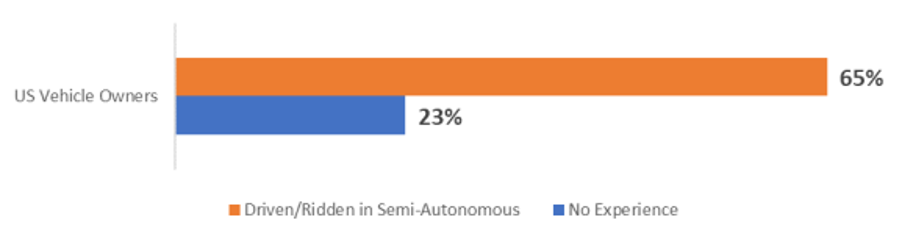

The thought of an autonomous or self-driving vehicle is a somewhat scary concept. Most consumers are not aware of these kinds of cars or don’t think a robot or computer can drive more safely than a human, so why release control of driving duties to the vehicle? Ipsos has been monitoring numerous disruptions to the automotive industry for the last several years, with the interest in and barriers to autonomous driving among the key topics.

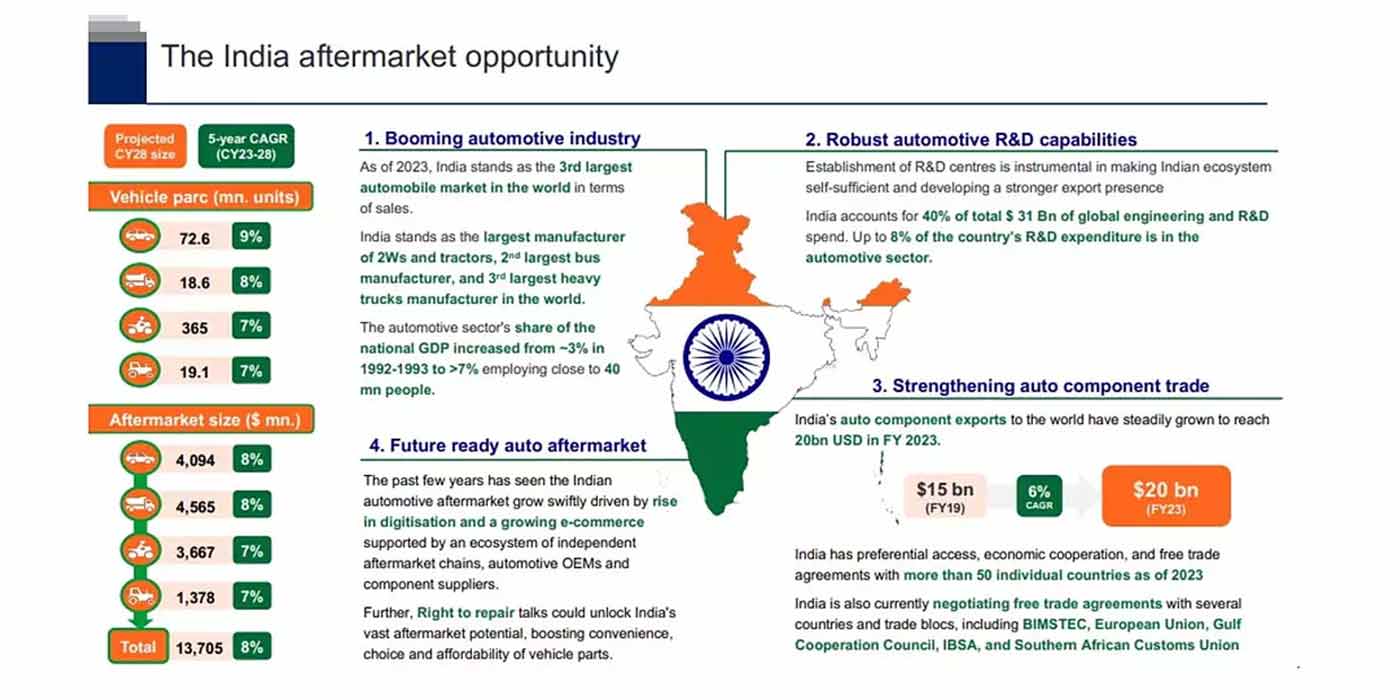

The Ipsos Mobility Navigator Global Study reveals new vehicle owners in US, China, Germany and Brazil remain steady in their interest in autonomous driving in 2021. But, how can we broaden the appeal and interest?

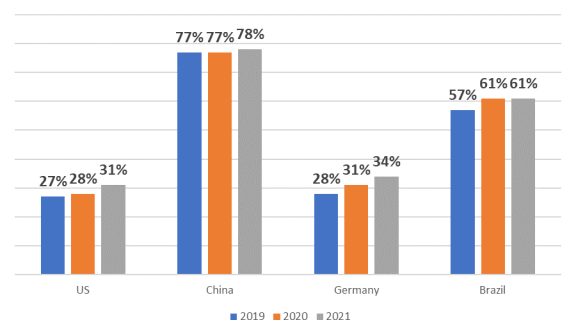

Vehicles today offer more potential interactions for the driver, raising concerns over the level of driver distraction. These worries are becoming a common issue, drivers encounter a distracted driver almost daily. We recently conducted a poll in the U.S. among 1,000 adults in April 2021 and found that today’s drivers believe they encounter a distracted driver in one of every two drives they take.

These U.S. drivers have noticed the following top three distractions while driving, two of which require the driver to have their eyes and attention away from the road, a very dangerous and concerning situation.

As much as we would prefer drivers to stay focused on the task of driving, it would be foolhardy to expect consumers to fully disengage from their smartphones and connected lives while operating their vehicle. So, what can be done to improve this safety and protect drivers from themselves? Today’s automotive technology is aimed at helping consumers deal with the complexity of driving and making it easier and safer to drive. This new technology is often referred to as ADAS, or Advanced Driver Assist Systems.

Most light-duty vehicle accidents in the U.S. are due to human error or driver distraction. In a recent study conducted at Carnegie Mellon University, results suggested the combination of vehicle crash avoidance technologies reduces crash frequency by about 3.5%. The research further estimated that if vehicle crash avoidance technologies were deployed throughout all light-duty vehicles, the crash prevention cost savings could mount to as much as $264 billion, assuming all relevant crashes would then be prevented.

The potential avoidance of accidents has a two-fold benefit, one being the estimated cost savings but more importantly, a potential significant reduction to injuries. However, the issue of the mass adoption of any of these ADAS technologies is centered on awareness and knowledge of the improved safety impacts.

When using multiple ADAS features together (i.e., blind spot detection, lane centering, crash avoidance) this results in the vehicle providing a semi-autonomous driving system. While a fully autonomous vehicle is a scary thought for the average driver, the industry can promote multiple ADAS features working together for a safer, more controlled semi-autonomous experience, paving the way for broader understanding and acceptance of autonomous.

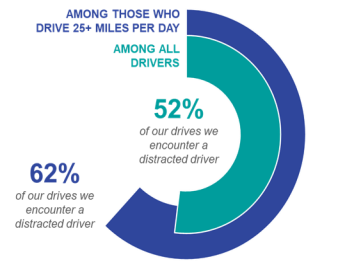

Our Ipsos Mobility Navigator Global study shows that Americans who have experience (ridden or driven) using semi-autonomous indicated a 3x increase in interest in getting a vehicle with an autonomous driving functionality.

Interest in Autonomous Driving Vehicle

Top 2 Box % Among US new vehicle owners per country by experience level (n=2,000)

Awareness or willingness to try a semi-autonomous car remains low but gaining traction. While there is still a minority who have used semi-autonomous features, the key is to expand this exposure.

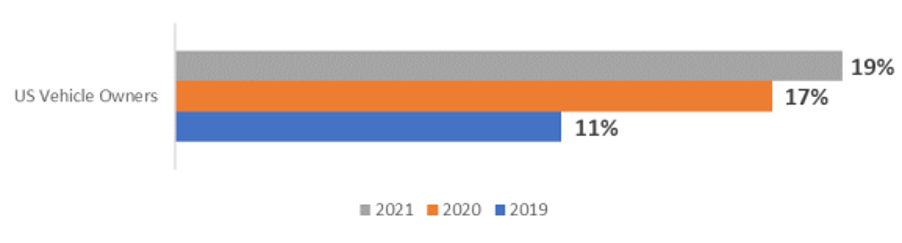

Semi-Autonomous Feature Usage

% Driven + Ridden Among US new vehicle owners (n=2,000 per year)

Safety has always been an important factor in automotive decision making, but clearly that definition is changing and increasing in importance. With the increased number of distractions within our vehicles, drivers need help to be safer even if they don’t want to admit it. Again, most accidents are human error and occur as a direct result of vehicles being operated by distracted drivers.

A solution to this growing issue is semi-autonomous features and making consumers aware of the clear safety benefits they offer. This will directly correlate to demand and usage of the semi-autonomous functionality.

We are all aware of and greatly concerned over driver and passenger safety. The focus should be on accident avoidance and improved safety while driving. Auto manufacturers who focus their marketing efforts of ADAS into the core consumer need of “safety” can convince customers to use the functionality of these features at a great level and reduce accidents in the future.

The Ipsos Mobility Navigator will provide further insights through 2021, which automotive insiders can immediately use to capitalize on new consumer behaviors such as electrification perceptions and shared mobility usage.

Look for our next installment when we focus on Electrification in July 2021.