Lear Corp., a global automotive technology leader in seating and electrical and electronic systems, has revised its full year 2019 financial outlook and reported preliminary second quarter 2019 results.

The company indicated that its financial results in the first half of 2019 were negatively impacted by continued declines in industry production volumes and other macroeconomic headwinds, including continued weakening of global currencies against the U.S. dollar.

“Previously, we indicated that we anticipated an increase in industry production volumes in the second half of the year and an associated improvement in sales and earnings. We now believe general macroeconomic and industry factors will continue to put pressure on sales and earnings throughout the remainder of 2019,” said Ray Scott, Lear’s president and CEO. “We are aggressively responding to the current environment. We have already undertaken significant restructuring actions and are currently developing a comprehensive operational and organizational plan designed to further reduce costs and improve profitability. We intend to increase our 2019 restructuring program to $200 million. The additional $60 million in restructuring cost is intended to reduce capacity, improve our manufacturing footprint and organizational efficiency, and position our business for continued success in the future. We look forward to providing additional detail on our restructuring program and our operational and organizational plans more broadly on our second quarter earnings call later this month.”C

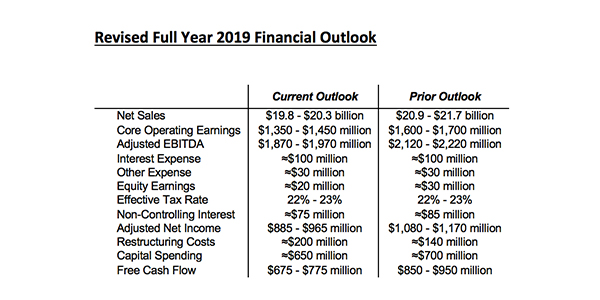

The assumptions underlying Lear’s current 2019 financial outlook are derived from several sources, including internal estimates, customer production schedules and the most recent IHS production estimates for Lear’s vehicle platforms. The 2019 outlook assumes an average full year exchange rate of $1.12 for the Euro and 6.85 RMB/$.

At the midpoint of Lear’s current 2019 outlook, sales are expected to be $20.1 billion, down 5% from 2018. Excluding the impact of foreign exchange and acquisitions, sales are expected to be down 2% year over year, reflecting lower production on key Lear platforms, partially offset by the addition of new business.

Core operating earnings at the midpoint of Lear’s current 2019 outlook are expected to be approximately 7% of sales compared to 8.3% of sales in 2018. The margin decline results primarily from the decrease in sales, which is partially offset by favorable operating performance. Adjusted margins in the Seating segment are expected to be approximately 8%. Adjusted margins in the E-Systems segment are expected to be in the mid-8% range, including the impact of the Xevo acquisition.

Preliminary Second Quarter 2019 Results

Lear expects second quarter sales to be approximately $5 billion, down 10% from 2018 (down 7% excluding the impact of foreign exchange and acquisitions), and core operating earnings to be approximately 7% of sales. Adjusted margins in Lear’s Seating and E-Systems segments are expected to be approximately 8.2% and 8% (including the impact of the Xevo acquisition), respectively.

According to Lear, the Seating division performed well in the quarter against a challenging macroeconomic backdrop, with second quarter margins expected to exceed first quarter margins by approximately 60 basis points. As anticipated and communicated on Lear’s first quarter earnings call, E-Systems’ margins in the second quarter were lower than in the first quarter due primarily to lower volumes on key programs. Incremental investments, including the decision to execute certain strategic commercial agreements that support growth, also affected segment margins.

In the second quarter of 2019, Lear expects free cash flow to be approximately $265 million and share repurchases to total approximately $160 million.