Robert Bosch Venture Capital GmbH, the corporate venture capital company of the Bosch Group, has set up a third venture capital fund with 150 million euros (approximately $171 million USD).

“Robert Bosch Venture Capital successfully shapes the innovation leadership of Bosch through valuable connections to the start-up ecosystem,” said Dr. Volkmar Denner, chairman of the board of management of Robert Bosch GmbH.

The investments give Bosch an early access to disruptive innovations generated by the start-up ecosystem. Furthermore, the company says the activities of Robert Bosch Venture Capital support Bosch’s technology leadership with open innovation powered by start-ups.

With its third fund, Robert Bosch Venture Capital now has 420 million euros (approx. $479 million) under management. It will continue investing in innovative start-ups and in selected industry-specific venture capital funds in Europe, the U.S., Israel and China.

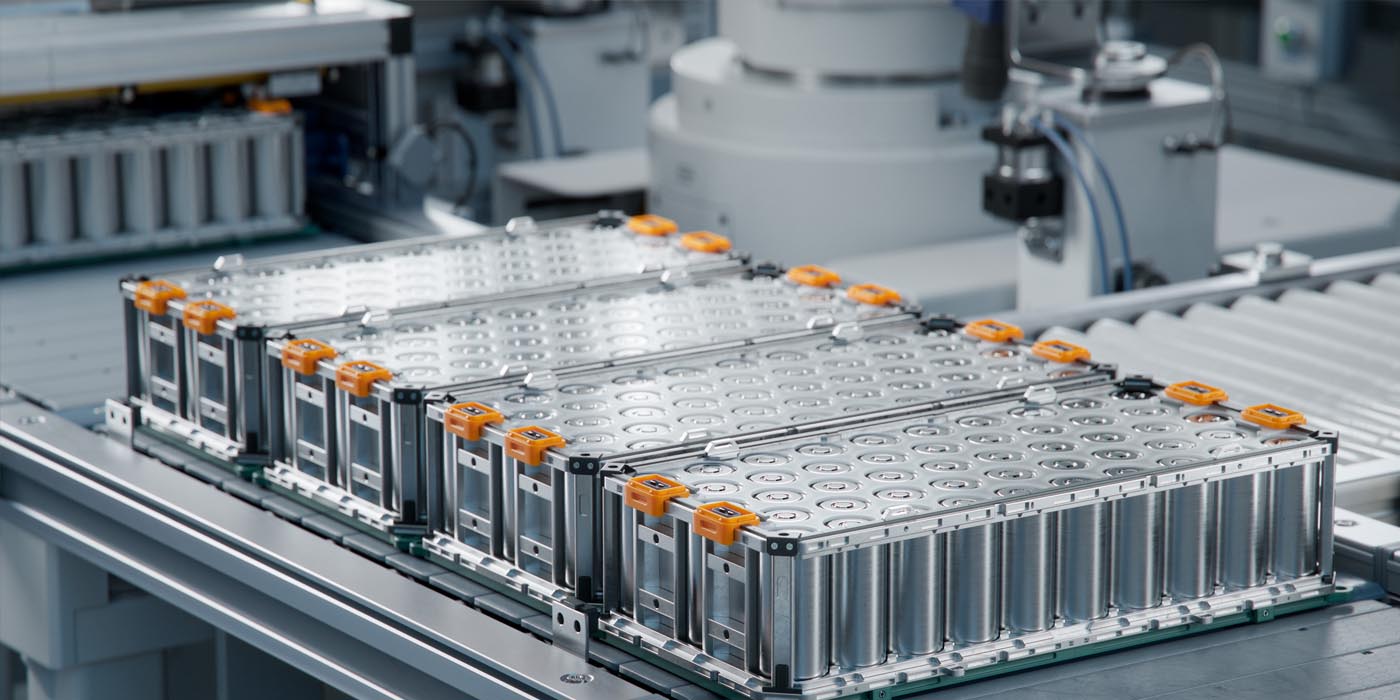

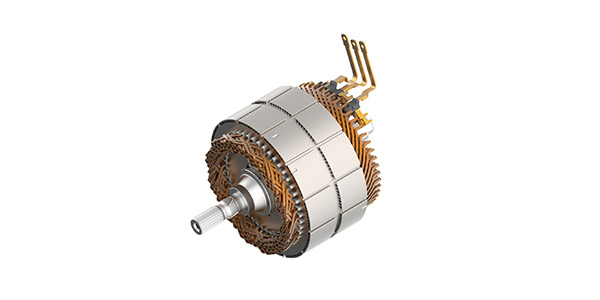

“The new fund will continue focusing on disruptive start-ups in the areas of automation and electrification, energy efficiency, enabling technologies and healthcare systems. Investments will also be done in services and business models as well as new materials that are relevant to the above-mentioned areas of business,” said Dr. Ingo Ramesohl, managing director and co-head of Robert Bosch Venture Capital.

Well-known companies currently in the existing portfolio of Robert Bosch Venture Capital include Movidius, market leader in embedded machine vision, and Greenpeak, market leader for smart home communication devices. In one of its latest exits, the Israeli company Pebbles, which Robert Bosch Venture Capital identified early as a leader in the field of gesture recognition, was sold to Facebook.

Investments from seed to growth stage

Robert Bosch Venture Capital invests in seed-, early- and late-stage venture capital rounds and participates in the follow-on investments in privately held companies. Depending on the stage of the company, the initial amount of investment ranges from below 500 thousand euros (approx. $570,000 USD) for a seed funding to more than 5 million euros ($5.7 million USD) in an early- to late-stage funding round. The typical aggregate investment allocation per portfolio company, including follow-on investments, ranges typically between 6 million euros ($6.8 million USD) and 15 million euros ($17 million USD) for usually a 10 to 25 percent equity position in each company.

Start-ups interested in getting in contact with Robert Bosch Venture Capital can find more information at rbvc.com.