Standard Motor Products, Inc., an automotive replacement parts manufacturer and distributor, reported recently its consolidated financial results for the three months and nine months ending Sept. 30, 2019.

Consolidated net sales for the third quarter of 2019 were $307.7 million, compared to consolidated net sales of $296.6 million during the comparable quarter in 2018. Earnings from continuing operations for the third quarter of 2019 were $22.7 million or $1.00 per diluted share, compared to $19.3 million or 84 cents per diluted share in the third quarter of 2018. Excluding non-operational gains and losses identified on the attached reconciliation of GAAP and non-GAAP measures, earnings from continuing operations for the third quarter of 2019 were $23.1 million or $1.02 per diluted share, compared to $19.1 million or 83 cents per diluted share in the third quarter of 2018.

Consolidated net sales for the nine month period ended Sept. 30, 2019, were $896.7 million, compared to consolidated net sales of $845.1 million during the comparable period in 2018. Earnings from continuing operations for the nine month period ended Sept. 30, 2019, were $56.3 million or $2.47 per diluted share, compared to $44.7 million or $1.95 per diluted share in the comparable period of 2018. Excluding non-operational gains and losses, earnings from continuing operations for the nine months ended Sept. 30, 2019 and 2018 were $57.3 million or $2.51 per diluted share and $46.7 million or $2.03 per diluted share, respectively.

Eric Sills, Standard Motor Products’ CEO and president stated, “We are quite pleased with our third quarter and with our year overall. We posted record sales and earnings, with both of our operating divisions continuing to perform well.

“Engine Management sales rose approximately 9.3% for the quarter and 7.8% year-to-date. Excluding Wire and Cable which is in secular decline, Engine Management sales in the quarter were up almost 14%, or roughly $22 million. Revenue from the Pollak acquisition, previously announced, accounted for nearly $10 million of this gain. Our Engine Management segment, excluding Pollak and Wire and Cable, increased 7.8% for the quarter. The growth was primarily attributable to a combination of several customer pipelines, a benefit from pricing actions and pass-through of tariff costs, as well as low single digit organic growth.

“Our sales in Engine Management have exceeded our customers’ low single digit POS growth all year, and this tends to even out over time. Excluding Pollak, we anticipate that Engine Management sales will likely be flat or down for the fourth quarter of 2019 as these sales move closer to our customers’ POS numbers. However, we remain optimistic for the year as a whole.

“Engine Management gross margins in the quarter improved nearly two points from last year to 30.7%, with sequential quarterly improvements throughout 2019. This margin improvement was the result of several factors – the completion of the integration of our wire operations in Mexico, a continued emphasis on cost reductions, as well as certain pricing actions, and was partially offset by the adverse impact of tariffs being passed through to customers at our cost.

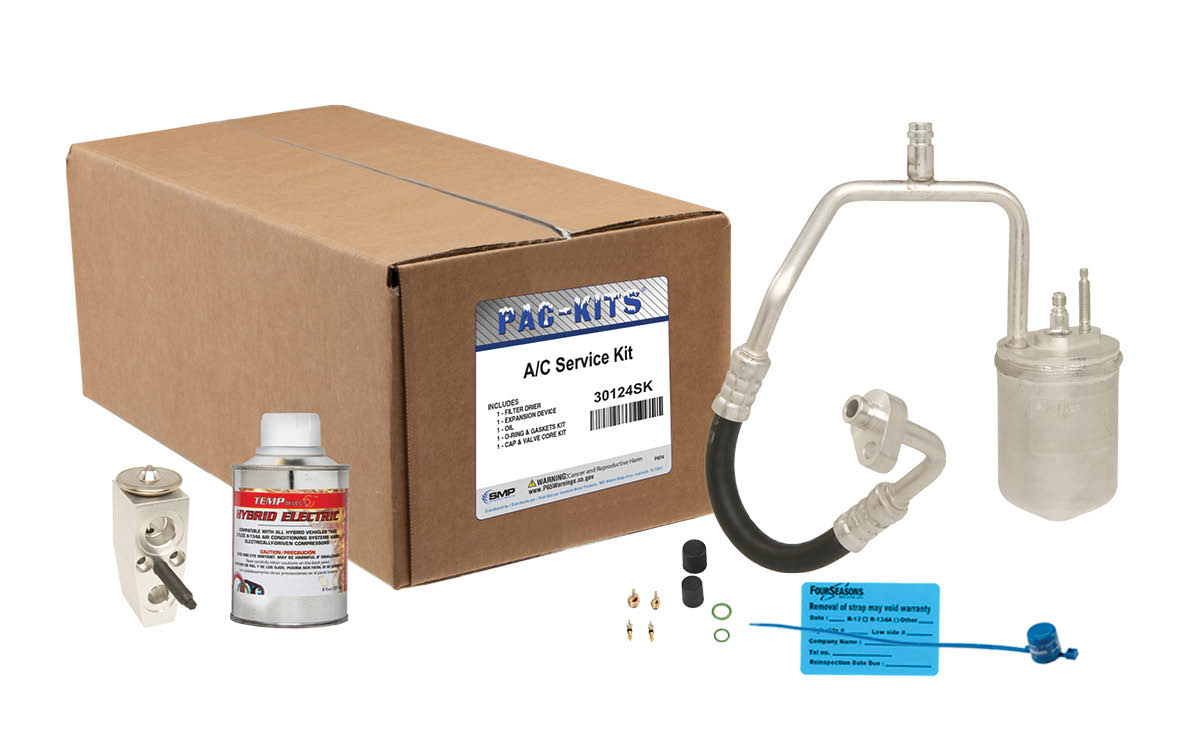

“Temperature Control sales were 8.1% lower than the third quarter of 2018. However, a portion of the 2018 volume included working down a large order backlog, generated by some of the hottest spring months in history, plus some start-up inefficiencies as we introduced our new automated warehouse system in Lewisville, Texas. Year-to-date our Temperature Control sales are 2% above 2018.

“Temperature Control gross margins decreased by 1.6 points in the quarter, reflecting the dampening effect of tariffs being passed through to customers at our cost. The improvement in SG&A expenses reflects savings in distribution costs as we continue to refine and improve our new automated warehouse system.

“On Aug. 1, we acquired a minority position in Jiangsu Che Yijia New Energy Technology Co. (CYJ), a Chinese manufacturer of electric compressors for electric vehicles. Founded in 2016, the company is still in its early stages, but we are pleased to have a strategic partner focused on parts for electric vehicles in the fast-growing Chinese market.

“Finally, as previously announced, we are pleased to welcome Nathan Iles as our new CFO. We believe he is an excellent fit for SMP, and we look forward to his contributions.”

Loss from discontinued operations, net of income taxes, in the third quarter of 2019 was $7.9 million compared to $3.5 million in the comparable period last year. The loss pertains to asbestos-related liabilities from a brake business, originally acquired in 1986 and subsequently divested in 1998, which are adjusted in the third quarter each year when the company engages an independent actuary to assess the company’s exposure. In the third quarter of 2019, the company increased its asbestos-related indemnity liability to $52 million by recording a non-cash $9.7 million provision, or $7.1 million net of taxes.

The board of directors has approved payment of a quarterly dividend of 23 cents per share on the common stock outstanding. The dividend will be paid on Dec. 2, 2019, to stockholders of record on Nov. 15, 2019.