SOUTHFIELD, Mich. — Federal-Mogul Corp. has reported higher sales, gross margin, net income and EBITDA for the fourth quarter and full-year 2010. The company’s sales in the fourth quarter increased $180 million to $1.6 billion with growth in all business segments and all markets, led by a 20 percent OE and 12 percent U.S. aftermarket sales increase versus fourth quarter 2009.

Full-year revenue of $6.2 billion represents an increase of $889 million or 17 percent, driven by a 32 percent constant-dollar increase in sales to original equipment customers and a 2 percent increase in global aftermarket revenue, before the impact of Venezuelan currency restrictions. Gross margin of more than $1 billion in 2010, an improvement of $215 million or 27 percent, and EBITDA of $671 million, an improvement of $168 million or 33 percent, was the result of increased sales and higher conversion of incremental revenue to profit, the company said.

The company’s net income in the fourth quarter was $45 million or 45 cents per share, beating analyst consensus estimates. Net income for 2010 was $161 million, a $206 million improvement compared to full-year 2009. Cash flow for 2010 remained strong at $231 million before funding $55 million in pension contributions and the $39 million acquisition of the Daros Group.

Federal-Mogul reported fourth quarter 2010 sales of $1.6 billion versus $1.4 billion in the fourth quarter of 2009. All business segments reported year-over-year sales increases and continued to strengthen the company’s market position in the fast-growing BRIC markets. The company further diversified its global sales base in the fourth quarter, with revenue coming from markets outside the U.S., Canada and Europe representing 19 percent of total revenue versus 17 percent during the same period in 2009.

Annual sales increased by $889 million, or 17 percent, to more than $6.2 billion in 2010 compared to $5.3 billion in 2009, demonstrating strong customer demand for Federal-Mogul’s leading products that improve fuel economy, reduce emissions and enhance vehicle safety. The company’s sales improved in all business segments and core markets for 2010 versus 2009.

The company’s 2010 global OE constant dollar sales growth was 32 percent in light and commercial vehicle markets. Sales in the U.S. in 2010 were up 41 percent, while in Europe, Federal-Mogul’s OE sales increased by 23 percent. Federal-Mogul OE sales in the BRIC markets increased 44 percent with sales in China up 60 percent, India up 28 percent, Russia up 226 percent and Brazil up 22 percent.

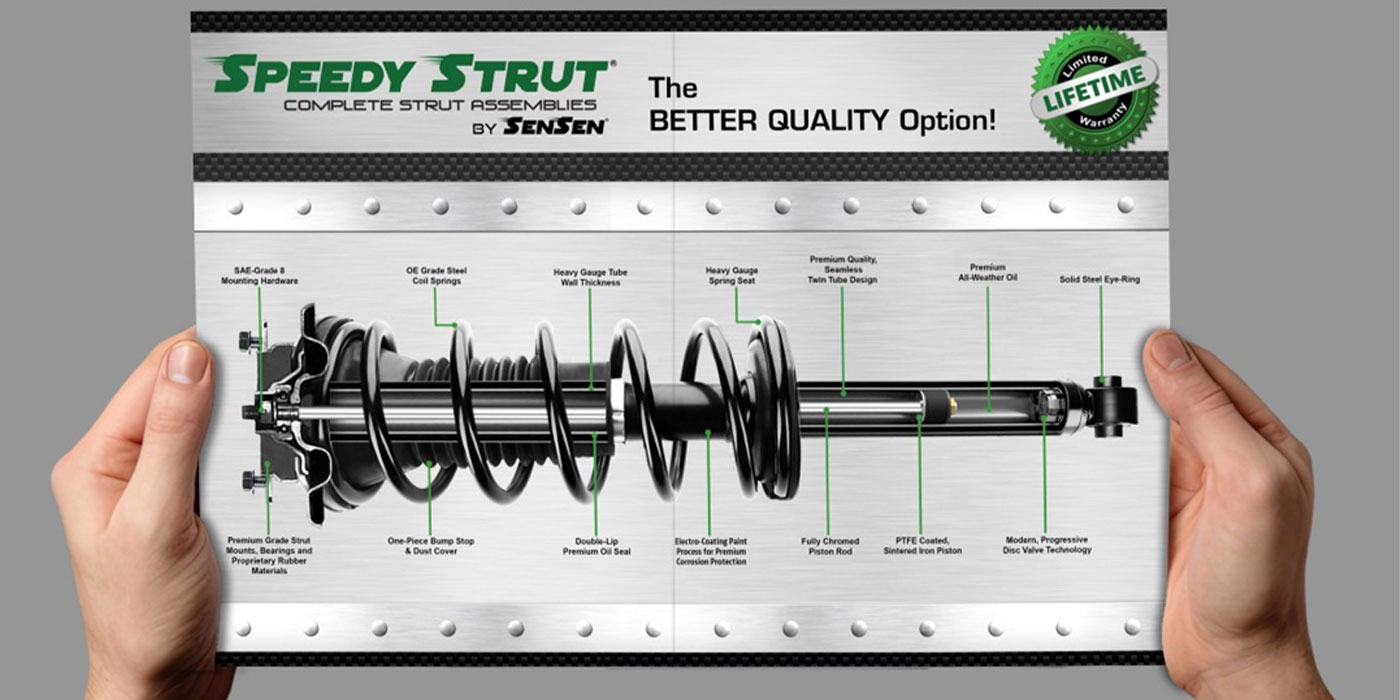

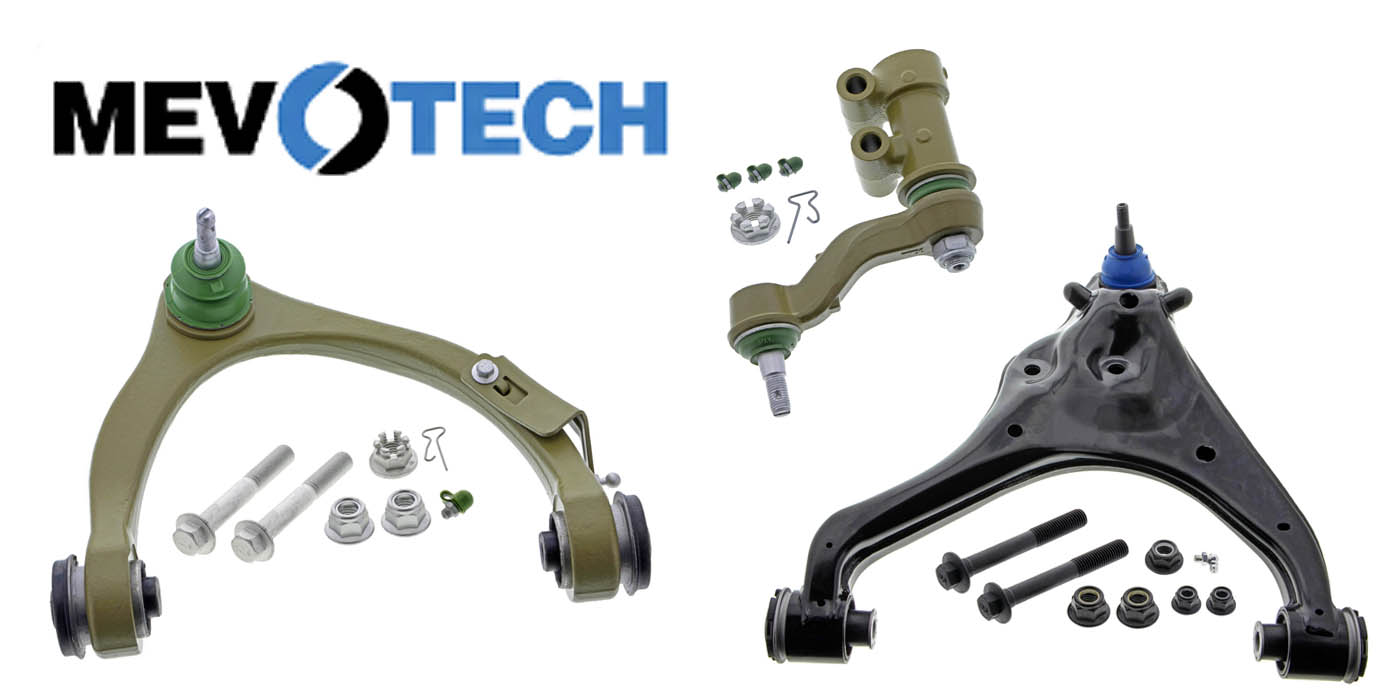

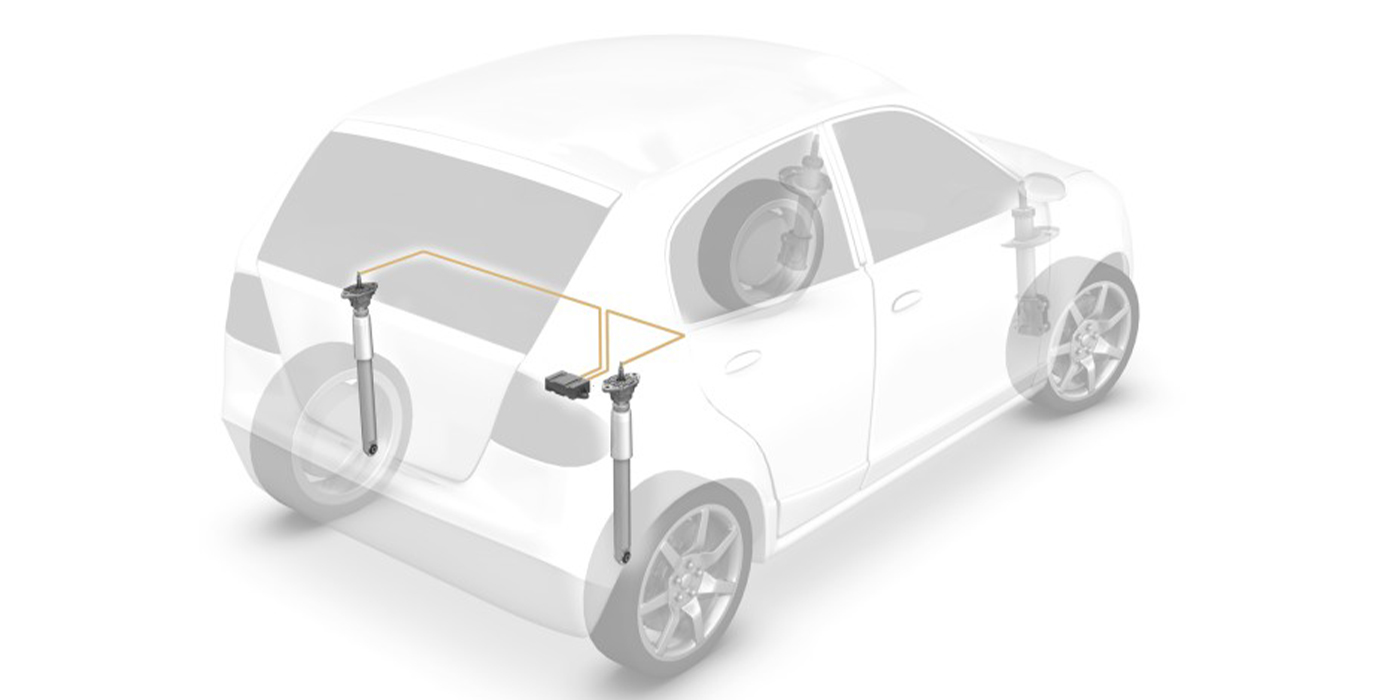

The company’s global aftermarket sales grew 2 percent in 2010, excluding reduced sales in Venezuela due to currency restrictions. Total aftermarket sales in North America were higher by 1 percent in 2010 and 10 percent during the fourth quarter, while in Europe sales were up 9 percent in 2010 and 12 percent for the fourth quarter of 2010. In the BRIC markets, Federal-Mogul aftermarket sales in full-year 2010 increased 10 percent with China up 18 percent, India up 9 percent and Russia up 31 percent. The company in the fourth quarter introduced new braking, suspension and filtration product lines, expanding the product offerings in its Wagner, MOOG and Champion brands. Federal-Mogul also expanded aftermarket sales and distribution channels in 2010, especially in BRIC markets where the high automotive market growth rates are creating an expanded car parc and therefore new aftermarket growth opportunities.

Gross margin in 2010 was more than $1 billion or 16.2 percent of sales, a $215 million or 27 percent improvement over the same period of 2009. Federal-Mogul’s higher gross margin demonstrates the company’s ability to respond to higher demand by leveraging its lean infrastructure. Gross margin was $240 million in the fourth quarter of 2010, a $15 million improvement versus $225 million in the same period of 2009.

The company reported improved fourth quarter net income of $45 million or $0.45 earnings per share (EPS), up from $43 million or $0.43 EPS in the fourth quarter of 2009. The company’s net income in 2010 rose significantly to $161 million or $1.62 earnings per share versus a loss of $(45) million for 2009, an improvement of $206 million, with the impact of improved sales and higher conversion of incremental revenue into profit through efficient cost structure management.

Operational EBITDA in the fourth quarter was $170 million versus $162 million in the same period of 2009. Full-year operational EBITDA increased by $168 million or 33 percent to $671 million or 11 percent of sales versus $503 million or 9 percent of sales in full-year 2009. The company’s EBITDA improvement was driven by stronger volumes and market share gains in all regions combined with higher operating efficiency throughout the company’s global business.

Cash flow in 2010 was a very solid $231 million before the company’s $55 million pension contributions and $39 million acquisition of the Daros Group, which compares very favorably to full-year 2009 cash flow of $173 million. The company generated strong cash flow in every quarter of 2010, while increasing investments in market growth, R&D spending and capital equipment expenditures.

"The strong fourth quarter and full-year 2010 sales and financial performance demonstrate our ability to grow faster than the markets and convert incremental revenue into solid profitability," said President and CEO Jose Maria Alapont. "The company continued to generate strong cash flow in 2010, which enabled Federal-Mogul to invest in sustainable global profitable growth initiatives to enhance our OE and aftermarket portfolio through internal development and acquisitions, while also funding pension obligations," he explained.

Selling, general and administrative (SG&A) expenses further improved to 10.6 percent of sales in the fourth quarter, demonstrating the efficiency of the company’s lean SG&A structure. Full-year SG&A expenses improved to 11.0 percent of sales in 2010 from 12.9 percent of sales in 2009. This helped to off-set additional investment in research and product development to address current market challenges in fuel efficiency, emissions reduction and vehicle safety without increasing SG&A as a percent of sales.

The company continued to introduce new products in 2010 with multiple leading technologies designed to improve fuel economy and reduce emissions by enhancing power cylinder efficiency, enabling higher operating loads and enhancing vehicle performance and safety. Notable examples include the PACE award-winning DuraBowl piston, plus EcoTough-coated pistons, LKZ piston rings, MicroTorq shaft seals, IROX engine bearings and many others. The company’s technology pipeline continues to deliver leading innovations, for example, the all-new Advanced Corona Ignition System (ACIS), a major breakthrough technology for fuel economy and emissions reduction.

The Federal-Mogul-developed ACIS is designed to provide higher energy ignition capability than a conventional ignition coil and spark plug design. This high efficiency ignition will enable advanced lean combustion strategies, resulting in significant improvement in fuel economy and reduced emissions, while the optimized design provides ease of installation in current and new engine architectures, facilitating rapid implementation into high-volume production.

Federal-Mogul maintains $1.6 billion of liquidity with over $1.1 billion of cash and an unused revolver of $0.5 billion. The company internally funded research and development, pension contributions, capital expenditures and an acquisition while generating strong cash flow from operations.

"Our performance throughout 2010 is indicative of the effectiveness of Federal-Mogul’s sustainable global profitable growth strategy. The global vehicle market is forecasted to grow from about 75 million units in 2010 to 104 million units by 2015," said Alapont. "During this period, in response to customer and regulatory demands, the global vehicle manufacturers are expected to increase spending on technology to improve fuel economy, reduce emissions and improve vehicle safety. The rising industry volumes, major growth in emerging markets and Federal-Mogul’s leading technology and innovation in core products to address customer and market needs provide very favorable opportunities for Federal-Mogul."

"We remain optimistic that the global markets will keep strengthening in 2011 and beyond, and we are well-positioned to introduce innovative OE technologies and further develop leading aftermarket brands to capitalize on global profitable growth opportunities to exceed the market rates," Alapont concluded.