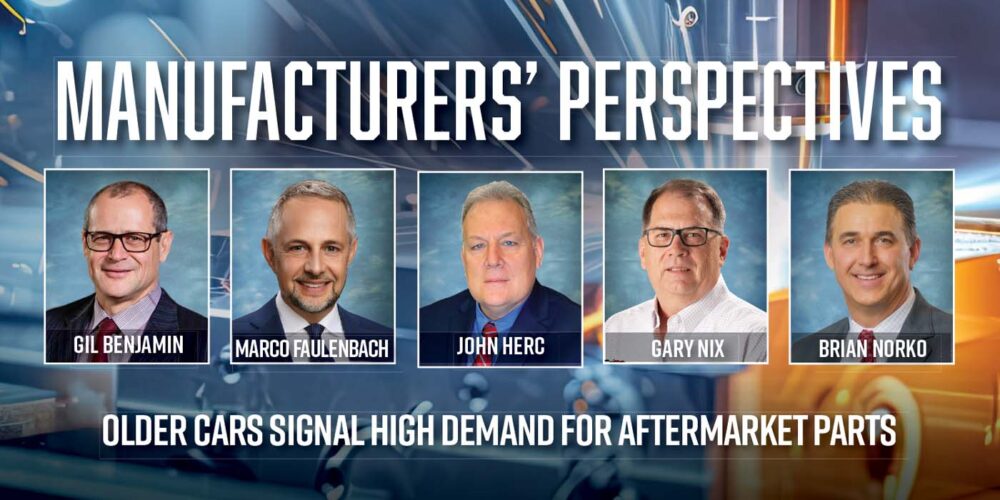

A new year brings new growth opportunities, and according to several parts manufacturers, 2024 is showing positive signs. Vehicle miles driven is up, which means cars need more maintenance—that means replacement parts. The average price of new cars has increased, meaning drivers will be holding onto their vehicles longer. With the average vehicle age at 12 years, opportunities for replacement part sales and tweaking the coverage, ordering and distribution of them abound for manufacturers and all stakeholders in the automotive aftermarket.

With these tailwinds, we asked parts manufacturers in the automotive aftermarket to give us an update on certain aspects of their businesses and what they’re expecting for 2024 and beyond.

Gary Nix, President, AP Emissions Technologies

AMN: What are your thoughts on the aftermarket business environment for 2024?

Nix: Overall, the aftermarket business environment will likely continue to be challenging but also full of opportunities. We are extremely optimistic at AP Emissions about our industry in 2024 and feel like we are well-positioned for growth. Rising vehicle age and VIO counts are all factors that are favorable to our business. With the average age of vehicles now over 12 years old, we are seeing multiple exhaust and converter replacements. New-car shortages, uncertain lead times and costly financing concerns are causing people to hold onto their existing vehicles for longer periods, resulting in necessary repairs and system upgrades.

AMN: Tell us about how AP Emissions is using data to improve its manufacturing and fill rates?

Nix: High-quality data is extremely important in every area of our business from production optimization, inventory planning and management to innovation. At our catalyst coating facility for our Aristo brand, data is used to drive every aspect of the operation. The science behind the product is based on R&D efforts that pour volumes of data into the system, driving formulation technologies, production forecasting, supply chain needs, production, laboratory testing, quality control and the delivery of high-quality products on time to our customers. Data is constantly analyzed by our teams in real time to identify process efficiencies. The same goes for our other exhaust production sites at AP, Catco and Eastern.

Besides the production operations, AP is focused on inventory management, which relies almost exclusively on our demand planning and forecasting systems. Again, all driven by data from a variety of sources including historical sales data, market trends, weather patterns, OE failure rates and even theft data as in the recent case with catalytic converters to forecast demand. This information helps them optimize their inventory levels and minimize the risk of stockouts or overstocking.

AMN: What are your company’s priorities/focus areas for 2024?

Nix: Our priorities in 2024 are very clear. Our company is focused on giving our customers market-leading new product offerings, the highest quality in customer service and order fill, supported by a comprehensive focus on deploying transformative lean manufacturing and automation strategies. We will continue our journey to control costs with a focus on energy-efficient and sustainable practices. AP will continue to enhance and leverage data to gain deeper insights into consumer behavior, market trends and operational efficiency, all while doing what is right for our employees, our customers and our supplier partners.

Marco Faulenbach, Senior Vice President, Americas, Automotive Aftermarket, MANN+HUMMEL

AMN: Tell us about the company’s emission-neutral driving advancements over the past year.

Faulenbach: MANN+HUMMEL has a variety of products and solutions for emission-neutral vehicles, with solutions ranging from battery electric to hydrogen-powered vehicles. While experts aren’t sure what technology will prevail, we know for sure that filtration will be needed! We are continuing to invest heavily into research and new technologies, as we are committed to protecting machinery, people and the planet through filtration.

We must remember that when talking emission-free driving, we must not only focus on the powertrain. Only 15% of a vehicle’s emissions are from the tailpipe. That leaves 85% of emissions coming from other factors, including brake dust, tire abrasion, etc. That’s why we develop products like our brake-dust particle filter and integrated fine-dust filters for cleaner mobility. There are also other filtration solutions within an alternative-drive vehicle that are being developed by our team – products like filtration and separation solutions for battery and hydrogen systems, e-axles, transmissions, coolant-particle filters and a variety of other filtration and membrane solutions.

We recently introduced our smart cabin air filter systems with HEPA filters to remove 99.95% of pollutants from the vehicle cabin. Our new cyclo-multi-sorber system improves cabin air quality by using granulate adsorbers to regulate the H2O and CO2 concentration in the passenger compartment. Intelligent control strategies and optimum air regulation of the vehicle cabin can save energy and extend range, especially in battery-electric vehicles.

AMN: What are your thoughts on the aftermarket business environment for 2024?

Faulenbach: We are excited about the potential of the aftermarket in 2024. As the aftermarket continues to grow in dollars, automotive unit sales are showing a rebound throughout 2023. For us in the category of filtration, unit sales are increasing year-over-year. Economic predictions for 2024 are positive, the U.S. vehicle population continues to age and scrappage rates are low. With all these indicators, we at MANN+HUMMEL are anticipating a positive 2024 for our industry.

We are very proud that our Purolator team has just wrapped up its 100th year in business in 2023 and is moving into the next century with pride and ambition. In 2024, WIX Filters will celebrate its 85 years as a leader in filtration. Last but not least, MANN-FILTER, our European premium import brand, celebrates 70 years! We are proud of these incredible milestones and will support the continued development of these brands for generations to come.

AMN: What are your company’s priorities/focus areas for 2024?

Faulenbach: MANN+HUMMEL will continue our evolution and transformation for the future, continuing our focus on three key areas to guide our company to stay focused and prioritized in our actions. Our three transformation drivers are mobility, digitalization and sustainability. Our mobility driver highlights our transformation towards cleaner mobility. Through an intense focus on digitalization, we will embrace the future through the digitalization of our products and solutions, through our processes and R&D, as well as the digitalization of our customer interface. Finally, our sustainability driver enables our customers to be more sustainable while increasing sustainability actions in our daily work. In 2024, these key areas will continue to be the cornerstones of our endeavors.

In the Americas region, you’ll see us continue to invest in our infrastructure to support the growth and development of our business – and that of our customers. We are always focused intently on the introduction of new parts to increase coverage in both light-duty and heavy-duty markets. You’ll also see us doing more to support our customers’ sustainability goals – and how that will require filtration. MANN+HUMMEL will continue to solidify our position in making the world a cleaner place through our filtration products, solutions and services.

Brian Norko, Senior Vice President, Commercial Business Operations, Niterra

AMN: In our April 2023 cover story, Niterra executives said the company will expand its core ceramic technologies and explore its capabilities beyond traditional areas of business. In what ways will Niterra act on this in 2024?

Norko: Niterra has identified four focus areas: environment and energy, mobility, medical and communications. We will explore new business opportunities that align with our core ceramics technology and leverage our strengths in these areas. Our goal is to create new businesses that are sustainable and profitable. At the same time, we remain open to other business areas and will adapt our technology to new fields that align with our focus areas.

We will ensure that any further pursuit aligns with our existing focus fields.

AMN: What are your thoughts on the aftermarket business environment for 2024?

Norko: We’re optimistic with gas prices decreasing, strong miles driven and vehicles in the aftermarket averaging over 12 years old. Positive indicators and replacement parts add to our positive outlook.

AMN: What are your company’s priorities/focus areas for 2024?

Norko: We must continue to promote our new company, Niterra, to showcase our direction and plans. Niterra is committed to contributing to the global environment while creating a linkage to our well-known and trusted product brand names.

We aim to strengthen and expand our leading position in the automotive industry. We plan to achieve this by developing and growing the ICE business with our newest product lines, NGK ignition coils and NTK technical sensors, while continued growth in NGK spark plugs and NTK oxygen sensors. Furthermore, we aim to strengthen our presence in North America by optimizing our business areas across the United States, Canada and Mexico, contributing to a more substantial Niterra global presence.

John Herc, Vice President of Marketing, Vehicle Control Division, Standard Motor Products

AMN: SMP recently announced a product expansion focused on powertrain-neutral categories. What categories are being expanded, and why is the focus on powertrain-neutral products?

Herc: “Powertrain neutral” emerged from ongoing discussions with our distribution partners, who often asked us, ‘What do you have for hybrid and electric vehicles?’ While we offer thousands of parts for these vehicles, many are not exclusively tied to the powertrain. Notably, zero-emission vehicles share commonalities with traditional internal combustion engine (ICE) vehicles, such as ABS speed sensors, ADAS components and blower motor resistors. Despite advancements in vehicle propulsion, OE vehicle manufacturers continue to leverage the traditional 12-volt battery system, even on fully electric vehicles.

As we communicate our marketing messaging about our product offering, we point out that around half of our current product lineup is “powertrain neutral.” Interestingly, several technologies initially developed to enhance the efficiency of ICE vehicles are transitioning to electric vehicles. Features like active grille shutters, once exclusive to ICE vehicles, are now integral to improving efficiency and temperature management in EVs. Initially designed for smaller turbocharged engines with limited vacuum production, electronic vacuum pumps have found a home in EVs that produce no vacuum. Similarly, electrical AC compressors, utilized in modern ICE vehicles for enhanced fuel economy, seamlessly integrate into EVs, and the rest of the HVAC system remains unchanged regardless of the powertrain.

Products like electronic parking brakes, introduced as part of a vehicle’s advanced safety system, are now becoming standard across all vehicles, irrespective of powertrain. Recognizing the rising adoption rates of these technologies by OEs, we are committed to highlighting and expanding these “powertrain-neutral” categories. We aim to ensure that our distribution partners can capitalize on sales opportunities in these segments as they grow.

AMN: What are your thoughts on the aftermarket business environment for 2024?

Herc: Core fundamentals of the aftermarket remain strong and are forecasted to grow. Miles driven has rebounded, the average age of the vehicle is up, and as people are not yet purchasing new vehicles at pre-pandemic levels. This will continue to be a tailwind for our industry. Nevertheless, challenges persist, notably the impact of higher interest rates.

AMN: What are your company’s priorities/focus areas for 2024?

Herc: In 2024, our strategic focus is set to sharpen as we refine our manufacturing capabilities and improve our distribution footprint. We are committed to fostering stronger partnerships with our distribution partners as we develop existing product categories and ensure we introduce new product categories our customers can sell. Our category management capabilities are exceptional, and we aim to collaborate closely with our distribution partners to ensure they maintain optimal inventory levels to meet current and future demand.

Additionally, we are dedicated to providing them with comprehensive marketing and communication materials, equipping them to promote our products effectively. Another key priority is ensuring professional technicians are trained to tackle advanced vehicle systems. Our commitment to knowledge transfer is evident in the ongoing expansion of our Pro Training Classes library. Notably, last year saw the launch of our Pro Training Power Hour—a live, complimentary training session tailored for technicians and future technicians.

Gil Benjamin, CEO & President, US Motor Works

AMN: Give us an update on USMW’s newest fulfillment center in Kansas City. How does this center fit into the company’s overall growth strategy?

Benjamin: Our brand-new Liberty, Missouri, fulfillment center is fully functional and running at capacity as of Dec. 1. The Liberty facility will allow US Motor Works to centralize distribution, expand capabilities and speed up delivery times.

Being centrally located in the USA, and specifically in the Kansas City area, we are three days away from 90% of anywhere in the country by truck. This new fulfillment center will not only allow us to serve our customers better, but it will also allow our products and brands to continue growing without space limitations.

AMN: What are your thoughts on the aftermarket business environment for 2024?

Benjamin: Last year was an exciting year at US Motor Works and we are optimistic that 2024 will be another successful year for our company.

We do expect the automotive aftermarket environment for 2024 to remain steady despite the current world turmoil. We believe there will be a continued dip in new-car sales, which will continue to increase the average age of vehicles on the road in the U.S., currently at 12.5 years.

AMN: What are your company’s priorities/focus areas for 2024?

Benjamin: As US Motor Works enters its 29th year in the automotive aftermarket, the team will continue to focus on the expansion of our new facility. With the purchase of our Missouri fulfillment center, our 2024 focus will be to strategically fill this facility with products to better serve our growing customer base. US Motor Works will also focus heavily on improving the overall customer experience, which includes expanding the current product offerings, sustaining high fill rates and expanding operations to maintain our expected on-time delivery expectations.