SPRINGFIELD, Mo. – O’Reilly Automotive has announced record revenues and earnings for its second quarter ended June 30, 2013.

Sales for the second quarter ended June 30, 2013, increased $152 million, or 10 percent, to $1.71 billion from $1.56 billion for the same period one year ago. Gross profit for the second quarter increased to $872 million (or 50.8 percent of sales) from $780 million (or 49.9 percent of sales) for the same period one year ago, representing an increase of 12 percent.

Net income for the second quarter ended June 30, 2013, increased $31 million, or 21 percent, to $177 million (or 10.3 percent of sales) from $146 million (or 9.3 percent of sales) for the same period one year ago. Diluted earnings per common share for the second quarter increased 37 percent to $1.58 on 112 million shares versus $1.15 for the same period one year ago on 127 million shares.

"We are very pleased to again report another record-breaking quarter highlighted by a 37 percent increase in diluted earnings per share to $1.58, representing our 18th consecutive quarter of 15 percent or greater adjusted diluted earnings per share growth," said Greg Henslee, president and CEO. "We generated an impressive 6.5 percent increase in comparable store sales, which exceeded the top end of our quarterly guidance range of 4 percent to 6 percent. Our unwavering commitment to providing consistent, excellent customer service drove outstanding sales results across all of our markets. We achieved a record quarterly gross margin of 50.8 percent, primarily driven by improvements in acquisition costs, product mix and pricing management. Our relentless focus on expense control, along with our strong gross margin results, generated a record quarterly operating margin of 17.3 percent, which was a 170 basis point improvement over the prior year. We continue to believe in the strength of the long-term demand drivers in our industry, and we are establishing our third quarter comparable store sales guidance at 4 percent to 6 percent and reiterating our full year comparable store sales guidance of 3 percent to 5 percent. I would like to take this opportunity to thank each of our 60,000 team members for their hard work and commitment to O’Reilly’s continued success."

Sales for the first six months of 2013 increased $208 million, or 7 percent, to $3.30 billion from $3.09 billion for the same period one year ago. Gross profit for the first six months of 2013 increased to $1.67 billion (or 50.6 percent of sales) from $1.54 billion (or 49.9 percent of sales) for the same period one year ago, representing an increase of 8 percent . SG&A for the first six months of 2013 increased to $1.12 billion (or 34 percent of sales) from $1.05 billion (or 34 percent of sales) for the same period one year ago, representing an increase of 7 percent. Operating income for the first six months of 2013 increased to $547 million (or 16.6 percent of sales) from $491 million (or 15.9 percent of sales) for the same period one year ago, representing an increase of 11 percent.

Net income for the first six months of 2013 increased $38 million, or 13 percent, to $331 million (or 10 percent of sales) from $294 million (or 9.5 percent of sales) for the same period one year ago. Diluted earnings per common share for the first six months of 2013 increased 28 percent to $2.94 on 113 million shares versus $2.29 for the same period one year ago on 128 million shares.

Henslee continued, "We are on track to meet our goal of 190 net, new stores in 2013 with the opening of 111 net new stores across 30 states in the first half of the year. In June, we issued $300 million of 10-year senior notes, representing another measured step to reaching our targeted leverage range of 2 to 2.25 times adjusted debt to adjusted EBITDAR, and we remain very focused on maintaining or improving our investment grade credit ratings."

As previously announced, on May 29, the company’s board of directors approved a resolution to increase the authorization under the company’s share repurchase program by an additional $500 million, raising the cumulative authorization under the share repurchase program to $3.5 billion. During the second quarter ended June 30, 2013, the company repurchased 2.5 million shares of its common stock at an average price per share of $107.61 for a total investment of $274 million.

During the six months ended June 30, 2013, the company repurchased 5 million shares of its common stock at an average price per share of $100.10 for a total investment of $502 million. Subsequent to the end of the second quarter and through the date of this release, the company repurchased an additional 0.5 million shares of its common stock at an average price per share of $113.66 for a total investment of $56 million. The company has repurchased a total of 37.6 million shares of its common stock under its share repurchase program since the inception of the program in January of 2011 and through the date of this release, at an average price of $79.27, for a total aggregate investment of $2.98 billion. As of the date of this release, the company had approximately $521 million remaining under its current share repurchase authorizations.

FullSpeed Automotive Appoints New Chief Marketing Officer

Stacey Pool brings more than two decades of marketing and e-commerce experience to FullSpeed.

FullSpeed Automotive has announced the appointment of Stacey Pool as the new Chief Marketing Officer, effective May 28, 2024. She will report directly to Chief Executive Officer, Rob Lynch, and serve on the FullSpeed Automotive executive leadership team.

Pool brings more than two decades of marketing and e-commerce experience from Nike, Vail Resorts, and most recently, Noodles & Company.

SMP Announces Q1 2024 Results

Net sales for the first quarter of 2024 were $331.4 million, compared to consolidated net sales of $328.0 million during the comparable quarter in 2023.

DENSO Announces Year-End Financial Results

Consolidated revenue totaled 7,144.7 billion yen (US$47.2 billion), a 11.6 percent increase from the previous year.

Allison Transmission Announces Q1 2024 Results

The company reported record net sales of $789 million.

GPC Reports Q1 2024 Results, Updates Full-Year Outlook

Sales were $5.8B, a 0.3% increase compared to the same period of the prior year.

Other Posts

Advance Auto Parts Offers Race Fans Once-in-a-Lifetime Trip

One winner and a guest will “Do the Double” by attending the Indianapolis 500, before traveling to Charlotte for NASCAR’s 600-mile race.

PACCAR Elects New Board Directors

Pierre Breber and Brice Hill have been elected to serve on the PACCAR Board, effective July 1.

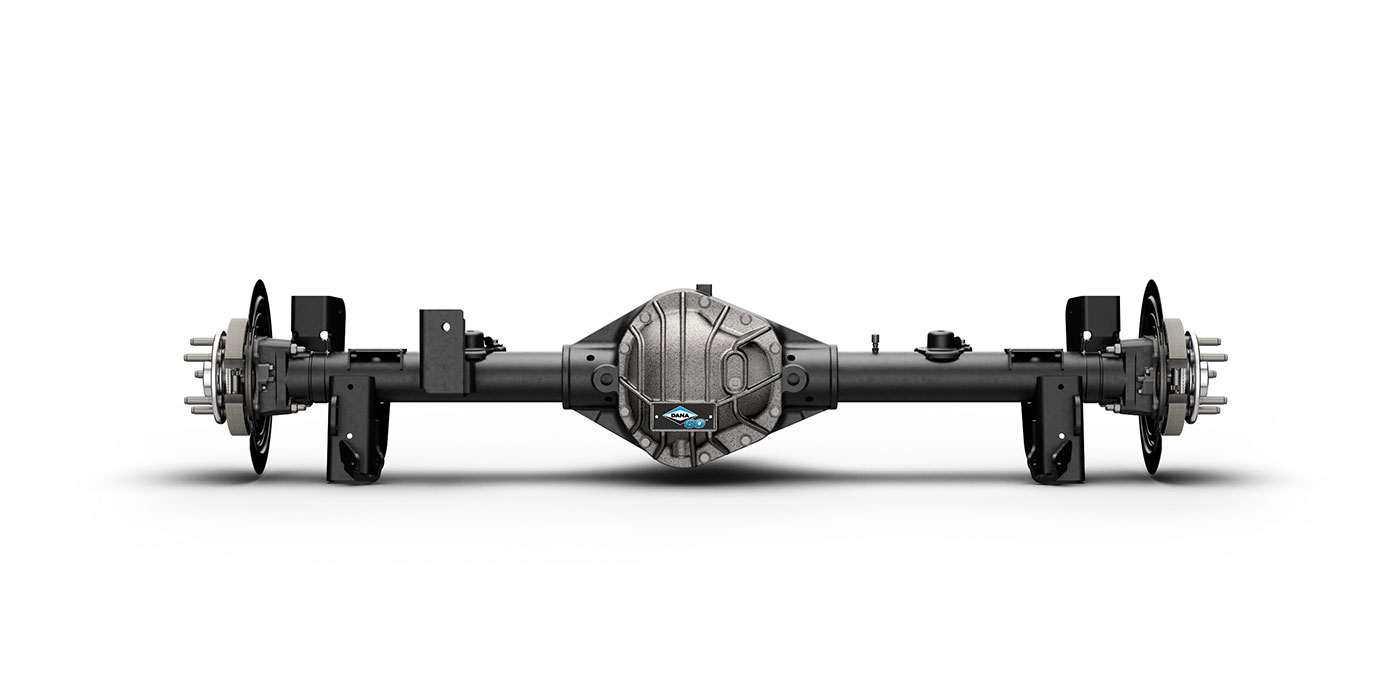

Dana Releases Rear Semi-Float Axles for Jeeps

The axles provide Jeep owners with a direct-fit, bolt-in upgrade solution that is built for superior strength inside and out, the company said.

Dayco Announces Leadership Hires, Headquarters’ Relocation

Dayco said these developments strengthen its focus on innovation and growth.