In this installment of “The Pulse,” TLG Research looks at the economic trends influencing third quarter 2014 pricing changes for various parts and service categories. Here are TLG’s thoughts on the matter, including the continued impact of high unemployment, and strategies for pricing.

At the risk of sounding repetitive, high structural unemployment and underemployment continues to hamper growth. While the oft-reported U3 unemployment shows those actively seeking a job, the U6 is a better measurement in our opinion since it includes this group, the discouraged and no longer looking, part-time and underemployed who want full-time and more.

At the risk of sounding repetitive, high structural unemployment and underemployment continues to hamper growth. While the oft-reported U3 unemployment shows those actively seeking a job, the U6 is a better measurement in our opinion since it includes this group, the discouraged and no longer looking, part-time and underemployed who want full-time and more.

While the U3 is a much lower rate at 6.1 percent, the U6 for January was 15.8 percent. It is this U6 group that is not spending money. So, in essence, we do not have 1 in 6 people participating in our economy in a meaningful way currently.

Add this to the tougher credit standards, employers who have not grown businesses even as the sales have recovered for fear of the future and more, the inflationary pressure expected has not developed as quickly and as strongly as first thought.

What does all of this mean to us? Cut away the statistics and we see an economy that has a long way to go before wage demands reaches a place of driving pricing. As a result, the price changes we see are food costs, fuel costs and other essentials. More pressure on the consumer’s wallet.

With lowered demand for increased wages in order to hire and retain workers, except in key spots, any interest rate increase is bound to be rather minimal and in response to increased sales.

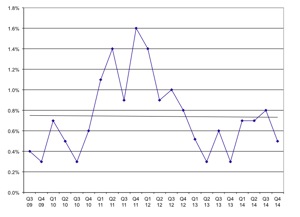

Our opinion is to continue planning a strategy of targeted, regular price increases. While it is understood that any change will be modest at best, when our staggering debt as a country and our easy money policies catch up, interest rate costs may well skyrocket. Think circa late 70s in to the early 80s. Better to have crept up on the increases than to have to come out bold all at once! You’ll look like a hero!

As we enter 2015, we are watching the many economic reports and they appear to be pretty much a big ditto to 2014 as long as the stock market holds and there are not sudden interest shocks, implications from the soft economies globally and sales of durables continue reasonably strong. However, there seems to be consensus on the part of many that there are some rather large looming risks for us this year into the next four or five. As one person put it, “Maximize margin and cash while controlling expenses like the roof falls in tomorrow and we’ll be ok.”

Who knows. However, I was never let down by my dad’s advice to save half of my money and stay out of debt!

Here’s to what is hopefully a great 2015 for all of us!

CLICK HERE to view TLG’s report from the prior quarter.

METHODOLOGY:

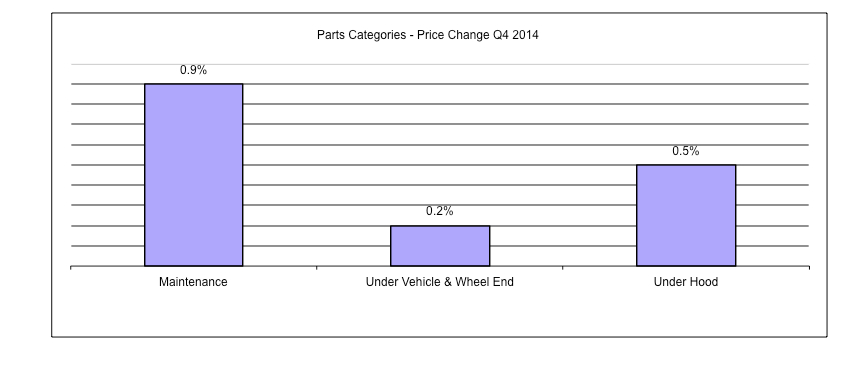

PARTS CATEGORY

- Based on reported pricing of parts to service repair centers

- Represents change of current quarter over the prior quarter

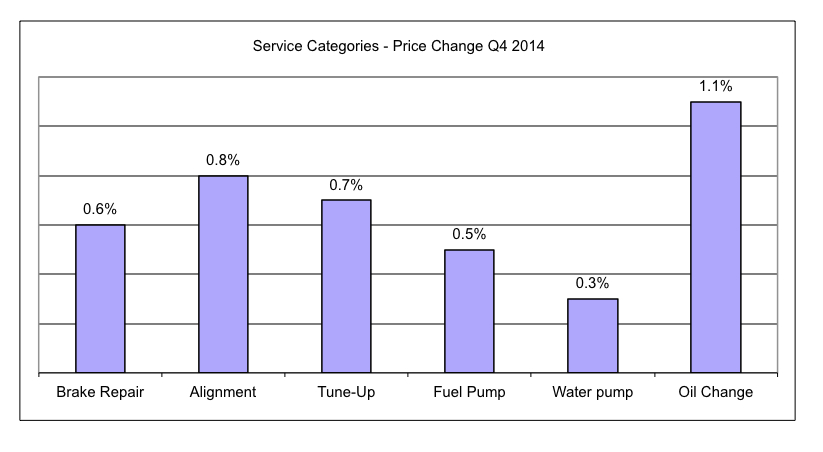

SERVICE CATEGORY

- Represents total job repair order price to prior quarter

NOTES TO PRICING CALCULATIONS:

The pricing is based on changes in the current quarter relative to the prior quarter. The data is collected from service repair centers with additional service repair center level pricing information provided by a number of sources. The “Parts Categories” includes only the parts.

The “Service Categories” include both parts and labor and is based on the average reported. Pricing is collected in percent change, and is averaged across the U.S. Where needed the data is weighted in order to represent the entire market.

©2015 TLG Research, Inc. All rights reserved.