EDITOR’s NOTE: Please check back as this story will be updated.

Tenneco has signed a definitive agreement to acquire Federal-Mogul, a leading global supplier to OEMs and the aftermarket. Federal-Mogul is being acquired from Icahn Enterprises L.P. for a total consideration of $5.4 billion to be funded through cash, Tenneco equity and assumption of debt.

Tenneco has signed a definitive agreement to acquire Federal-Mogul, a leading global supplier to OEMs and the aftermarket. Federal-Mogul is being acquired from Icahn Enterprises L.P. for a total consideration of $5.4 billion to be funded through cash, Tenneco equity and assumption of debt.

Tenneco also announced its intention to separate the combined businesses into two independent, publicly traded companies through a tax-free spin-off to shareholders that will establish an aftermarket & ride performance company and a powertrain technology company.

The acquisition is expected to close in the second half of 2018, subject to regulatory and shareholder approvals and other customary closing conditions, with the separation occurring in the second half of 2019.

“This is a landmark day for Tenneco with an acquisition that will transform the company by creating two strong leading global companies, each in an excellent position to capture opportunities unique to their respective markets,” said Brian Kesseler, CEO, Tenneco. “Federal-Mogul brings strong brands, products and capabilities that are complementary to Tenneco’s portfolio and in line with our successful growth strategies. Unleashing two new product focused companies with even stronger portfolios will allow them to move faster in executing on their specific growth priorities.”

Carl Icahn, chairman of Icahn Enterprises, said, “Icahn Enterprises acquired majority control of Federal-Mogul in 2008 when we saw an out-of-favor market opportunity for a great company. During that time, we have built one of the leading global suppliers of automotive products. I am very proud of the business we have built at Federal-Mogul and agree with Tenneco regarding the tremendous value in the business combination and separation into two companies. We expect to be meaningful stockholders of Tenneco going forward and are excited about the prospects for additional value creation.”

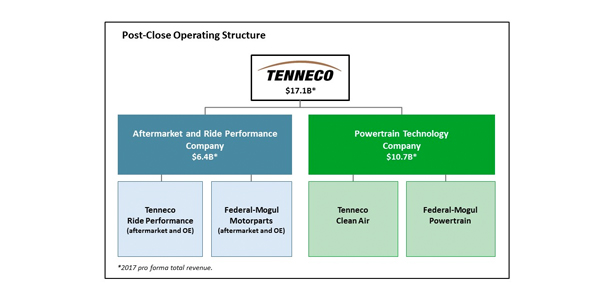

Post-Close Operating Structure

Upon completion of the acquisition, Tenneco will operate the combined businesses under a structure designed to begin concurrently the successful integration of Tenneco and Federal-Mogul and the separation of the aftermarket & ride performance and the powertrain technology companies.

Aftermarket & Ride Performance Company

The strategic combination of Tenneco’s Ride Performance business with Federal-Mogul’s Motorparts business will establish a global aftermarket leader with an impressive portfolio of some of the strongest brands in the aftermarket including Monroe, Walker, Wagner, Champion, Fel-Pro and MOOG. The company’s broader aftermarket product coverage, stronger distribution channels and enhanced channel development will strengthen its position in established and high-growth markets such as China and India, and drive success through new mobility models and capturing evolving e-commerce opportunities.

On the OE side of the business, the combination creates a portfolio of braking and advanced suspension technologies and capabilities that set the foundation for meeting changing performance requirements for comfort and safety and ultimately reinventing the ride of the future with new solutions for ride differentiation and capitalizing on electrification and autonomous driving trends.

Powertrain Technology Company

The powertrain technology company will be one of the largest pure play powertrain suppliers through the combination of Tenneco’s Clean Air product line and Federal Mogul’s Powertrain business, bringing together market leaders with reputations for innovation in meeting the changing needs of customers. The combined business will offer a robust portfolio of products and systems solutions – from the engine to the tailpipe – to improve engine performance and meet tightening criteria pollutant regulations and fuel economy standards. With its global scale, the company will drive content growth due to the demand for improved engine performance, tightening emissions regulations, light vehicle hybridization and expanded market opportunities with commercial truck and off-highway customers.

Strategic Rationale for Separated Companies

- Strategically positions each company: focused, purpose-built leaders in their respective markets with the strategic and financial flexibility to drive long-term value creation.

- Scales each company to win: size, broader product portfolios and greater capabilities to capitalize on industry trends unique to each.

- Enhances capabilities to capture growth with focused investments.

- Provides investors with distinct investment opportunities: two strong companies that have specific growth, capital deployment and product profiles.

“Today’s announcement is an extension of Tenneco’s proven strategies for delivering profitable growth and will accelerate each company’s ability to capitalize on trends that are fundamentally changing our industry,” said Gregg Sherrill, executive chairman, Tenneco. “This is a major step forward in building an even stronger position with the combination of strategically aligned companies and the subsequent separation of the businesses, realigned in such a way to unlock shareholder value.”

Summary Terms of Agreement

Tenneco will acquire Federal-Mogul for $5.4 billion through a combination of $800 million in cash, 5.7 million shares of Tenneco Class A common stock (representing a 9.9 percent voting interest), 23.8 million shares of Non-Voting Class B common stock and assumption of debt. Under the agreement, Tenneco can reduce the number of shares of Class B Non-Voting common stock by up to 7.3 million shares and increase the cash consideration proportionately at the closing.

Tenneco has put in place committed debt financing to fund the transaction, which will replace Tenneco’s existing senior credit facilities and certain senior facilities at Federal-Mogul.

Upon closing, Tenneco expects a pro forma net debt-to-adjusted EBITDA ratio of approximately 3x. The company is targeting a net debt-to-adjusted EBITDA ratio of approximately 2.5x by the end of 2019. Tenneco expects that the transaction will generate significant value for shareholders.

EDITOR’s NOTE: Please check back as this story will be updated.