Traditionally, the business of selling aftermarket auto parts has thrived in a brick-and-mortar environment. But high-speed internet, mobile technology, social media and e-commerce have reshaped customer expectations and behavior, giving rise to the notion of an “omnichannel” experience. Today’s customers want to research, buy and receive products in the way that’s most convenient for them – and increasingly, that means ordering via a computer or mobile device.

Randy Buller, CEO and president of Parts Authority, talked about the challenges and opportunities of this new reality in a March 25 AASA Vision Conference session entitled, “Hybrid Distribution: Traditional Meets Online.” Long Island, New York-based Parts Authority has more than 200 locations in 13 states, and the company expects to have 249 locations by the end of 2020.

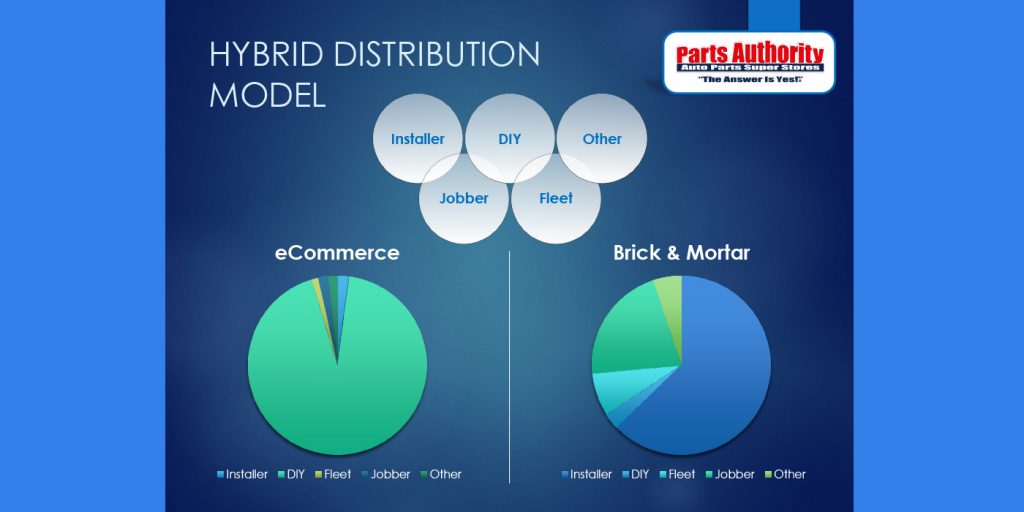

Buller estimates that DIY sales comprise 90% of Parts Authority’s e-commerce business, but that comes with an asterisk. When repair shops order parts electronically on a B2B platform – through their WD or program group, for example – he doesn’t lump those sales in the e-commerce category. “E-commerce, to me, is all coming in over the B2C internet,” Buller said.

One of the biggest challenges with Parts Authority’s DIY-driven e-commerce business, Buller noted, is keeping that demand separate from its brick-and-mortar locations, which largely cater to DIFM customers, jobbers and fleets. If the company were to fulfill e-commerce orders from its stores, “we’d be stocking very classic parts and brand-new parts in all of our locations,” because the e-commerce demand is so much larger and broader.

“The building space and the enormous cost of inventory is another huge challenge,” Buller added.

The process of packing and shipping e-commerce orders is much more involved than it is for other orders. Parts Authority ships e-commerce orders from dozens of locations, each of which has stations to prep the orders for shipping.

“We have to pick the parts immediately,” Buller explained. “We have to issue tracking numbers immediately. The quality of the boxing, the packing has to be different. The packing that many manufacturers send the parts in is fine, but we have to then reship them out to people’s houses. When UPS, FedEx and DHL get their hands on it, those boxes get crushed. So we always have to secure the parts with additional packing and wrapping.”

The many challenges notwithstanding, Buller encouraged parts suppliers to “recognize the value of e-commerce.”

E-commerce provides an outlet for old and obsolete inventory, and an ideal market for new parts. “If you’re going to launch a line of brand-new SKUs, start selling e-commerce first,” he said.

Also, e-commerce sales are predictive of early failure rates, Buller noted, and they provide a great platform for feedback on SKUs and brands.

“If you want to see how your parts are doing, you can see how they’re reviewing online,” Buller said. “Everything gets reviewed online.”

While many industries “treasure e-commerce,” the automotive aftermarket “tends to penalize it through MAP pricing, extra freight and handling charges,” Buller asserted. He urged suppliers to collaborate and communicate more with e-tailers. Suppliers also need to show more willingness to adapt, and they need to embrace the internet. Buller quipped: “It’s going to be around for a while.”

The rise of online ordering has emboldened customers – and not just the DIY customers – to expect more from their parts providers.

“Our customers – whether they’re installers or e-commerce customers – expect even greater speed,” Buller asserted. “They expect more freight options, just like you’d see from Walmart or Amazon. They expect same-day [delivery], they expect free freight. They want more menu options. They might want a discount for no returns. They might want a discount for pick-up in store. They might want a discount for delivery next week.”

They also want “greater flexibility” for mobile orders. He called this trend “the Harrison Effect,” which refers to a colleague’s son who never called in an order over the phone or on his computer.

“He only orders on his phone,” Buller said. “So if you can’t make your products available like that, guess what – you’re not going to be around in the future.”