CANTON, Ohio – The Timken Co. has reported sales of $1.1 billion for the second quarter of 2013, a decrease of 16 percent from the prior year. The company said this decline primarily reflects lower off-highway, industrial distribution and oil and gas demand as well as the impact of the company’s market strategy in the light-vehicle sector, partially offset by the benefit of acquisitions. In addition, sales reflect a $49 million decline in raw material surcharges from the prior-year quarter.

Timken generated net income in the second quarter of $82.8 million, or 86 cents per diluted share. This compared with $183.6 million, or $1.86 per diluted share, during the same period a year ago, which included income of $69 million, or 70 cent per share, from Continued Dumping and Subsidy Offset Act (CDSOA) receipts. The company said the decrease in second quarter earnings also reflects lower demand as well as unfavorable sales mix. The decrease was partially offset by lower raw material costs (net of surcharges) and selling and administrative expenses as well as lower costs related to previously announced plant closures.

"We continue to perform very well, maintaining double-digit operating margins despite weak demand lingering in many global markets," said James Griffith, Timken president and CEO. "Although our outlook for the year now reflects a more modest market recovery in the second half, we continue to expect strong financial performance for the remainder of the year."

Timken posted sales of $2.2 billion in the first half of 2013, down 20 percent from the same period in 2012. The decrease reflects lower off-highway, industrial distribution and oil and gas demand as well as the impact of the company’s market strategy in the light-vehicle sector, partially offset by acquisitions. In addition, a $121 million decline in raw material surcharges from the prior-year period negatively impacted first-half revenues.

In the first half of 2013, the company generated net income of $157.9 million, or $1.63 per diluted share. That compares with $339.3 million, or $3.44 per diluted share, in the same period last year, which included CDSOA receipts of $69 million, or 70 cents per share. The decrease in earnings during the first half of 2013 was driven by lower demand, sales mix and higher manufacturing costs, partially offset by improved pricing and lower selling and administrative expenses as well as lower costs related to previously announced plant closures.

As of June 30, 2013, total debt was $462.5 million, or 16.6 percent of capital. The company had cash of $396.8 million, resulting in $65.7 million of net debt, compared with a net cash position of $107.4 million as of Dec. 31, 2012.

Outlook

The company revised its outlook for the full year based on a slower-than-expected economic recovery in the second half of 2013. The Timken Company now expects 2013 sales to be 10 percent lower year-over-year with:

* Mobile Industries sales down 7 to 12 percent for the year due to the impact of lower customer demand and the company’s market strategy;

* Process Industries sales to be down 2 to 7 percent, due to weaker industrial markets, partially offset by the benefit of acquisitions;

* Aerospace sales up 3 to 8 percent, due to increased demand in civil and defense markets; and

* Steel sales down 15 to 20 percent, driven by lower industrial and oil and gas end-market demand and surcharges.

Timken projects 2013 annual earnings per diluted share to range from $3.30 to $3.60, which includes approximately 15 cents per share for previously announced plant closure costs. The company expects to generate cash from operations of approximately $475 million in 2013. Free cash flow is projected to be $25 million after making capital expenditures of about $360 million and paying about $90 million in dividends. The company does not anticipate making further discretionary pension contributions this year beyond the $66 million, net of tax, made in the first quarter, as it expects its pension plans to be essentially fully funded by year end given the recent increase in interest rates. Excluding discretionary pension contributions, the company forecasts free cash flow of approximately $90 million in 2013.

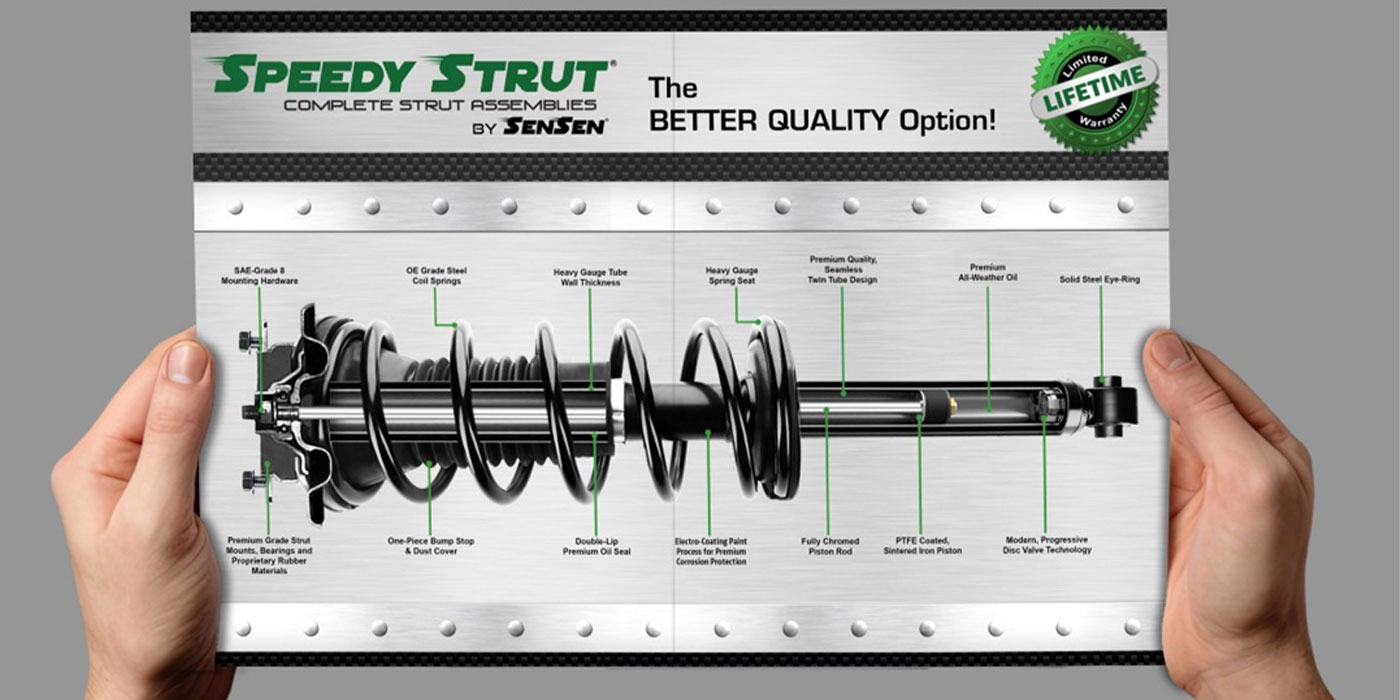

PRT Launches 59 New Complete Strut Assemblies

Extending PRT’s product portfolio in North America, the new release represents nearly 12M vehicles in new coverage.

PRT announced the launch of 59 new complete strut assemblies for the North American market.

The launch includes application coverage for Nissan Frontier, Toyota Highlander and Mercedes E-Class models, in addition to brand-new applications, such as the Dodge Durango 2022, the Ram ProMaster City 2022, and the Mazda CX-9 2022, among others, according to PRT.

SMP Releases 2023 Corporate Sustainability Report

The report provides insight into the company’s initiatives, future goals and achievements, Standard Motor Products said.

GSP Announces New May Part Numbers

The units released in May are in stock and ready to ship, GSP said.

Cooper Standard Issues Corporate Responsibility Report

Titled “Commitment to Excellence,” the report provides updates on key sustainability targets, initiatives and ambitions.

Mevotech Expands Coverage with 188 New Part Numbers

The release covers domestic and import passenger vehicles, pickup trucks, vans, SUVs and EVs, up to the 2023 vehicle model year.

Other Posts

MAHLE Finalizes Sale of its OEM Thermostat Business

As part of the transaction, ADMETOS is taking on around 600 employees in six countries.

ZF Aftermarket Releases 36 New Parts for US, Canada

ZF has introduced a total of 185 new products in 2024 under the ZF, LEMFÖRDER, SACHS, TRW and WABCO brands.

Dana Expands Spicer ReadyShaft Assembly Coverage

The addition of more than 3,000 new part numbers brings Dana’s ReadyShaft program

to over 13,000 active SKUs.

Litens Aftermarket North America Elevates Sustainability Efforts

Litens said it is dedicated to achieving carbon neutrality by 2030.