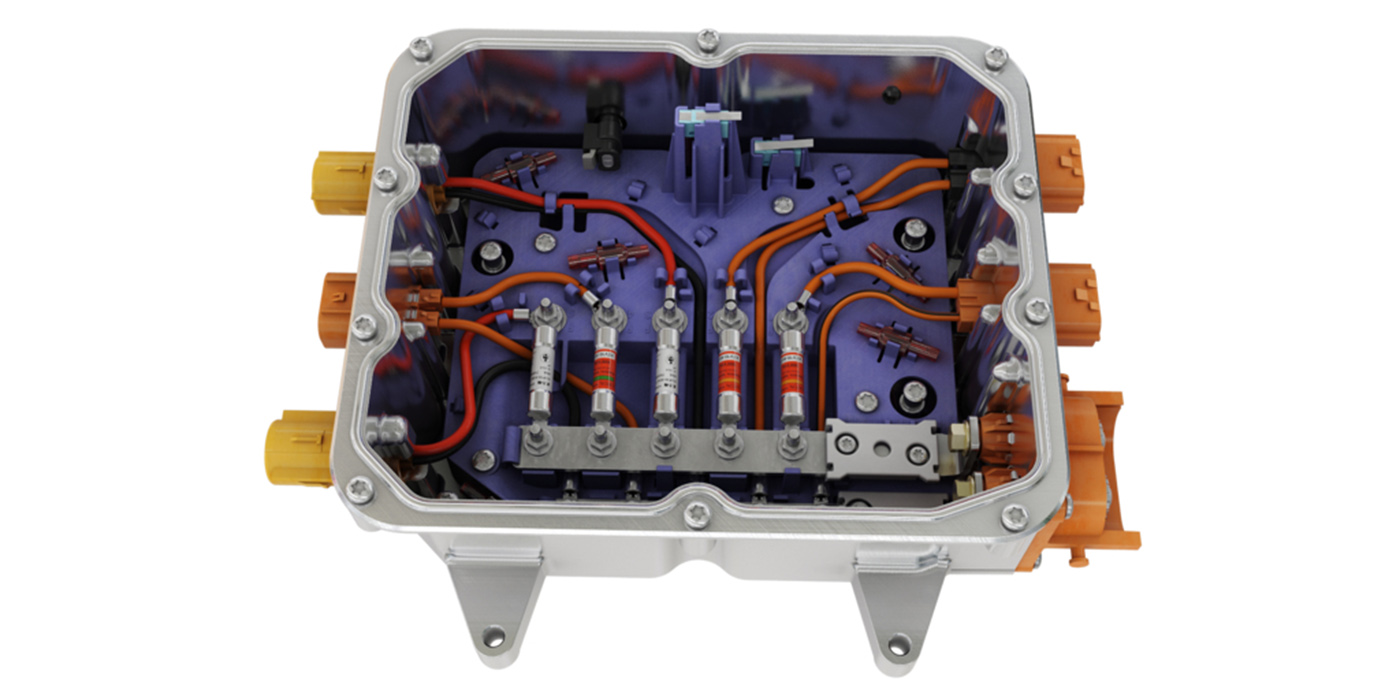

eMobility segment sales were a record $161 million, up 18% over the second quarter of 2022, driven entirely by organic sales growth. The segment recorded an operating loss of $1 million with a 100-basis point improvement over the second quarter of 2022 driven by higher volumes, partially offset by wage and commodity inflation.