MILWAUKEE – For the fiscal 2013 second quarter, Johnson Controls Inc. (JCI) reported net income of $148 million, or 21 cents per share, on $10.4 billion in sales. JCI said the results were in line with expectations. Excluding restructuring and non-recurring items in the 2013 and 2012 fiscal second quarters, highlights include:

* Net sales of $10.4 billion versus $10.6 billion in Q2 2012, down 1 percent.

* Income from business segments of $463 million compared with $581 million a year ago, down 20 percent.

* Net income of $287 million versus $378 million in Q2 2012.

* Diluted earnings per share of 42 cents versus 55 cents in the same quarter last year.

Johnson Controls said it believes that using the adjusted numbers provides a more meaningful comparison of its underlying operating performance. A number of non-recurring items impacted Q2 2013 earnings and related earnings per share. They include:

* $82 million pre-tax gain from acquiring the remaining 50 percent equity interest in an Automotive Experience joint venture in India (7 cents per diluted share).

* $111 million of non-cash tax charges related primarily to valuation allowances in Germany and Brazil (16 cents per diluted share).

* $84 million restructuring charge at Automotive Experience related primarily to Interiors-Europe and South America (12 cents per diluted share).

The company noted that there were non-recurring items as well in Q2 2012, but that there was no net impact on earnings per share.

"Our second quarter results were at the high end of our previous guidance. Building Efficiency posted earnings level with last year despite soft institutional and construction markets, which negatively impacted revenues. Automotive Experience benefited from higher auto production in North America and Asia, but these improvements were more than offset by the low production levels as well as operational and restructuring-related costs in Europe," said Stephen Roell, chairman and CEO of Johnson Controls. "We remain committed to improving profitability despite soft global demand in our markets. Our restructuring initiatives are gaining momentum and proceeding as planned. We expect to see significant benefits in the second half of the fiscal year."

Revenues in China, which are primarily related to JCI’s seating business and generated through non-consolidated joint ventures, increased 31 percent to $1.3 billion.

Automotive Experience segment income was $103 million, significantly lower than the same quarter last year. The profitability of all three automotive segments was impacted by the low level of European production, according to JCI. The company said the performance of its European and South American businesses improved sequentially. Seating segment income in the quarter was $98 million, down significantly versus last year, primarily due to operational costs and lower European volumes. Electronics segment income was $24 million, down 35 percent due to European volumes and higher research and development costs. The Interiors business reported a $19 million loss in the quarter mainly due to lower volumes in Europe. Automotive Experience anticipates improved profitability in the second half of fiscal 2013, led by better operational performance in its European and South American businesses, as well as the benefits of its restructuring program in Europe.

Power Solutions saw strong growth in revenue and earnings versus the second quarter of 2012. Sales increased 10 percent tom$1.6 billion versus the same quarter last year. Stronger unit shipments in Asia and North America were partially offset by lower volumes in Europe. Power Solutions segment income was $221 million, 11 percent higher than the same quarter last year.

The company also completed the ramp-up of its recycling facility in South Carolina and the construction of its second Chinese battery plant is proceeding on schedule.

Sale of Automotive Electronics Business

On March 6, Johnson Controls announced it had retained JPMorgan to explore a potential sale of the electronics business to maximize shareholder value. The company said the process is in its early stages and it expects to provide an update within the next three to four months.

2013 Outlook

Johnson Controls also reaffirmed its previous earnings guidance for the 2013 fiscal year of $2.60 to $2.70 per diluted share. The company said factors driving improved second half performance included:

* Realization of benefits from restructuring initiatives

* Seasonality of Building Efficiency profitability with increasing benefits of improved cost and pricing initiatives

* Continued sequential improvements in Automotive Experience European and South American businesses

* Improved Power Solutions profitability associated with vertical integration and favorable year-over-year net lead costs

* Improved North America and Europe production comparables

The company said it is comfortable with analyst consensus of 75 cents per share for third quarter 2013 earnings.

"Despite a challenging global market, we anticipate stronger profitability in the second half of fiscal 2013 consistent with market expectations," said Roell. "Our second half results will reflect restructuring benefits and improved operating performance. We feel confident with our previously issued guidance for higher Johnson Controls earnings in 2013."

FCS Introduces 42 New Numbers in May

Complete strut assemblies, shock absorbers, shock absorber assembly kits and suspension struts for some of the most popular VIO applications are included in the release, FCS said.

FCS Automotive announced the release of 42 new numbers in May, including:

8 Complete Strut Assemblies (936,389 vehicles in operation)

6 Shock Absorber Assembly Kits (2,696,801vehicles in operation)

16 Shock Absorbers (6,245,071 vehicles in operation)

12 Suspension Struts (2,135,974 vehicles in operation)

USMW Releases New Fuel Pump Module Assembly

US Motor Works released Part No. USEP9214M, for several BMW applications.

MEYLE Expands Electronics, Sensor Product Portfolio

The focus is on assistance systems and engine and transmission management, with more than 300 new part numbers, as well as the expansion of its product lineup for EVs.

Dana, Fox Factory Collaborate on Chevrolet Silverado Truck Build

Dana 60 semi-float rear axles will be featured on the limited-edition Chevrolet Silverado Fox Factory Edition truck.

Standard Motor Products Expands Cam and Crank Sensor Program

The Standard and Blue Streak Camshaft and Crankshaft Position Sensor program features nearly 1,000 SKUs covering more than 250 million vehicles, SMP said.

Other Posts

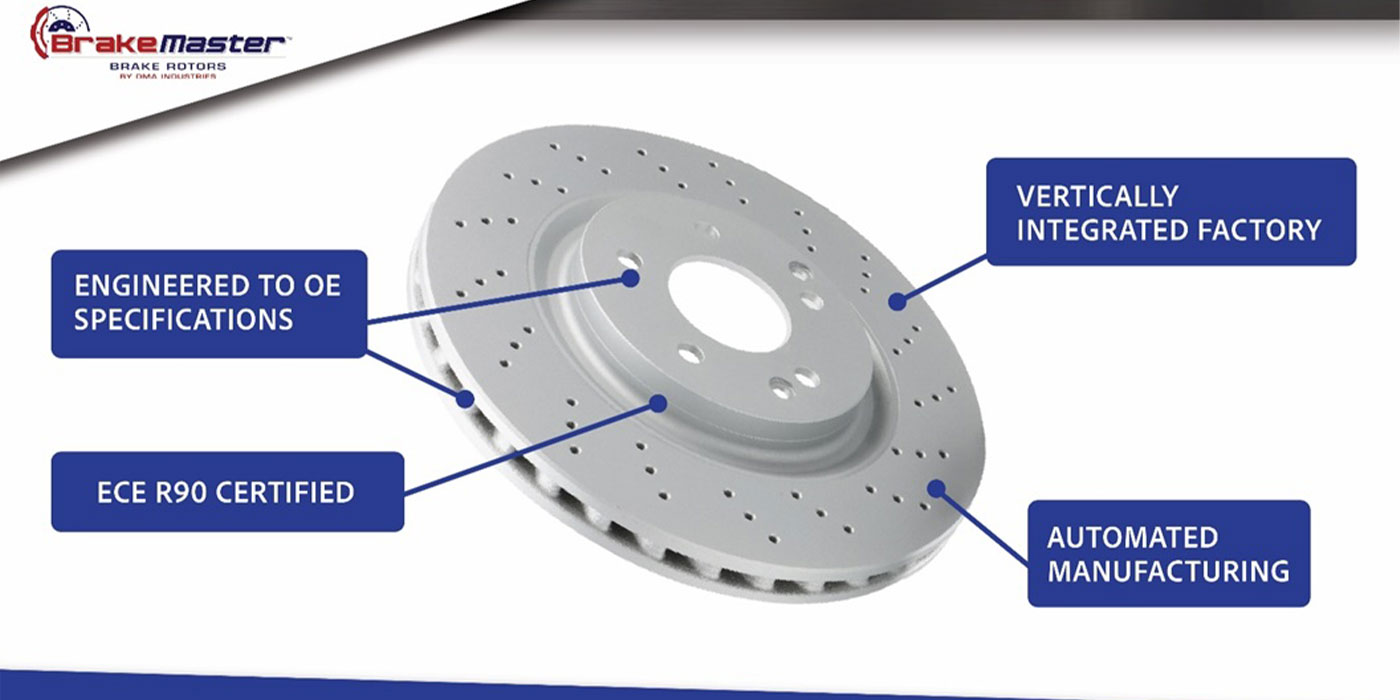

DMA Adds New BrakeMaster Coverage

New coverage for Ford and Chevy includes popular pickup trucks and SUVs.

GSP Releases New CV Axle Part Numbers

GSP said 14 new CV axle part numbers are in stock and ready to ship.

Akebono Expands Severe Duty Disc Brake Pad Kits

Akebono said it expanded its severe-duty ultra-premium disc brake pad line by 14 new part numbers.

Philips Ultinon Drive 5000 LED Lightbar Line Expands

Lumileds has expanded the Philips Ultinon Drive 5000 series to include eight models.