BETHESDA, Md. and RESEARCH TRIANGLE PARK, N.C. – The U.S. automotive aftermarket is expected to grow on a compound annual growth rate (CAGR) of 3.4 percent until 2017, according to the “2014 Joint Channel Forecast Model” produced jointly by the Automotive Aftermarket Suppliers Association (AASA) and the Auto Care Association.

The 2014 Joint Channel Forecast Model also predicts that total aftermarket sales will grow from $238.4 billion in 2013 to $273.4 billion in 2017, an increase of $35 billion over the four-year period.

“The forecast model demonstrates that despite strong new vehicle sales, historic high gas prices and a flattening of miles driven, our industry is poised for steady growth,” said Kathleen Schmatz, Auto Care Association president and CEO. “Why? The average age of vehicles is 11.4 years, the oldest ever, and the age mix of vehicles continues to favor older vehicles, creating a robust sweet spot for service and repair.”

“The forecast model anticipates that growth in population, employment and income will lead to an increase in miles driven and the number of vehicles on the road resulting in long-term aftermarket growth,” said Bill Long, AASA president and COO. “The Channel Forecast Model is a tool to help participants achieve that growth despite some of the major market shifts facing our industry such as vehicle telematics, increasing vehicle technology, new-model introductions and parts proliferation.”

The market sizing and forecast is conducted on behalf of AASA and the Auto Care Association by IHS – driven by Polk, the renowned economic and market information firm. It is based on the U.S. Census Bureau’s Economic Census, IMR and Polk data, and proprietary IHS economic analysis and forecasting models.

The Joint Channel Forecast Model is available at the AASA website, www.aftermarketsuppliers.org, and in the Auto Care Association’s 2015 Digital Auto Care Factbook, available at www.autocare.org.

Auto Parts 4 Less Announces Investment from RB Capital

Auto Parts 4 Less announced it has completed the first tranche of funding from RB Capital Partners.

Auto Parts 4 Less announced today it has completed the first tranche of funding from RB Capital Partners, following the successful restructuring of its balance sheet, ahead of its returning to the auto parts industry.

RB Capital, under the leadership of Brett Rosen, has agreed to invest in Auto Parts 4 Less Group Inc. This collaboration is expected to provide the necessary resources for the company to achieve its strategic objectives and continue its growth trajectory, the company said.

Advance Auto Parts Reports Q4, Full Year 2023 Results

President and CEO Shane O’Kelly said Advance continues to act with a sense of urgency to “return to profitable growth.”

AutoZone Reports Q2 Results with Increases in Same Store Sales

During the quarter, AutoZone opened 19 new stores in the U.S., while adding six new stores in Mexico and four in Brazil.

Dana Inc. Reports 2023 Record Sales and Q4 Earnings

For the full-year 2023, Dana reported sales of $10.6 billion, up from $10.2 billion in 2022.

LKQ Corp. Announces Q4, Full Year 2023 Results

President and CEO Dominick Zarcone expressed satisfaction with the company’s results amid macroeconomic challenges.

Other Posts

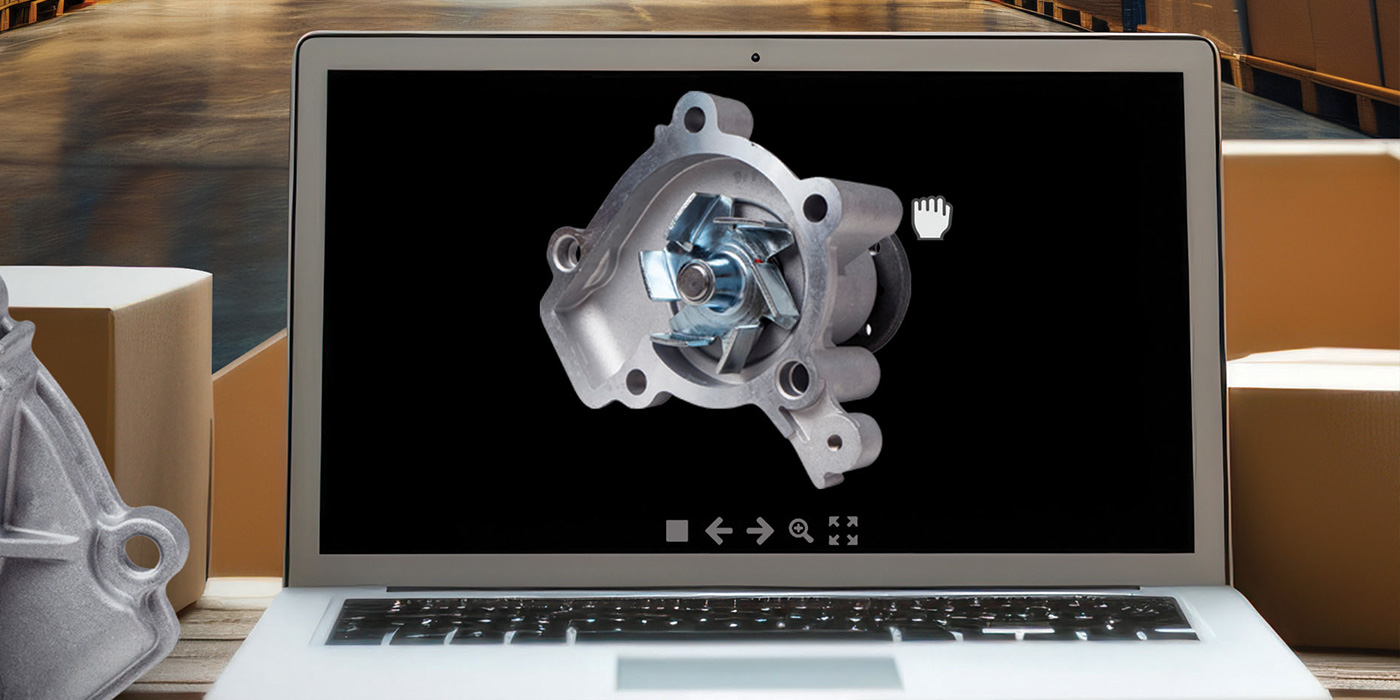

360-Degree Imagery: A Picture Is Worth a Thousand Words

Captivating imagery takes auto parts sales to new heights.

Standard Motor Products Releases Q4, 2023 Year-End Results

Eric Sills, chairman and CEO, said the company is looking to continue to find ways to better service customers and explore opportunities to partner for growth in 2024.

Phinia Reports Q4 Results & 2024 Outlook

Phinia reported that it expects strong earnings and cash generation in 2024, driven by operational efficiencies, and growth in aftermarket sales.

GPC Delivers on 2023 Financial Goals

GPC reported mid-single-digit total sales growth and its third consecutive year of double-digit earnings growth.