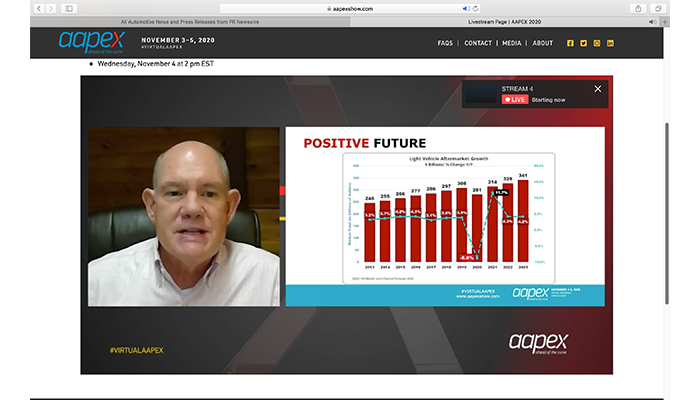

Bill Hanvey, president and CEO, Auto Care Association, and Paul McCarthy, president, Automotive Aftermarket Suppliers Association (AASA), opened the keynote session for the recent 2020 Virtual AAPEX Experience on Nov. 3, by outlining a positive outlook for the aftermarket. The theme of this year’s keynote was, “What to Expect on the Road Ahead.”

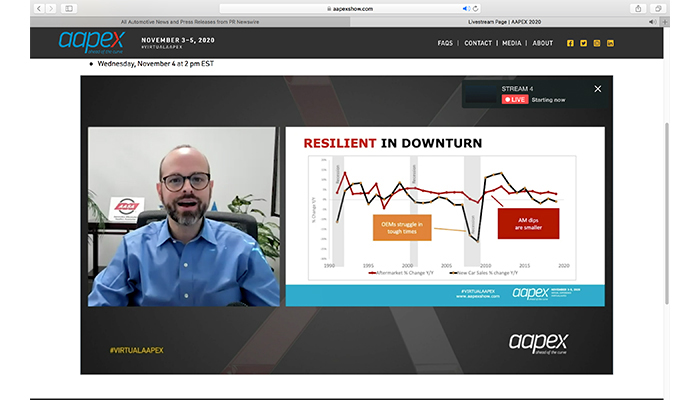

“Compared to new vehicles, compared to most other retail sectors, the aftermarket sees much more stable demand. We are essential and we’re a great market to be in, rain or shine,” said McCarthy. Hanvey added that the aftermarket is forecasted to grow 11.7% in 2021 and anticipated to reach a market size of $341 billion in 2023.

The two leaders also discussed their respective association roles on several issues impacting the aftermarket today and in the years to come, such as the “Your Car. Your Data. Your Choice.” campaign, contributing to diversity and attracting talent to the industry. McCarthy noted that there are today some 135,000 open technician jobs.

“These positions are there waiting for talented individuals to pick us, to choose the aftermarket as an industry,” he said. “We have to open our arms and let them know that the automotive aftermarket is open, not just for business, [but also] for a career, for families, for a life well-lived. We have all of us gained so much from this fantastic industry and it’s our duty to welcome the diverse next generation of our industry. It’s our duty to make sure nothing stands in the way of the automotive aftermarket attracting the best talent out there, period,” said McCarthy.

The keynote session also included an esteemed panel of industry executives who shared their views on the outlook for the aftermarket in this time of uncertainty.

Greg Johnson, CEO, O’Reilly Auto Parts, noted that in his 39 years, he has seen the industry remain very consistent and resilient throughout various economic changes. “I remain very optimistic,” said Johnson. “The result of the softer car sales will help us; most people will continue to maintain their vehicles as opposed to buying new vehicles and I also see miles driven improving.”

From the manufacturer/supplier side, Duncan Gillis, CEO, BBB Industries, expects to see growth in aftermarket replacement parts. He said, “We are very bullish about 2021 … we’re fortunate that our industry is not like a lot of others. We are relatively recession-resilient, and we need to take advantage of that. We’re in a great position, let’s go drive some business.”

When asked if the aftermarket will see permanent changes as the result of COVID-19, Sue Godschalk, president, Federated Auto Parts, noted that the e-commerce segment has largely outperformed the rest of the aftermarket recently as consumers are opting for more online delivery due to brick-and-mortar closures and to limit exposure to the virus. “I believe online ordering will continue to increase … I also think we’ll see more automation in the manufacturing and distribution centers and warehouses and I believe it’s going to continue to be hard to find workers,” said Godschalk.

Eric Sills, CEO, Standard Motor Products, said, “We’re a very stable industry, so even something as dramatic and unprecedented as this pandemic, I don’t think it’s going to cause any stepwise permanent changes to our overall market and how business is done … There’s going to be some trends that either accelerate or decelerate, but no hard left turns as a result of this.”

Tom Greco, president and CEO, Advance Auto Parts, identified trends in the aftermarket that may have a mid-term impact for the foreseeable future, including that more people are repairing and maintaining their vehicles and more DIY, as well as the decline in people using mass transportation. “People will continue to order online and vehicle ownership is increasing in importance with people having more time to work on their cars,” said Greco.

Industry executives weighed in on the growth in omnichannel and e-tailing and how the pandemic has challenged their leadership skills. The panel also discussed what changes businesses made during the pandemic – employee safety protocols, for example – will stick around and which may not. Many agreed that while remote work was a benefit, they see most companies wanting to bring employees back into the workplace, with collaboration being a significant element to many corporate cultures.

Gillis also gave his thoughts on the virtual tradeshows and other virtual meetings and events that have taken place this year and where that trend is headed. Many agreed that the cost savings of cutting back on travel have been a positive, but nothing replaces face-to-face interaction.

“Tools are great short-term and they help to build a bridge,” he said. “I don’t know that they’re going to be a permanent solution. Companies have learned that some of the traveling and spending they were doing pre-COVID was not the best use of resources. I’ll be the first to admit that it was a great learning experience for our company, but there’s really no replacement for human interaction and building relationships. I would say that tradeshows will be back. They’ll probably be re-imagined a bit, but they’ll be back.”

AAPEX 2021 will return to the Sands Expo and Caesars Forum Conference Center in Las Vegas, Tuesday, Nov. 2, through Thursday, Nov. 4. AMN