EVANSVILLE, Ind. – Accuride Corp., a leading supplier of components to the commercial vehicle industry, has reported its financial results for the fourth quarter and fiscal year ended Dec. 31, 2011.

Accuride says it achieved fourth quarter 2011 net sales from continuing operations of $242.5 million, compared with $175.7 million in the same period in 2010, an increase of 38 percent, with each business segment posting double-digit gains.

Net income for the quarter was $4.1 million, while adjusted EBITDA was $24.3 million, an increase of $11.9 million, or 96 percent, over the fourth quarter of fiscal year 2010.

“Increasing production volumes, driven by rapidly recovering Class 8 truck and trailer demand, helped drive our fourth quarter performance and gave us solid momentum going into 2012,” said Accuride President and CEO Rick Dauch. “The increased demand had the greatest impact on the performance of our Accuride Wheels business and validates our decision to expand our aluminum wheel capacity. In addition, our margins are beginning to reflect the impact of greater operating efficiencies and working capital performance as we execute our ‘Fix and Grow’ strategy.”

Net sales from continuing operations for the fiscal year ended Dec. 31, 2011, were $936.1 million, compared with $674 million in the prior year, an increase of 38.9 percent. The sales growth resulted from the continued strong demand from the company’s commercial vehicle customers, as well as the benefits of increased pricing in the company’s Gunite and Brillion businesses.

The company reported a fully diluted loss per share of 36 cents for the year. Included in the loss per share was 30 cents related to losses recognized as part of the sale of assets of the company’s Fabco Automotive and Bostrom Seating businesses, and acquisition costs related to the assets in Camden, S.C.

“2011 represented a year of transformation for Accuride,” Dauch said. “Our new leadership team has developed and is executing a ‘Fix and Grow’ strategy aimed at restoring our reputation as a dependable supplier to our customers and as a reliable, profitable investment for our shareholders. In an effort to increase our focus on our core wheel and wheel-end systems businesses, we divested non-core businesses and acquired new aluminum wheel production capacity in Camden, S.C. We also developed and began the execution of a two-year, $110 million capital investment program to restore operational excellence in our core businesses. This means that we will have production capacity available where and when our customers need it, using more standardized processes to achieve higher levels of product quality and reliability.”

“With the restructuring efforts to fix the business that we initiated in 2011 setting the stage, 2012 becomes a year of execution for the Accuride team,” Dauch added. “Because the commercial vehicle market is projected to continue growing through 2014-2015, our work this year focuses on executing the plans that will enable us to capitalize on rising market demand. Our highest priorities are completing Gunite’s operational turnaround, successfully launching the additional aluminum wheel capacity, improving Imperial’s operating performance, and implementing common LEAN Manufacturing systems companywide. In addition, we will target additional cost reductions and working capital improvements by fully revamping our supply chain, which today represents more than half of our cost of goods sold.”

New CFO Greg Risch stated, “We are projecting 2012 net sales to be in the range of $1,000 to $1,025 million, and fully diluted earnings per share to be in the range of $0.07 to $0.15. We expect Adjusted EBITDA to be in the range of $100 to $105 million for the year. Our ‘Fix and Grow’ strategy is focused on serving the North American commercial vehicle market in a cost-effective manner, while creating sustainable improvements in quality and delivery.”

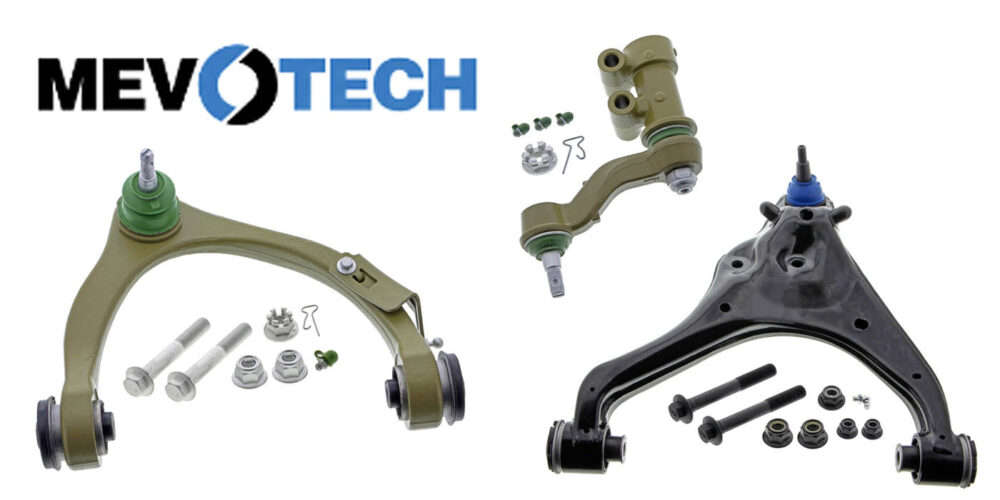

Mevotech Expands Coverage with 188 New Part Numbers

The release covers domestic and import passenger vehicles, pickup trucks, vans, SUVs and EVs, up to the 2023 vehicle model year.

Mevotech announced the addition of 188 new part numbers, expanding its TTX, Supreme and Original Grade product catalogues. Extending up to the 2023 vehicle model year, this release covers domestic and import passenger vehicles, pickup trucks, vans, SUVs and EVs.

The new part numbers include control arms for newer 2023-2021 Ford F-150 and F-150 Lightning models from Mevotech’s flagship TTX and Supreme lines. “These components are designed with exclusive features for improved part service life and increased overall durability,” Mevotech said.

MAHLE Finalizes Sale of its OEM Thermostat Business

As part of the transaction, ADMETOS is taking on around 600 employees in six countries.

ZF Aftermarket Releases 36 New Parts for US, Canada

ZF has introduced a total of 185 new products in 2024 under the ZF, LEMFÖRDER, SACHS, TRW and WABCO brands.

Dana Expands Spicer ReadyShaft Assembly Coverage

The addition of more than 3,000 new part numbers brings Dana’s ReadyShaft program

to over 13,000 active SKUs.

Litens Aftermarket North America Elevates Sustainability Efforts

Litens said it is dedicated to achieving carbon neutrality by 2030.

Other Posts

HELLA Introduces HELLA BLADE LED 6” Series Auxiliary Lights

The HELLA BLADE Series combines powerful illumination with innovative features for the ultimate driving experience, the company said.

Transtar Announces Agreement for Axalta to Acquire The CoverFlexx Group

Axalta Coating Systems has signed a definitive agreement to acquire Transtar Holding Company’s subsidiary The CoverFlexx Group.

Bendix: Air Disc Brake Production has Doubled Since 2018

Commercial ADB adoption rates in Class 6-8 vehicles are now up over 50%, according to Bendix.

MPA: ‘We’re as Strong as Ever’

Chairman, President and CEO Selwyn Joffe discusses what he’d like the aftermarket to know about Motorcar Parts of America.