Standard Motor Products (SMP) has reported its consolidated financial results for the three months ended March 31, 2022.

Net sales for the first quarter of 2022 were $322.8 million, compared to consolidated net sales of $276.6 million during the comparable quarter in 2021. Earnings from continuing operations for the first quarter of 2022 were $20.6 million or 91 cents per diluted share, compared to $22.2 million or 97 cents per diluted share in the first quarter of 2021. Excluding non-operational gains and losses identified on the attached reconciliation of GAAP and non-GAAP measures, earnings from continuing operations for the first quarter of 2022 were $20.6 million or 92 cents per diluted share, compared to $22.2 million or 97 cents per diluted share in the first quarter of 2021.

Eric Sills, Standard Motor Products’ CEO and president, stated, “We are quite pleased with our first quarter results. Our sales increased nearly 17% over last year’s strong first quarter, posting our seventh consecutive record quarter, with solid performance in both divisions.

“By division, Engine Management sales were up nearly 13% in the quarter, driven by sales from acquisitions made during 2021, along with solid customer demand, price increase benefits, and phase-in of business wins.

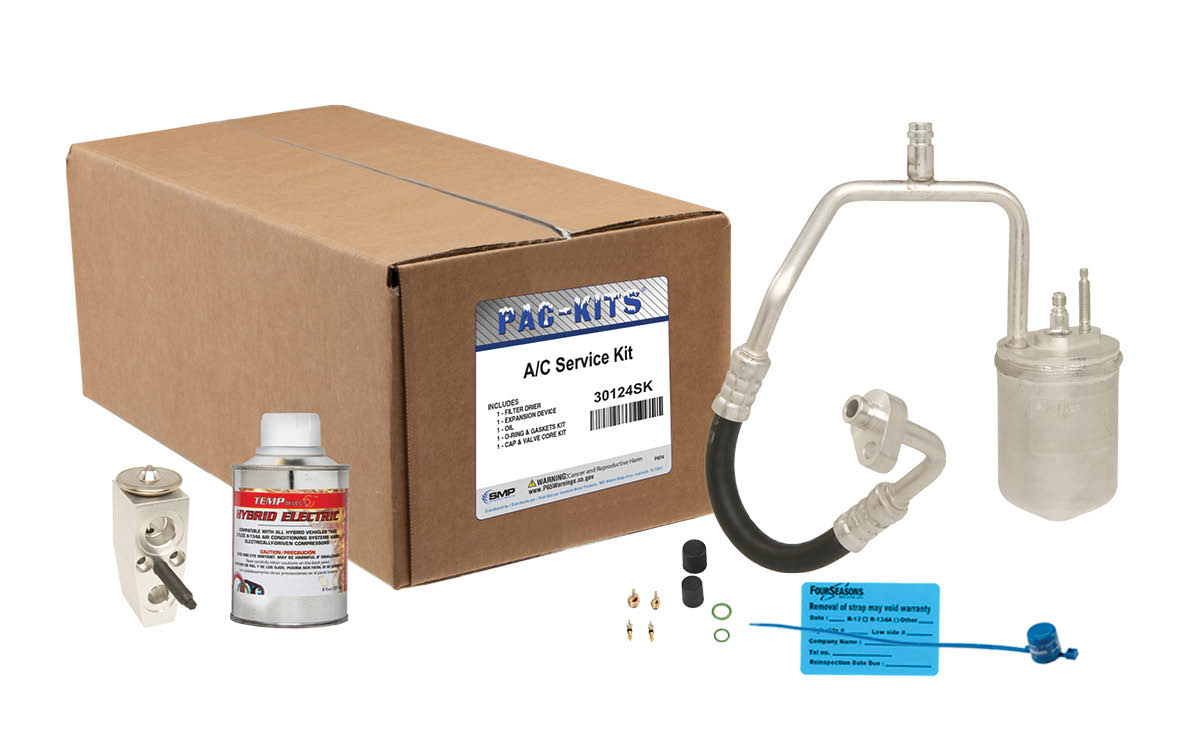

“Turning to Temperature Control, the robust year-end demand from 2021 has continued as sales in the quarter grew 30% year over year. This strong performance was due to a combination of strong pre-season orders, ongoing customer replenishment, and new business wins in winter-related categories.

“Looking at profitability, consolidated operating margins were in line with expectations, finishing at 8.3% in the first quarter, down from 10.6% in the first quarter of 2021. Our lower operating income was mainly the result of lower gross margins in both divisions, partly offset by continued improvement in operating costs, which were down to 19.5% of net sales in the quarter.

“As we’ve noted before, last year’s gross margin enjoyed many non-recurring benefits from reopening after COVID, while this year was impacted by inflationary headwinds and elevated supply chain costs. While we were successful in passing through some of these higher costs, we anticipate more pricing actions to be taken in 2022 to match our elevated expenses during this volatile inflationary environment. We expect our consolidated gross margin will be in the range of 28-29% for the full year after taking into account more normalized production levels, pricing to offset inflation, as well as a mix shift to higher sales in our specialized non-aftermarket channels.

“These specialized business channels, which focus on custom-engineered products for niche end markets such as medium and heavy-duty vehicles, construction and agricultural equipment, power sports, and others, represented 23% of our revenue in the first quarter of 2022, compared to 17% the prior year, with most of the growth related to our recent acquisitions. As we have stated in the past, we are quite excited about this business as it brings new customers, products and geographies and is highly complementary to our core aftermarket business.

“As we seek to improve our transparency related to sustainability, we are pleased to have recently published our 2021 Corporate Social Responsibility and Sustainability report. In it, we announced our ambition to achieve net-zero greenhouse gas emissions by 2050, and introduced specific reduction targets related to our scope 1 and scope 2 emissions, along with many other first-time environmental and diversity disclosures.

“Our strong operating results have allowed us to continue to return value to our shareholders. The Board of Directors has approved payment of a quarterly dividend of 27 cents per share on the common stock outstanding, which will be paid on June 1, 2022, to stockholders of record on May 16, 2022. Furthermore, we repurchased shares of our common stock in the amount of $6.9 million in the quarter, with $22.8 million remaining under our current share repurchase authorization.

“In closing, we are pleased with our momentum as we exit the first quarter and remain cautiously optimistic for the balance of the year. We understand that there are various headwinds including ongoing inflation, increased borrowing costs, supply chain disruption, and an eventual normalization of demand. Still, the industry is one of resiliency, with many favorable trends such as an aging fleet, constrained new car availability, and rebounding miles driven. Finally, thanks to our people, our position in the industry has never been stronger.”