From aftermarketNews/Counterman staff reports

Each week, The Pulse provides insight into the buying, sourcing and brand-loyalty habits of counter professionals and professional technicians. This week, we look at technicians’ sourcing habits for ceramic brake pads.

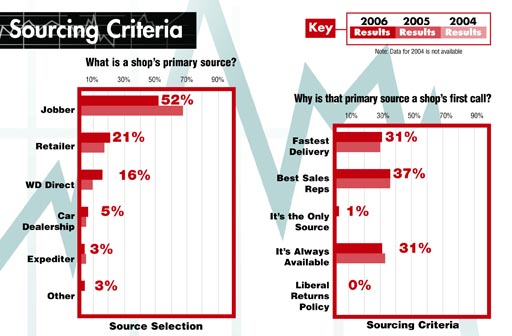

When it comes to buying ceramic brake pads, technicians and shop owners rely on jobbers as their primary source. According to a recent survey by Counterman magazine, 52 percent of shops go to jobbers for ceramic brake pads; 21 percent go to retailers; and WD direct was their third choice with 16 percent of the votes. Technicians surveyed said their primary source, be it jobber, retailer or WD, is their first call for three leading reasons: Best Sales Reps (37 percent); Fastest Delivery (31 percent); and Availability (31 percent).

Comparing 2006 data to the same survey conducted in 2005 shows that with technicians’ increasing understanding of ceramic brake technology, more will spec it for jobs. The survey shows that 20 percent more shops are now stocking ceramic friction. The places these shops source from has increased slightly as well – from 2.4 sources in 2005 to 2.6 sources in 2006.

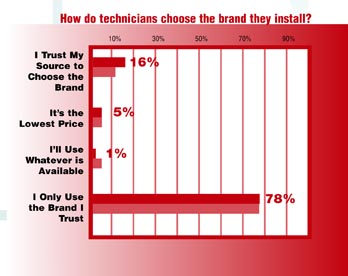

Similar to their responses on brake pads and shoes, technicians overwhelmingly said that they only use a brand they trust when choosing a brand of ceramic brake pads to install.

These and other statistics can be found in the Professional Automotive Repair Technician Survey (P.A.R.T.S.), p rod uced annually by Counterman magazine. Seven years ago, Counterman began surveying repair shops annually to determine when, how and why they source specific automotive parts and p rod ucts. The resulting data, published every Fall, offers perspective on how sourcing and brand-loyalty trends have changed.